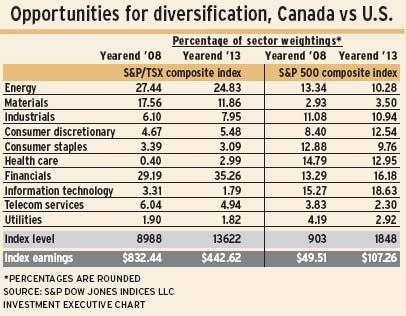

The bull market of the past five years has done little to diversify the nature of Canada’s main stock market. Financials, energy and materials continue to dominate. In fact, these sectors combined accounted for 72% of the overall weighting in the S&P/TSX composite index at yearend 2013 – barely two percentage points less than at yearend 2008.

As the seven other sectors offer only a 28% share of the market, portfolio diversification remains a challenge. With the aged bull market teetering, Canadian investors seeking more opportunities for diversification will look to Wall Street.

In the U.S. market, resources (energy and materials) account for not quite 14% of the S&P 500 composite index’s weighting; financials, for 16%. At 30% in total, those sectors account for less than half the weighting of the same sectors in Canada. The other seven sectors in the U.S. stock market cover 70% of the weighting. In contrast to Canada, the U.S. sector with the largest scope and weighting is information technology (IT), which barely registers in the Canadian market.

In the five years from 2008-13, the S&P/TSX composite index rose by 52%. Although that sounds good, it’s only half the 105% gain made by Wall Street’s S&P 500 composite index. And the Canadian index wound up 2013 with earnings at 47% below the 2008 level. (However, Canadian dividends did rise by 11%.)

Financials increased their pre-eminence in Canada, now accounting for more than 35% of the S&P/TSX composite index. That’s up from 29% at yearend 2008. The sector reached a new record closing monthly index high as 2013 ended, surpassing the previous peak reached in 2007.

Resources lost ground in those five years, yet that didn’t harm their significance. Energy and materials together now represent almost 37% of the market vs 45% at yearend 2008.

Two market cycles were in play to account for the resources’ weighting drop: materials – such as fertilizers, base metals and gold – did peak during those five years, but have been dropping relative to the market since 2010-11; and the energy bull peaked ahead of the five-year period, making its cycle’s high earlier in 2008.

Canada’s health-care sector has jumped in market weighting, although from a very low base. And Catamaran Corp., one of the two stocks chiefly responsible for this, operates in the U.S.

The U.S. financials sector grew in market weighting over the past five years, along with consumer discretionary and IT. Growth in U.S. financials has been a recovery out of the depths for “too big to fail” financial services institutions, while smaller banks have become favoured investments.

Among U.S. consumer stocks, the discretionary group’s index weighting is up by 50%. Among the 31 industries within that sector, automobiles, broadcasting and Internet retailing have become major industries. For the auto industry, its gain in weighting is a return to significant heft in the investment market. Consumer electronics, although small in industry size, also has gained strongly in weighting.

And while the U.S. materials sector comprises far less of the U.S. market than of Canada’s, it offers more diversification – thanks to its array of chemical industries.

Index weighting of the U.S. industrials sector has changed little since yearend 2008. The U.S. index lists 18 industries in the sector; the Canadian index, 14. Railways are by far the largest Canadian industry in this sector vs aerospace and industrial conglomerates on Wall Street.

The S&P/TSX composite index’s lagging performance relative to Wall Street reveals itself in trading. Volume in Canada’s main stock market index has dropped every year since 2009, the year the bull market began. Despite that, quoted market value of TSX stocks reached $2.3 trillion in 2013 – a new high. That’s because the market has become less speculative, with turnover dropping to 52% of shares listed in 2013 from 93% in 2009.

© 2014 Investment Executive. All rights reserved.