Socially responsible investing (SRI) adds a dimension to your clients’ portfolios, enabling clients to feel they are improving the world while generating healthy returns in the process.

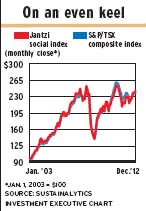

In the past, SRI was criticized because it was believed that such investments could not deliver the same punch as traditional stocks. However, a look at the performance of the Jantzi social index, which tracks the performance of Canadian SRI-approved stocks, reveals that the Jantzi index matched the returns of the S&P/TSX composite index within 10 basis points over the three-, five- and 10-year periods ended Dec. 31, 2012.

Typically, SRI excludes sectors and firms having environmental, social and governance (ESG) impact that is deemed to be harmful. However, that still leaves most stocks eligible – including 80%-85% of those in the S&P/TSX composite index. This means that an SRI approach has a wide enough universe that you and your clients still can pick the stocks with the best growth prospects.

At the same time, SRI supports the work of SRI specialists who actively engage with companies on ESG issues. All SRI mutual funds, for example, have dedicated staff who have ongoing discussions with many companies and will introduce shareholder resolutions.

Institutional investors have even more clout. The Canadian SRI Review 2012, a report released by the Toronto-based Canadian Social Investment Organization in mid-January, reveals that pension funds had $532.7 billion in assets under management using SRI guidelines as of Dec. 31, 2011.

SRI guidelines can change as a result of discussions with companies. For example, most SRI mutual funds have recently sold their holdings in Enbridge Inc. – after several years of discussions with, and monitoring of, the company – because of concerns regarding its proposed Northern Gateway pipeline (NGP) from Alberta to the British Columbia coast.

“Enbridge has not developed specific criteria to determine whether or not [the] NGP should proceed despite substantial opposition by First Nations,” explains a shareholder-engagement activity report issued by Meritas SRI Funds, which are managed by OceanRock Investments Inc. in Kitchener, Ont. Enbridge, however, says it doesn’t have enough information yet. SRI fund portfolio managers don’t agree.

The Meritas report mentions 15 other companies with which the fund firm is in discussions regarding ESG issues. These include: Encana Corp., on hydraulic fracturing; Canadian Tire Corp. Ltd. and Gilden Activewear Inc. on child labour and cotton-supply chains; and Tim Hortons Inc., on sustainable coffee sourcing.

Fund-management firms such as OceanRock; Toronto-based NEI Investments (co-owned by Vancouver-based Northwest & Ethical Investments LP and Montreal-based Desjardins Group), which sponsors the Ethical Funds lineup; and Vancouver-based VanCity Investment Management Ltd., which manages IA Clarington Investments Inc.’s Inhance SRI Funds, says Michael Jantzi, CEO of ESG research firm Sustainalytics in Amsterdam, “have had a real impact on corporate behaviour.”

Included in the universe of SRI-acceptable companies are firms that are involved in the oilsands – even though some environmentalists view the oilsands’ byproduct as harmful, “dirty” oil. Says Jantzi: “The oilsands are the second-largest deposits of oil and gas in the world, and they are going to be developed.”

As a result, he and most SRI portfolio managers believe it’s better to encourage firms such as Cenovus Energy Corp. and Suncor Energy Inc., which are considered “best of class” in their ESG approach to oilsands extraction.

Even Desjardins Environment Fund also invests in Cenovus and Suncor, even though the fund’s environmental focus means its SRI screening excludes many energy and mining companies – more than 60% of the energy companies and more than 70% of the mining firms listed on the Toronto Stock Exchange (TSX) are ineligible for investment in the Desjardins fund.

SRI investors also don’t rule out firms that have operations in countries with poor human rights records. According to Bob Walker, vice president, ESG services, with NEI Investments in Vancouver, the thinking goes: if investors refuse to invest in these firms, they may then sell their operations to organizations that are not susceptible to pressure to change their ways, such as government-owned entities.

The SRI approach does exclude some sectors and companies, such as tobacco and weapons manufacturers, and – in some countries, including Canada – uranium producers and nuclear-energy generation.

Some individual companies also may be excluded, such as: Wal-Mart Stores Inc., because of labour-related issues; and Barrick Gold Corp. and Goldcorp. Inc., because of environmental issues.

It’s important to note that mutual funds labelled “sustainable” don’t necessarily exclude these sectors or companies. Sustainable companies are defined as firms with a sustainable business – and that can include tobacco firms.

For clients who are picky, below are some subsectors or firms that Dermot Foley, manager of ESG analysis with VanCity, and Stephen MacInnes, portfolio manager with VanCity, consider to be top performers from an ESG perspective:

– Railways, including Canadian National Railway Co. and Canadian Pacific Railway Co., transport goods efficiently and without wear on highways.

– Brookfield Renewable Power Inc. has vast hydroelectricity generation and also is developing wind power and gas. This stock pays a good dividend.

– Northwest Co. is a retailer serving remote northern communities in Canada. It’s the largest employer of First Nations Canadians and has won awards for its employment practices, including hiring young people. MacInnes adds that the firm has little competition, continues to expand gradually and pays a good dividend.

– Church & Dwight Co. Inc. is a firm based in Princeton, N.J., that produces the Arm & Hammer brand products and has a good understanding of the life cycle impact of its products, and it pays dividends on a consistent basis.

– Inditex Group of Spain is a clothing franchiser whose brands include the popular Zara line. The firm has very good supply-chain management, including auditing the labour practices at companies that produce Inditex’s clothing.

© 2013 Investment Executive. All rights reserved.