Stock market action anticipates better times for the Canadian insurance industry. Insurance companies’ shares have gained strength, while other financial services industries have floundered. This is welcome news, given that insurers have had seven tough years – thanks to central bank policies – with interest rates pushed to the ground.

While banks and the real estate industry feasted on the low rates, insurers suffered. They need better returns on their investments to finance their long-term liabilities. Higher interest rates will do the trick, and the market seems to expect this outcome.

The S&P/TSX insurance industry index peaked in 2007. It then plummeted by 59% to a monthly closing low at the 668 index level in February 2009.

Since then, there has been a failed rally. But, since late 2011, the industry’s stock prices have been rising. The insurance industry index stood at 1332 before the August stock market crunch started. At the August close, the index was at 1263, down 5% in the month.

The best news for insurance stocks’ outlook is their improving relative strength. The TSX insurance index has outperformed not only the S&P/TSX composite index but also Wall Street’s S&P 500 composite index. This trend started in earnest in mid-2012. Within the TSX financial sector, insurance has since been the only outperforming industry.

Mind you, the rise in relative strength of the insurance group vs the S&P 500 index has been slow compared with its two preceding periods of rising relative strength, between 2000 and 2008, and between 1993 and 1998.

Life and health insurers form the dominant part of the TSX industry index. These firms account for 79% of earnings and 86% of indicated dividends on that index.

Earnings have been somewhat volatile after plunging in the 2008-09 financial crisis. They have been as high as $98 on the index recently, up from only $4 in 2009 but still way below their $136 high in 2008.

Dividends have been little changed. Payments have been flat since 2008, and only in the past 12 months has there been any improvement. The index’s yield has been slightly above 3% in the past year and a half.

The past year may have marked a turnaround in the industry. One indication is dividends: Manulife Financial Corp. and Industrial Alliance Insurance & Financial Services Inc. raised their dividends in 2014 for the first time since the 2008-09 crash.

All four leading insurers – Manulife and Industrial Alliance plus Great-West Lifeco Inc. and Sun Life Financial Inc. – had their largest earnings per share since the 2008-09 drop. Profitability also rose significantly.

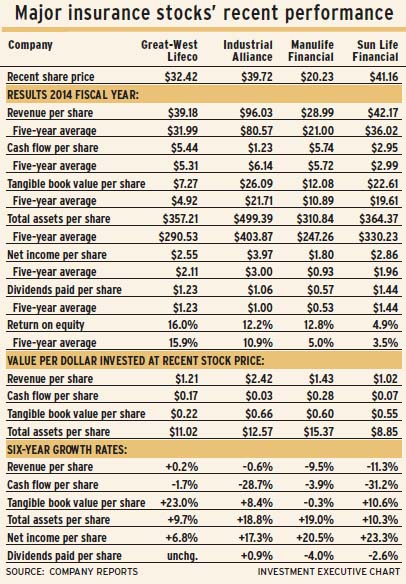

Valuations vary widely among the four firms. (See table.) For example, $1 invested in any of the stocks purchases between $8.85 and $15.37 of total assets, based on 2014 yearend figures.

Such comparisons tend to favour Industrial Alliance and Manulife. Industrial Alliance provides the most tangible book value and annual revenue per dollar invested in the stock, while Manulife provides the most assets and cash flow per share.

Great-West Lifeco’s 2014 return on equity is the highest in the group, and so was its five-year average return on equity.

By one measure, Sun Life has the strongest balance sheet. Sun Life’s common shareholders’ equity equalled 8.5% of assets at yearend 2014, and averaged 9% over the past five years. Next highest on this score was Manulife, with shareholders’ equity equal to 4.8% of assets, with a five-year average of 6.0%.

The comparisons here exclude Power Financial Corp. and Power Corp. of Canada, because they are the parent companies of Great-West Lifeco. Both Power companies are included in the TSX insurance index.

© 2015 Investment Executive. All rights reserved.