A drop in Chinese equities in June and July alarmed a lot of investors who were already worried about a slowing in China’s economy. However, this wasn’t a collapse due to faltering earnings; it was a correction from overinflated share prices. And the market correction provides an opportunity to pick up some good Chinese stocks at reasonable prices.

“The correction is healthy,” says Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London. Burbeck says the recent 4.4% devaluation in the renminbi also is healthy because the currency was overvalued.

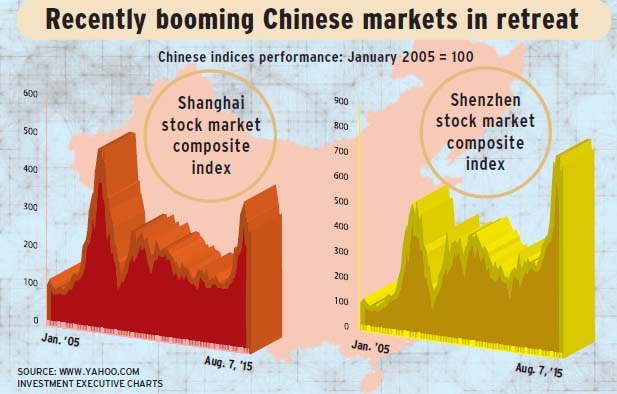

It’s helpful to remember how high China’s markets have risen: stock prices on both the Shanghai and Shenzhen stock exchanges rose by 100%-150% between late October 2014 and June 12 of this year, so some correction was both expected and needed. By July 9, share prices were down about 30% but still up by 50%-75% from late October. Since then, prices have been up and down in a much narrower range.

Investing in Chinese stocks does have its challenges. Neither government policy nor corporate governance in China is as transparent as in the developed world.

In addition, China doesn’t yet have big pension funds, hedge funds or asset managers. That means China’s stock markets are dominated by retail investors, who currently hold 80%-85% of the free float in Chinese shares (those available for trading), says Don Reed, president and CEO of Franklin Templeton Investments Corp. in Toronto and portfolio manager of Templeton International Stock Fund. These retail investors had been buying on margin and were forced to sell as prices declined, which exacerbated the market correction.

The market capitalization of the free float of Chinese companies is small by global standards. It is around 1% of gross domestic product (GDP), compared to more than 100% for most other countries, says Catherine Yeung, equities investment director with Fidelity Investment Management Ltd. in Hong Kong,

This results in what Reed calls a “decoupling” of the stock markets and the economy. Indeed, Chinese stocks lagged the appreciation in share prices elsewhere in the world prior to 2014, despite the strength of China’s economy.

This is typical of developing equities markets and doesn’t mean that there aren’t good opportunities. China’s economy is slowing, but from a torrid pace. Real GDP still is expected to grow by 6%-7% a year, a rate that’s at least twice as fast as in developed economies. And rising incomes are starting to create a middle class, leading to strong, long-term demand for consumer products.

Here’s a look at stocks recommended by portfolio managers:

– CHINA MOBILE COMMUNICATIONS CORP. With 816 million subscribers, this is the world’s largest cellphone service provider. Growth, which was phenomenal over the past few years, started to plateau recently, but the company is converting to 4G service, for which it can charge a premium.

– CHINA LIFE INSURANCE CO. LTD. This company has a 35% share of China’s life insurance market through its 650,000 to 700,000 agents. Reed expects growth of about 15% a year, as many consumers still lack insurance.

Yeung also likes this firm. She says it has been restructuring, government regulation has become more favourable and demand is rising with incomes.

– CHINA MERCHANTS BANK. Both Burbeck and Yeung like this company. Yeung calls it the “Wells Fargo” of China – a very well-run bank. She notes it doesn’t have as much exposure to local government loans as many peers do. (Local government debt can be a murky area, as municipalities use debt to pay for infrastructure.)

– HAIER ELECTRONICS CO. LTD. This is the world’s largest washing-machine manufacturer. “People without washing machines want them,” says Reed. The firm has 7,000 outlets.

– HENGAN INTERNATIONAL GROUP CO. LTD. This firm makes baby diapers, sanitary napkins and other personal products. People buy more disposables as their incomes rise, says Mark Lin, vice president of international equities with CIBC Asset Management Inc. in Montreal and portfolio manager of CIBC Asia-Pacific Fund.

– SINOPHARM GROUP CO. LTD. This firm is a major distributor of pharmaceuticals, with about 15% of the Chinese market. This is a fragmented sector, with the next two largest companies having a combined 10% of the market. Sinopharm’s growth is being managed well, says Reed.IE

© 2015 Investment Executive. All rights reserved.