Canada’s real estate stocks are returning to the party. Although they appear to have peaked early in 2013, they began a slow advance after a swift, sharp drop. This year, the S&P/TSX capped real estate index has approached its 2007 record high. In fact, some of the largest-cap stocks have reached new highs.

There’s no wonder clients love these stocks. The real estate industry dominates the investment trust sector of the market. Payouts are high in a period of suppressed interest rates. The capped real estate index yields 4.1% while five-year guaranteed investment certificates yield 3.1%, at best.

Low interest rates have contributed mightily to the real estate boom. These stocks have outperformed in price, reflecting their strong asset growth. The capped real estate index is 2.8 times higher than its 2009 low.

However, real estate stocks are getting expensive. The index is trading at almost 30 times earnings – double the multiple of 12 months ago. In that time, payouts on the index have risen by 11%.

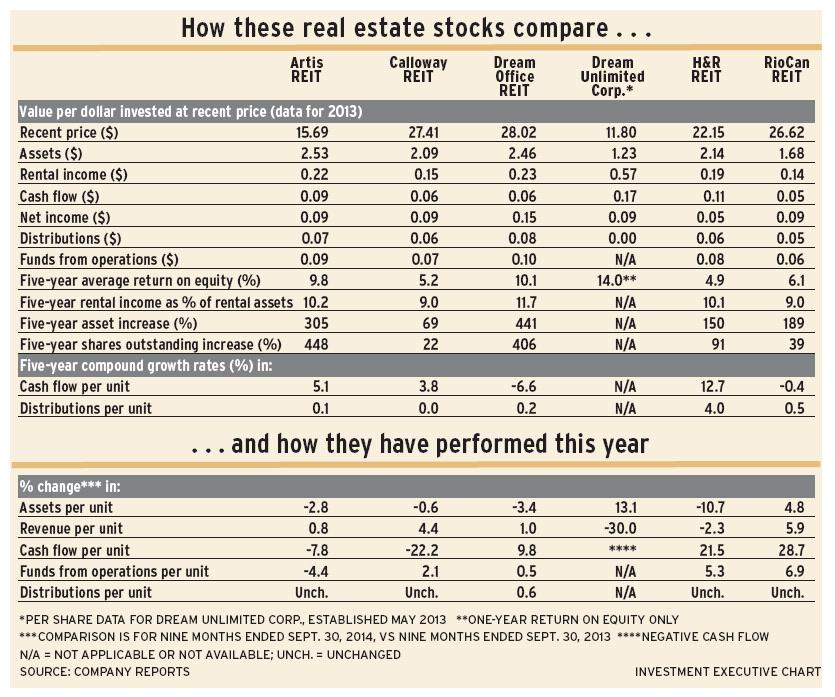

Despite seeming stability, there is volatility in the industry. There have been occasional sharp swings in revenue and returns. Some of these anomalies reflect new financings, acquisitions or accounting changes. As a result, compound growth rates for some stocks appear weak. (See table.)

Six of the 20 stocks in the index have led the revival, as all six closed above their six-month average price in October. These relative-strength rankings imply continued positive performance in the subsequent six months.

This leading group includes the largest real estate investment trust (REIT), RioCan REIT, which has a market capitalization of $8.2 billion. The only non-REIT among these six is Dream Unlimited Corp., which is the smallest in terms of market cap, at $900 million.

Comparisons of these six enterprises, shown in the table, show values on a common basis – what a dollar of investment buys.

Although analyses of real REITs customarily focus on “funds from operations,” the table emphasizes other measures. Funds from operations is a real estate industry standard, not a generally accepted accounting item. Cash flow, though, is a standard accounting item. And cash flow is what it says; there are no assumptions about value changes or future gains or losses.

These six stocks have had huge growth in assets. Topping the growth table is Dream Unlimited’s associated firm, Dream Office REIT. This firm has increased its assets by more than 400% in the five years ended Dec. 31, 2013.

Financings to accelerate corporate growth often result in units outstanding exceeding asset growth. This cuts per share values.

Significantly, such large investment by these businesses has yet to earn comparable returns. Rental assets are generating rental income mainly in the 10% range.

Dream Unlimited is an exception to some of these generalizations. It’s not a REIT and came into being in May 2013 from Dundee Corp. assets.

Results for this group of six stocks in the nine months ended Sept. 30, 2014 are mixed. Assets per unit failed to increase from the year prior for most. Rental revenue, though, mostly was stronger.

A key point to consider: distributions mainly were unchanged. Greater rental income from assets built up in the past five years holds the promise of significant payout improvement.

© 2014 Investment Executive. All rights reserved.