The average debt per Canadian household rose by only 0.3% in 2012, as most Canadians slowed or stopped their borrowing. Seniors were the exception, as their debt levels increased by an average 15.1%, according to a survey by Ipsos-Reid Corp.

Although that may sound like a disturbing trend, seniors have a history of adding to debt, boosting borrowing by an average 9.6% a year in 2002-10, significantly faster than the 5.7% increase for all Canadian households.

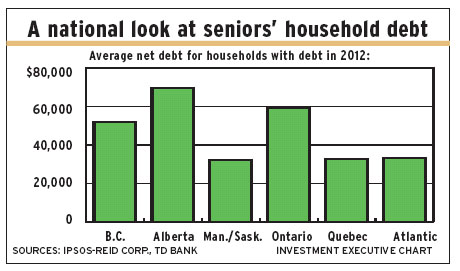

There are big regional differences. Increases were huge in Quebec (up by 39.9%) and Ontario (21.7%), but relatively moderate in Alberta (7.1%). There were drops of 4.3% in the Atlantic provinces, of 6.3% in British Columbia and of 10.8% in Manitoba/Saskatchewan.

However, Quebec seniors could afford the increase, collectively having one of the lowest average debt loads for their age group – $34,682 in 2012, not much higher than in the Atlantic provinces, and Manitoba/Saskatchewan, and way below Alberta, Ontario and B.C. (See chart.)

Of course, the ability to carry debt also varies across the country. The average debt/income ratio for seniors was highest in Alberta, at 107.2%, followed by B.C. (99.4%), Ontario (98.6%), Quebec at (70.1%), the Atlantic provinces (61.5%) and Manitoba/Saskatchewan (60.8%).

© 2013 Investment Executive. All rights reserved.