When markets are volatile, investors often prefer the comfort of large, well-known companies. However, these may not be their best options, since share prices in those companies may be overvalued, due to many other investors seeking the same kind of reassurance.

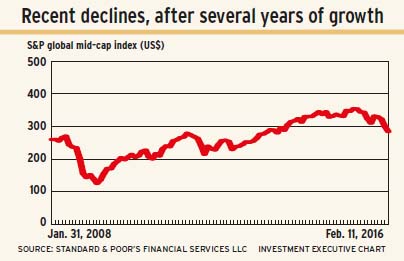

This may be a good time to suggest another option: the shares of high-quality, small- and mid- cap stocks whose prices have dropped in the past year. (Small-cap stocks are issued by firms with US$2 billion or less in market capitalization; mid-cap stocks are issued by firms with up to US$5 billion in market cap.)

Many clients are reluctant to consider these smaller companies because they are viewed as being risky. But some small- and mid- cap companies can be dominant in their industry and have good growth prospects.

This is a part of the market that tends to be overlooked by active money managers, says Mark Costa, senior research analyst, industrials team, with Brandes Investment Partners LP in San Diego and member of the Brandes Investment Committee. “It’s a big pond with few fishermen,” he says.

When clients are nervous, smaller-cap stocks are sold off, thus driving down their share prices, says Patrice Quirion, portfolio manager of Fidelity Global Concentrated Equity Fund at Fidelity Canada Asset Management ULC in Toronto. “A lot of those companies are lower-quality,” he says, “but there’s a subset that is very high-quality.”

High-quality small and mid-cap firms have competitive advantages and strong balance sheets. Costa looks for companies that don’t have too much debt and “will survive in a challenging economic environment.” They should also have “a lot of upside potential” if demand improves, he says.

Here are some global small- and mid-cap companies favoured by these managers:

– C&C GROUP PLC. This Ireland-based firm produces a popular alcoholic cider and has a 70% market share in Ireland and Scotland. The share price has declined because of operational problems in the U.S. and the U.K., where C&C is trying to establish its presence. Notes Costa: “Either the company will solve those problems or it can close them down at a small cost.”

– D’IETEREN SA. Costa says this Belgium-based company is misunderstood. Although half its revenue comes from distributing cars in Belgium, 80% of earnings are generated from the firm’s global auto-glass repair and replacement business, the main source of future growth. D’Ieteren has auto-glass outlets in 34 countries, with a dominant position in many, including the U.K., France and the U.S.

– EMBRAER SA. This Brazil-based company is a major competitor in the regional jet market. Embraer has been improving its regional jets and should be the biggest beneficiary when the regional jet market, in which demand is down by 50% since the 2008 global credit crisis, recovers. The company also sells small- and mid-sized jets, for which demand should pick up. Costa says Embraer benefits from the decline of the Brazilian real because 80% of its revenue is in U.S. dollars.

– G8 EDUCATION LTD. Quirion likes this Australia-based operator of child-care centres. This niche is a stable, growing industry that isn’t significantly affected by the ups and downs of the economy. The industry also is very fragmented, allowing G8 to expand by acquiring smaller competitors.

– IRISH RESIDENTIAL PROPERTIES REIT PLC. Residential apartment complexes in Ireland usually are owned by individuals, so a company like this one, which owns a lot of buildings, has a significant advantage in purchasing materials and supplies, says Edwin Lugo, senior vice president with Franklin Templeton Investments Corp. in New York and lead manager of Franklin Global Small-Mid Cap Fund. He notes the firm is acquiring apartments for below replacement cost due to Ireland’s economic struggles.

– NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC. This Shanghai-based company, another of Lugo’s picks, trades on the New York Stock Exchange and reports using U.S. generally accepted accounting principles. The firm provides after-school education, a growing market.

– OAKTREE CAPITAL GROUP LLC. This Los Angeles-based alternative-investment firm specializes in distressed debt, an asset class of rising popularity due to increasing yields. Lugo says Oaktree has “a good team, good processes and a good long-term track record.” The firm has US$70 billion-US$80 billion in assets under management (AUM) and another US$20 billion in cash to invest.

– PARTNERS GROUP AG. Quirion likes this Switzerland-based firm , a dominant global player providing private-equity financing for small and mid-sized companies. AUM has been growing at 10%-15% a year and now is around US$50 billion. He says it can manage a lot more AUM without adding substantially to staff.

– WELCIA HOLDINGS CO. LTD. This Japan-based company has used acquisitions to become the largest chain in the fragmented domestic pharmacy sector. Quirion expects Welcia to grow strongly for many years and thus increase its low 3% operating margin. In November 2014, Aeon Co. Ltd., one of Japan’s biggest retailers, bought a 50.15% interest in Welcia, which now runs Aeon’s in-store pharmacies.

© 2016 Investment Executive. All rights reserved.