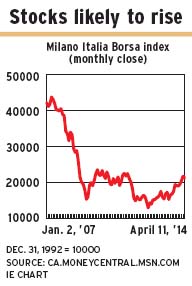

At first blush, there appears to be many reasons why now is not the best time to invest in Italy’s economy. But despite serious competitiveness issues and the rise of almost 40% in Italy’s stock market since June 2013, fund portfolio managers still are finding some investment opportunities.

Most of these suggested stocks are global in nature, such as transportation firm Ansaldo STS SpA, brake system manufacturer Brembo SpA, electric utility Enel SpA, oil and gas producer Eni SpA, aerospace firm Finmeccanica SpA and bank UniCredit SpA.

However, domestic bank Intesa Sanpaolo SpA also is recommended. Both Intesa and UniCredit, the latter of which generates more than 40% of its revenue in Italy, are plays on economic recovery in the country. Although real gross domestic product (GDP) is expected to rise by only about 0.5% this year, that is a significant turnaround from the drop of almost 2% in 2013.

Italy was not hit as hard by the global credit crisis as was Greece, Ireland and Spain because Italy’s housing market didn’t collapse, says Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London. However, Italy has structural issues that predate the crisis and have seriously eroded the country’s competitiveness.

“Unit labour costs are about 30% above the European average,” says Martin Fahey, head of European equities with I.G. International Management Ltd. In Dublin.

Other issues include significant youth unemployment of around 40%, huge public debt of 133% of GDP and a large “black” (underground) economy that’s estimated to represent about 20% of total economic activity.

These issues have yet to be addressed, partly because of the constantly changing government.

“I can’t remember Italy having a majority government,” says Don Reed, president of Franklin Templeton Investments Corp. in Toronto and portfolio manager of Templeton International Stock Fund.

Nevertheless, Italy is emerging from economic recession. The yield on its 10-year bonds has dropped to about 3.4% from 7% a couple of years ago.

The government deficit is neither large nor getting worse, says Stephen Oler, portfolio manager with Pyramis Global Advisors in Smithfield, R.I., a unit of Boston-based FMR LLC (a.k.a. Fidelity Investments) and co-manager of Fidelity Europe Fund.

New prime minister Matteo Renzi, who took over in February, has promised reforms, including personal income tax cuts, privatization of government-controlled companies and substantial cuts to salaries of senior civil servants. Time will tell what he’ll achieve.

Here’s a closer look at some recommended companies:

– ANSALDO STS SPA designs and constructs integrated transit systems for freight and passenger railways and mass urban transit. Fahey says this company might be privatized by its parent, Finmeccanica, at what he thinks could be a “potentially much higher price” than the stock is currently trading at.

– BREMBO SPA has almost 100% market share for ultra high-end sports car brake discs and brake calipers. Burbeck calls this a “very defensible niche” and adds that the firm is moving into the high-end general luxury auto market, in which people will pay for performance brakes. Burbeck expects more growth in the next five to six years: “Demand for luxury cars is still growing, even in mature markets, such as the U.S. and Europe.”

– ENEL SPA is the largest electricity utility in Italy and also operates in Spain and Brazil. Oler says it was a “classic fat company” that now has new management, which is “restructuring aggressively.”

A report from J.P. Morgan Cazenove, the European marketing arm for New York-based J.P. Morgan Securities LLC, suggests that “substantial potential value could be unlocked” through reduction of duplicated structures, real cross-country integration of operations and the cross-selling of best practices within the firm.

– ENI SPA is a “very interesting and highly regarded company that has good reserves, good production, some diversification and that is well run,” Reed says.

But Fahey is concerned about recent production problems in Kazakhstan and Eni’s exposure to North Africa.

– FINMECCANICA SPA is a major player in the global aerospace, defence and security sectors. Historically, this firm was “very bloated,” says Oler, but now has a “more dynamic management team. [It’s a] great stock.”

– INTESA SANPAOLO SPA is a “very attractively priced bank with a relatively clean” balance sheet, Burbeck says. He thinks “the worst is over” for the small and medium-sized firms that Intesa focuses on serving and notes that the net interest margin in Italy is increasing as Intesa, along with many other banks, are cutting the interest rates paid on deposits.

– UNICREDIT SPA is doing very well, says Oler, who considers this bank’s stock to be “very cheap.”

© 2014 Investment Executive. All rights reserved.