MEXICO, MUCH LIKE CANADA, is likely to experience an economic boost as a result of increased exports to the U.S. as growth in that massive economy picks up.

Mexico should benefit from the U.S. economic recovery even more than Canada, given Mexico’s competitive costs. Investors realize this, so stocks of Mexico-based firms aren’t cheap, although there are good opportunities to be had. In fact, analysts such as Mark Mobius, executive chairman of Toronto-based Franklin Templeton Investments Corp.’s emerging-markets group in Singapore, and Guido Giammattei, portfolio manager with RBC Global Asset Management (U.K.) Ltd. in London, U.K., favour financials and manufacturing firms with exposure to the U.S.

“Mexico’s economy has been exceptionally resilient in the past 20 years through different economic cycles,” says Mobius.

The watershed year was 1994, which featured both the implementation of the North American Free Trade Agreement (NAFTA) and a currency crisis (the so-called “Tequila crisis”) sparked by the Mexican government’s devaluation of the peso vs the U.S. dollar (US$).

NAFTA was very positive for Mexico. Many foreign companies in industries such as automotive, aerospace, electronics and medical devices set up large operations in the country because of its cost competitiveness. The resulting increase in exports to the U.S. kept Mexico’s economy growing despite the negative effects of the Tequila crisis, during which many Mexicans lost all their savings and subsequently avoided banks for years.

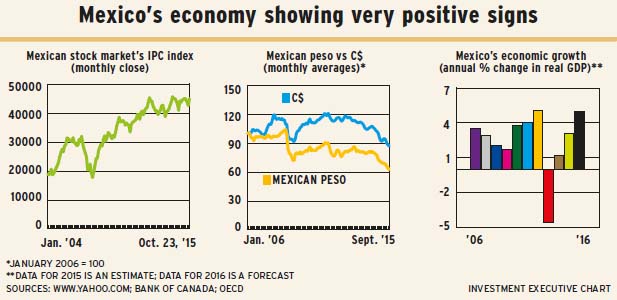

Mexico is now at another watershed. In the past couple of years, the federal government has pushed through an ambitious structural reform agenda aimed at improving productivity of the country’s assets. Mobius expects these reforms to stimulate further investment and consumption in the coming years, resulting in faster real gross domestic product growth than its historical average of 2.5% in the past 20 years.

Robert Mark, associate director of research with Montreal-based MacDougall MacDougall & MacTier Inc. in Toronto, says he’s already hearing anecdotal evidence of increased efficiency and greater investment, including in supply chains.

At the same time, trust in Mexico’s banking system appears to have been rebuilt finally, setting the stage for increasing use of bank products, including credit cards and consumer debt such as mortgages.

Mexico’s economy is in good shape, with low inflation, low interest rates, a competitive low value of the peso vs the US$, and relatively modest government debt. There will be cuts in government spending next year because low oil prices are resulting in lower revenue.

But this drag on the economy should be offset, not only by greater manufacturing exports to the U.S., but also by increased remittances from Mexicans who are U.S. residents, says Giammattei.

One sleeper is energy. Oil production had been in the hands of government-owned Petróleos Mexicanos SA de CV, known as Pemex, which hasn’t developed its resources aggressively or efficiently; the government finally opened up the energy sector with reforms at the end of 2013. And although the plunge in the oil price squashed private-sector and foreign interest, this is only a temporary setback. Investment will rise when oil prices stabilize.

The Mexican Stock Exchange’s broad-based benchmark IPC index – IPC stands for Índice de Precios y Cotizaciones – hasn’t dropped by as much as the S&P/TSX composite index because there are no Mexico-based publicly traded energy companies. Valuations on the IPC index are considered reasonable, but not inexpensive.

However, there are still good investment opportunities, particularly among manufacturing exporters. Another option is to invest in companies that benefit from Mexico’s growth, such as U.S. railway firms that transport Mexican goods across the border.

Here’s a look at some of the stocks with exposure to Mexico’s economy that analysts recommend. (Only those Mexico-based stocks trading as American depositary receipts [ADRs] are included):

– GRUPO FINANCIERO BANORTE SAB DE CV. Banks are a good way to get exposure to a country’s economic growth, but Mexico’s banks should see added growth as consumers increase their use of consumer credit.

Mobius favours Banorte’s stock, and a recent report from New York-based J.P. Morgan Securities LLC (JPM) gives an “overweight” rating on it, saying the stock is the JPM’s top pick among Mexico’s financials. The JPM report expects Banorte to benefit as consumer credit continues to grow faster than overall credit and the net interest margin increases when interest rates start to rise, which is expected at the same time or shortly after U.S. interest rates rise.

– CEMEX SAB DE CV. Gerardo Zamorano, director, investments, with Brandes Investment Partners LP in San Diego, favours this global cement company. Cemex will benefit from the ongoing recovery in the U.S. housing market; the firm also is very strong in Latin America in general and in Mexico in particular.

– GRUPO HERDEZ SAB DE CV. Giammattei considers this company to be one of Mexico’s premier companies. Herdez manufactures, distributes and sells packaged Mexican foods and has a very strong market share in most categories, offering both quality and value. The firm’s growth in the U.S. market is likely to continue, given its large Hispanic population.

Herdez’ management is very strong and has an excellent track record, Giammattei says. Management is very focused on innovation and creating a win/win situation for everyone – employees, suppliers and customers.

As a result, this is another stock that Mobius favours.

– KANSAS CITY SOUTHERN RAILWAY CO. (KCS). Although two of the four largest U.S. railway companies transport to and from Mexico, only KCS offers a strong play on the country, says Mark.

The other player, Union Pacific Railroad, is so big that its Mexico-related business isn’t an earnings driver. In contrast, KCS’ Mexico-based business accounts for almost half of the firm’s revenue.

– KIMBERLY-CLARK DE MEXICO SAB DE CV (KCM). Giammattei considers this be a premier company because it has a very strong franchise that has been built over decades. This subsidiary of U.S.-based Kimberly-Clark Corp. has a market share of 60%-70% in most of its personal hygiene product lines.

KCM management’s focus on innovation and sustainability is similar to that of Herdez’ in the support KCM offers customers, employees and suppliers; and its track record in creating shareholder value.

Mobius also likes this stock.

– MEGACABLE HOLDINGS SAB DE CV is a cable operator and provider of Internet and telephone services. A recent JPM report gives an “overweight” rating on the stock because of strong operational trends, favourable regulation and recent acquisitions.

– WAL-MART DE MEXICO SAB DE CV (WMM) has done exceptionally well; its long-term prospects remain excellent. However, the firm has been chasing sales at the expense of margins recently. This hasn’t discouraged investors, resulting in a higher stock price, which a recent JPM report suggests is justified and gives a “neutral” rating on the stock for now.

Mobius also favours WMM.

The JPM report recommends WMM’s key competitor, El Puerto de Liverpool SAB de CV, which isn’t very accessible to retail investors because the stock doesn’t have an ADR. Puerto de Liverpool has 65 department stores in Mexico’s largest cities, owns and manages shopping malls and is one of the largest issuers of credit cards in the country. Puerto de Liverpool is the JPM report’s top retail pick in Mexico.

© 2015 Investment Executive. All rights reserved.