Many global banks have been poor investments in the past decade. These banks have struggled to increase capital, meet new regulations, pay penalties and settle litigation. But most of those issues have been resolved and there could be strong share price appreciation in the next few years as economic recovery spurs earnings growth.

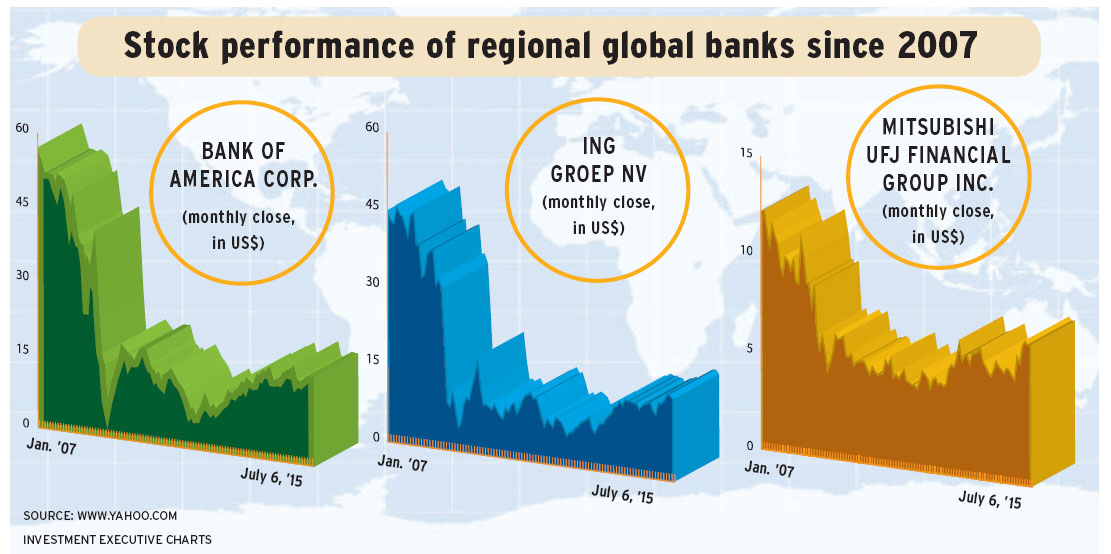

Among the potential winners are New York City-based Bank of America Corp. (BofA), ING Groep NV of Amsterdam and Tokyo’s Mitsubishi UFJ Financial Group Inc. All three are bets on economic growth in their respective markets.

In terms of regional economic health, the U.S. is furthest along the general economic recovery path. In addition, the Federal Reserve Board (Fed) is expected to begin raising interest rates later this year, which will increase the U.S. banks’ net interest margins (NIMs). However, if recovery in the domestic housing sector disappoints this year, as it did in 2014, the Fed could delay increasing rates. The consensus is that the housing market will recover due to rising consumer confidence.

Europe, on the other hand, lags significantly, with the European Central Bank starting its quantitative easing (QE) program only in the past year. That means higher interest rates and, thus, higher NIMs, are likely to come much later. But if borrowing increases, as expected, bank earnings are likely to improve.

Japan started its QE program in 2013, but its economic problems are more deeply rooted than those in Europe or the U.S. The administration of Shinzo Abe, Japan’s prime minister, has been trying to stimulate the domestic economy, with some success. If recent gains can be maintained, loan growth and interest rates will increase.

Here’s a look at the three banks in more detail. (All prices are in U.S. dollars unless otherwise noted):

– Bank of America. BofA was loaned $45 billion by the Fed to get the bank through the global credit crisis. But, while that loan was repaid by December 2009, the bank has continued to struggle.

A major issue was flawed mortgages. Most of these were issued and securitized prior to the 2008 global credit crisis by Countrywide Financial Corp. before it was acquired by BofA in 2008 for $2.5 billion. Last year, BofA agreed to pay penalties of almost $17 billion related to these mortgages.

A better deal for BofA was the purchase of New York City-based Merrill Lynch & Co. Inc., also in 2008, which made BofA the world’s largest wealth-management provider and a major investment banking player.

BofA dominates in retail banking, with these activities accounting for about 10% of the U.S. retail banking market. That means BofA will be a “very big beneficiary of higher interest rates,” says Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London. He expects BofA’s annual earnings growth to be more than 10% during the next two to three years. That should push up the stock price, which is trading at slightly above book value, while many other banks’ shares trade at around two times book value.

Analysts at J.P. Morgan Securities LLC (JPM) in New York have a “longer-term overweight” rating on BofA and expect the share price to rise by about 6% by Dec. 31, 2016.

A recent research report from JPM says BofA will “benefit from the large cost-cutting program underway, rising interest rates, reduction in the very large legacy asset servicing and other credit-related expenses as the housing market improves, and [a] decline in litigation expenses.”

However, Ian Nakamoto, research director with MacDougall MacDougall & MacTier Inc. in Toronto, is less enthusiastic. He notes that the U.S. banking system is very competitive and he’s concerned that there could be additional regulation of U.S. big banks.

Bill Fitzpatrick, senior equities analyst at Manulife Asset Management (U.S.) LLC in Milwaukee, thinks that U.S. consumers will be cautious about taking on debt, which will dampen loan growth.

BofA’s net income was $12 billion on revenue of $83.3 billion in the 12 months ended June 30. Those figures compare with earnings of $8 billion and revenue of $87.3 billion for the corresponding period a year earlier. BofA’s 10.5 billion outstanding shares closed at $16.94 each on July 6.

– ING Groep NV. The JPM analysts and Nakamoto like ING’s shedding of its insurance and asset-management operations and the refocus on core banking. These analysts also believe ING’s leadership role in Internet banking gives the bank a significant competitive advantage. (ING pioneered branchless direct banking through ING Direct.)

“The younger generation is more likely to do its banking on the Net, and ING is by far the most advanced in this type of banking,” says Nakamoto.

ING received a 10 billion euros ($13.4 billion) loan from the Netherlands’ government in 2008, which was repaid by 2014. As well, ING is paying dividends again.

Burbeck believes ING is an attractive medium-term play. After the recent divestments, ING is “a better managed, much leaner organization” that will benefit from cross-border opportunities in the European market for financial services. He also thinks ING’s return on equity should be more than 10% in the next year or so.

The JPM analysts have an “overweight” rating on ING, expecting the share price to increase by 7% by the end of this year.

ING’s net income was 4.9 billion euros ($6.3 billion) for the 12 months ended March 31 (vs a loss of 269 million euros [$361 million] in 2014) on banking revenue of 15.8 billion euros ($20 billion), vs 15.3 billion euros ($20.5 billion). ING’s 3.9 billion outstanding shares closed at 14.36 euros ($15.90) on July 6.

– Mitsubishi UFJ Financial Group Inc. Mitsubishi UFJ is the top pick from among Japan’s banks by JPM analysts, given the possibility that the bank’s shares could rise by 35% this year.

Mitsubishi has substantial overseas operations, including New York-based MUFG Union Bank NA and a 20% interest in Morgan Stanley, also of New York, which gives Mitsubishi UFJ growth potential. While Mitsubishi UFJ generates 60% of its revenue in Japan, the bank also benefits when its large customers expand overseas.

Burbeck calls this bank a “good play,” predicting growth in loans and asset values, including property values, in Japan.

Mitsubishi UFJ’s net income was $1 trillion yen ($9.4 billion) in the 12 months ended March 31 (vs $985 billion yen [$9.8 billion] in 2014) on revenue of $4.3 trillion yen ($38.6 billion), vs $3.8 trillion yen ($37.5 billion). The bank’s 14 billion outstanding shares closed at 886 yen ($7.23) on July 6.

© 2015 Investment Executive. All rights reserved.