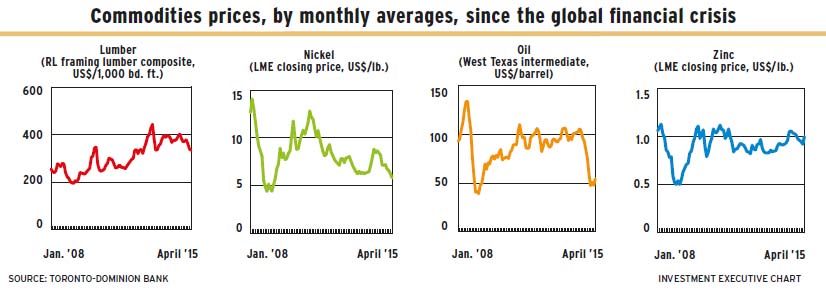

Despite a rally in commodities prices in April, excess supply in this sector is likely to weigh on the shares of most resources-related companies. Nevertheless, high-quality companies are making money and will benefit from even small increases in commodities prices.

These prices are likely to remain low unless there is a broad pickup in global economic growth. Resources are particularly dependent upon global growth because they are traded and sold around the world.

The major exception is natural gas, due to the difficulties of shipping gas. But even those markets are shifting because of the advent of liquified natural gas, which allows gas to be transported over longer distances without pipelines.

Gauging momentum in global growth is difficult, however. Businesses are waiting for the U.S. Federal Reserve Board to increase interest rates, which may signal healthy economic growth in the U.S. But, as of mid-May, the Fed was continuing to show caution. The U.S. is not the sole determinant of world growth, of course, but the U.S. remains the key economy and is the only one where significant pickup in growth is likely in the near future.

Nevertheless, there are some price increases on the horizon in some resources commodities. For one, the closing of two major zinc mines is likely to reduce total world production by 5%, which will raise prices. In addition, a ban in Indonesia on the export of nickel ores should push up the price of that metal.

The outlook for lumber and oriented strandboard also is good, assuming that the U.S. housing market picks up as is widely expected.

How quickly other metal prices are likely to move upward is less clear. For example, some analysts see the supply of copper going into a deficit position, with supply growth lagging behind an increase in demand next year. Other analysts don’t see copper prices rising until 2017, 2018 or even 2019.

The outlook for oil also is uncertain due to several variables. Some, such as declines in U.S. shale oil production or demand in the spring/summer U.S. driving season, could push prices upward.

Other factors, such as lack of storage space or increased oil exports from Iran and Libya, could pull the oil price down.

These uncertainties result in a range of forecasts, with some commodities analysts anticipating the price at $75 by the end of 2016. Others expect the price to move up and down within the $55-$65 range. (All prices are in U.S. dollars unless otherwise noted, including all resources prices globally.)

On the positive side for many firms are declines in the cost of production. At the same time, the value of their revenue has increased with the rise in the US$.

For example, the U.S. Energy Information Administration is predicting an average price per barrel for West Texas Intermediate crude oil of $55 for this year. (If the Canadian dollars [C$] averages 80¢, which many economists expect, the price becomes $68.75 in C$.)

Here’s a look at the major commodities in more detail, using US$:

– Oil. The price of oil is likely to rise in the medium to longer term. However, a lot of volatility is likely in the short term as positive economic news pushes the price of oil upward and negative economic reports pull it downward.

Nor is there agreement among commodities analysts about which of these variables will dominate in any particular period. For example, Dina Ignjatovic, economist at Toronto-Dominion Bank in Toronto, expects oil prices to settle in the $44-$55 a barrel range over the next few months as a result of high U.S. inventories.

On the other hand, Patricia Mohr, commodity market specialist at Bank of Nova Scotia in Toronto, thinks the price of oil could be stronger over the next few months, as Americans take more driving vacations than usual to take advantage of relatively low gasoline prices.

Both Ignjatovic and Mohr believe oil prices will be strong in the fourth quarter of 2015 – $60 and $65, respectively – as U.S. shale oil production decreases.

However, Mohr cautions, shale oil production could bounce back if the price of oil rises high enough. There is a large inventory of uncompleted wells that can be brought back on track quickly, which would push oil prices downward.

Scott Vali, resources portfolio manager at CIBC Asset Management Inc. in Toronto, is concerned that oil prices could rise too quickly. If the price for one-year forward contracts moves too high in the near term (for example $70), speculators would be likely to start betting on the price going back down – which, in turn, could push it downward.

Longer term, Vali thinks prices need to be in the $70-$75 range. If they’re below $70, there won’t be enough investment in oil production to generate sufficient future supply. If the oil price is above $75, there’ll be too much investment. In terms of stocks, he likes Canadian Natural Resources Ltd. and Suncor Energy Inc. in Canada, as well as Anadarco Petroleum Corp. and EOG Resources Inc. in the U.S.

The one caution about companies primarily operating in Canada is that the resources royalty regime will be reviewed by Alberta’s newly elected New Democratic Party government.

– Copper. The global average profit margin for copper producers – after operating expenses, depreciation, interest and royalties – was 30% in early May, when the price was $2.91 a pound, notes Mohr.

She expects the copper price to ease a little, averaging $2.75, both this year and next. That means copper producers will continue to make money. That’s why resources investors, including Vali, continue to favour copper stocks, such as HudBay Minerals Inc., First Quantum Minerals Ltd. and Lundin Mining Corp.

– Nickel. Indonesia imposed a ban on exports of nickel in January 2014 in an effort to encourage nickel miners to build smelters in that country. Because Indonesia accounts for about one-third of global nickel production, the commodity’s price rose.

However, prices fell in late March, when the European Union announced that it will impose anti-dumping fees on imports of stainless steel from China, which is a large consumer of nickel, used to make stainless steel.

However, Mohr thinks nickel has been oversold. She is sticking with her forecast of an average nickel price of $9 a pound in 2016, up from the recent $6.

– Zinc. This metal is expected to be the next base metal star, says Mohr. Two major zinc mines – Century in Australia and Lisheen in Ireland – are closing later this year, cutting global supplies by almost 5%. Mohr expects the price to average $1 a pound this year and $1.50 in 2016.

– Gold. No one has much interest in gold, although there certainly is widespread political and economic uncertainty – usually a plus for gold bullion. However, the rise in the US$, which is likely to continue when the Fed starts increasing interest rates, is an offsetting negative. Thus, bullion is expected to be range-bound in the next few years, trading between $1,100 and $1,300 an ounce.

– Lumber. The U.S. housing market disappointed in 2014, but is expected to improve significantly this year. Benoît Gervais, senior vice president, investment management, at Mackenzie Financial Corp. in Toronto, believes Americans have been waiting for solid wage increases, which he thinks will occur in the coming months.

This, in turn, will ignite the U.S. housing market. That could result in significant price increases in materials used for house construction, including lumber.

© 2015 Investment Executive. All rights reserved.