They may not be the investment choices for preachers, choirboys and other do-gooders, but investing in the “sin” stocks – of tobacco, alcohol, gaming and defence companies – can generate good returns for your clients. In fact, several portfolio managers see particularly good possibilities in tobacco and alcohol companies.

The prospects for tobacco, alcohol and gaming stocks, in particular, are tied to growth in emerging markets, which is expected to pick up speed this year. As incomes in these regions rise, consumers can afford to smoke, drink and gamble. And as their disposable incomes increase, consumer purchases move up the quality chain to more expensive Western brands and, in the case of alcohol, switch to spirits and wine from beer, says Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London.

In contrast, the prospects for defence stocks are tied to military spending – and the large debt bur- dens in the U.S. and Europe are forcing cuts in defence budgets. But, with no reduction in global political tension, the cuts may not be as large as many retail investors expect, says Gerry Sullivan, portfolio manager of USA MUTUALS Vice Fund – the world’s only “sin” fund, distributed by Dallas-based Quasar Distributors LLC – in Summit, N.J. Furthermore, he says, many defence firms make other products, such as non-military aircraft, so their prospects aren’t tied entirely to defence budgets.

All four sin sectors are heavily regulated, which means the likelihood of new entrants is low. This is particularly so in tobacco, for which advertising has been banned in most countries – and it would be virtually impossible to introduce a new brand without advertising. In most countries, licences are required for the production of alcohol and for gaming; permits for the latter are particularly difficult to get. Defence contracts are full of specifications and restrictions, and there’s often a “home bias,” making it difficult for foreign firms to compete.

Burbeck prefers the consumer sin stocks. He has three tobacco picks and one each in alcohol and gaming.

Patricia Fee, consumer-sector portfolio manager with I.G. Investment Management Ltd. in Dublin, also likes some of the tobacco and alcohol firms but doesn’t have any holdings in the gaming sector.

Sullivan is invested in all four sectors and usually has 25% weightings in each. He believes that things change quickly – often, unpredictably – so he prefers to keep the weightings equal.

The four sectors in more detail:

– Alcohol. In this sector, publicly traded companies are divided into two distinct categories: beer and spirits. Generally, consumers in the industrialized world already have a preference for beer, wine or spirits – and for particular brands within these categories. Thus, their purchases are not usually price-sensitive.

In the emerging world, most consumers still drink inexpensive local beers. But, every year, more consumers can afford to buy global-brand imports; they then try spirits and move up in that quality chain as they can afford to do so.

Sullivan considers London-based Diageo PLC the best of the spirits companies, given its extensive brands and geographical reach.

Burbeck, however, prefers Davide Campari-Milano SpA of Italy. He says its strategy is similar to Diageo’s, in that both companies have made many acquisition in the past 10 years. But Davide Campari’s success is not as well known, and that’s reflected in its stock price. The firm has been particularly active in Latin America, which has been over-shadowed by the strong growth in Asia, especially China; however, Latin America has a large population and fast-rising incomes.

Fee suggests Pernod Ricard SA of France, noting that this firm has a broader portfolio of brands and a greater share in emerging markets than Diageo does. She also notes that Pernod Ricard’s high debt load, the result of earlier acquisitions, is dropping.

On the beer side, Fee likes Anheuser-Busch InBev SAB of Belgium. It has significant exposure to emerging markets and a “robust” business model and is very good at cost-cutting. She would suggest buying shares on any weakness in the share price.

Fee also mentions Carlsberg A/S of Denmark. It’s a riskier bet because half its sales are in Russia, a country in which it’s difficult to do business and that is “constantly trying to reduce alcohol consumption.” However, she thinks Carlsberg will gain market share in the longer term. Now is a good entry point, she adds, in the belief that the share price has been beaten down too much.

U.S.-based Molson Coors Brewing Co. is another possibility, says Fee. Despite little exposure to emerging markets, it has good brands, its volumes are quite strong in the U.S. and it has been cutting costs.

– Defence. There are two kinds of companies in this sector: those that primarily make weapons and those that also make substantial amounts of non-military equipment.

The two big gun manufacturers are Smith & Wesson Holding Corp. and Sturm Ruger & Co. Inc. Both are based in the U.S., as are the other firms mentioned in this sector.

Raytheon Co. is primarily focused on the military, with 85% of its revenue coming from the U.S. government, Sullivan says. Raytheon’s many products include radar systems, sensors and stimulators, as well as missiles and missile-defence systems.

The output of Boeing Co. and Precision Castparts Corp., the latter of which Sullivan describes as a company that make high-end casting for expensive aircraft, is more mixed. As Sullivan puts it: “When you think of Boeing, you think aircraft, not bombs.”

A recent report from Royal Bank of Canada‘s (RBC) capital markets division in Toronto reveals that its analysts are not very optimistic regarding this sector, particularly for firms that primarily manufacture military equipment. In fact, the report says, there could be a “double whammy”: first, the expected pickup in global growth could cause portfolio managers to shift away from defensive sectors, such as defence, to more cyclical stocks. Second, there could be further cuts in U.S. defence spending “as the U.S. continues to grapple with its fiscal spending situation.”

Precision Castparts is the top defence-sector pick in the RBC report. Firms such as Boeing, General Dynamics Corp., Honeywell International Inc., Lockheed Martin Corp. and United Technologies Corp. are expected to outperform in the sector. But the RBC report rates Raytheon as only “neutral,” noting the “negative market response to respectable results from Raytheon.”

– Gaming. This sector is particularly an Asia-related story, as gambling is very popular in that part of the world – so much so that governments are trying to discourage it. Gambling is illegal in China, so people who can afford it go to Macau, which became part of China in 1999 but has special status.

Located on a peninsula near Hong Kong, Macau depends largely on tourism related to gambling. Foreign gambling companies were allowed in Macau as of 2002; the major Las Vegas-based firms – Las Vegas Sands Corp., MGM Resorts International and Wynn Resorts Ltd. – have set up shop on the peninsula.

Burbeck notes that shares issued by these U.S.-based companies can be treated as a play on domestic consumption in China.

Sullivan prefers Las Vegas Sands, which he considers the strongest company in this sector.

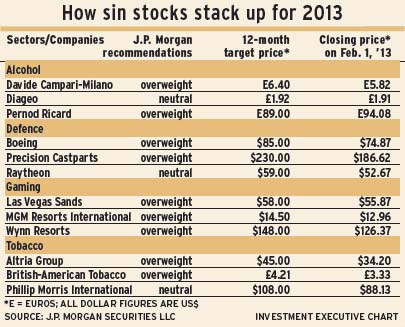

Analysts with J.P. Morgan Securities LLC in New York also favour these companies, particularly Los Vegas Sands because “it is probably the easiest of the four [publicly traded] Macau names to add as a new position here, given its leverage to growth in the market’s mass-market segment.”

– Tobacco. Regulation and litigation are always risks in this sector, but little of either risk is happening now. The most recent new regulation is the uniform, plain packaging now required in Australia.

For now, earnings prospects are pretty good for tobacco companies. Burbeck expects emerging-markets volumes to rise by about 1% a year, in line with population growth, but revenue to rise by about 5% a year as consumers move up the quality chain.

Sullivan says that tobacco companies pay the best dividends among the sin stocks. For example, the dividend yield of U.S.-based Altria Group Inc. was recently around 5.25%, vs 1.88% for Las Vegas Sands.

Sullivan considers both firms to be the strongest in their sectors, noting that, in Altria’s case: “It has always been able to raise prices” due to its strong portfolio of popular brands, including Marlboro. He adds that brand loyalty is very strong in tobacco – significantly more so than for alcohol.

Fee’s pick in the tobacco sector is British-American Tobacco PLC of Britain. She calls it the best top-line story, as the firm has 60% of its sales in emerging markets and strong operating margins. The company also owns 75% of Souza Cruz SA, a firm in Brazil that Burbeck particularly favours.

Burbeck’s other suggestions are Phillip Morris International Inc. and Imperial Tobacco Group PLC, both based in Britain.

Phillip Morris, which was the international operations division of Altria that was spun off into a separate company in 2008, has huge emerging-markets exposure. Burbeck notes that even though Philip Morris’s stock isn’t cheap at the moment, he still thinks the current valuation is attractive, given the firm’s growth prospects.

Meanwhile, Imperial Tobacco sells its products primarily in the industrialized world, much like Altria does, so Burbeck considers Imperial Tobacco a defensive stock – but one with a much more attractive price than Altria.

Fee agrees that Imperial Tobacco is an interesting option.

© 2013 Investment Executive. All rights reserved.