Wall Street is producing a few surprises in the early running of 2013: energy stocks are leading the way higher, and consumer staples are among the best performers. Consumer discretionary, though, is not performing as well as anticipated.

Information technology (IT), which was expected to be a leader this year, has gained the least, rising by only 3.6% in the first month and a half of 2013. This is significant, because IT is the largest of the 10 sectors in the S&P 500 composite index. Telecommunications services is the other laggard – although this is of little surprise to analysts.

Standing in the middle of the pack is the financial services sector, which the second-largest in the S&P 500. It has a market weight rating from Standard & Poor’s Financial Services LLC’s Capital IQ division.

Health care, which S&P Capital IQ recommends “overweighting,” has been the second-strongest gainer so far this year, up by 8.5%.

Placing third is the industrials sector, which also has an “overweight” recommendation, gained by 7.5% in the early running.

Consumer staples ranks fourth, with a 7.4% year-to-date gain. Analysts had been expecting this sector to underperform in 2013.

There are several ways to interpret the strength in the energy sector, which was up by almost 9% in the first month and a half of this year, as shown by S&P 500 composite index.

One possible reason is firmer oil pricing in the U.S.; another is the surge in U.S. petroleum production. A third view is bearish, according to age-old market lore: bull runs on Wall Street don’t end until the oil stocks have had a run, too – and that usually occurs at the end of a bullish move.

@page_break@The consensus among analysts regarding the energy sector is for average performance this year. For example, Standard & Poor’s Capital IQ recommends “market weighting” energy in portfolios.

Looking into the constituent industries in all sectors, you’ll find many leaders are from tiny industries – small in terms of market capitalization, compared with giants such as Exxon Mobil Corp. and Chevron Corp. in energy, for example.

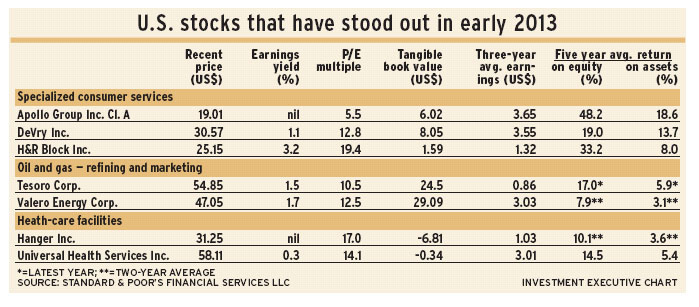

The largest year-to-date gain has been made by specialized consumer services, which account for just 0.4% of the disappointing (so far) consumer discretionary sector. What are these services? For-profit educational institutions and the U.S.’s largest income tax preparer, for example.

The two education-related stocks, Apollo Group Inc. and DeVry Inc., are rallying from a horrendous drop for the subgroup as a result of legislative changes and reluctance among students to take on more loans.

H&R Block Inc.’s primary business is tax returns. As a result, last year, the quarter ending in April accounted for 70% of revenue and all of its annual cash flow. This is a cyclical business to the extreme.

Oil and gas refiners and marketers lead the energy sector, although these stocks account for only 6.6% of the sector. Profit margins have been slim and companies have recorded losses in the past five years. Several companies – most recently Sunoco Inc. – have quit the business.

Stock prices for Tesoro Corp. and Valero Energy Corp. are in steep climbs, yet the technical outlook for both remains bullish.

In health care, providers of health-care facilities have been the strongest industry. Out of six companies in this group, Hanger Inc. and Universal Health Services Inc. stand out on fundamentals as well as on market performance.

Hanger operates orthotic and prosthetic hospitals and clinics, and its stock is included in the S&P 600 small-cap subindex.

Universal operates a variety of hospitals and clinics, and its services and treatments include acute care, surgery and radiation.

In the revival of the U.S. housing market, the industry that has gained the most is building products. Household appliances has been a second beneficiary of this housing revival.

Other individual industries that are among the largest gainers this year include trucking, investment banking and brokerage, distributors, human resources and employment services, as well as aerospace and defence.

© 2013 Investment Executive. All rights reserved.