With investors shying away from equities, investment-management firms may not seem like a great investment idea. However, Gluskin Sheff + Associates Inc. and Sprott Inc., both based in Toronto, are well worth considering. They both have excellent long-term investment performance track records, have a history of increasing dividends and operate in growing areas of the marketplace.

Gluskin Sheff and Sprott both were co-founded or founded by investment stars: Ira Gluskin at Gluskin and Eric Sprott at Sprott. Gluskin Sheff, with assets under management (AUM) of $5.5 billion as of June 30, serves high net-worth (HNW) individuals; the current minimum in investible assets for new clients is $3 million. Sprott, meanwhile, had AUM of $8.5 billion as of June 30 and specializes in precious metals investing. However, Sprott has launched core fixed-income and equity funds in the past two years to provide a full range of investment products for its clients.

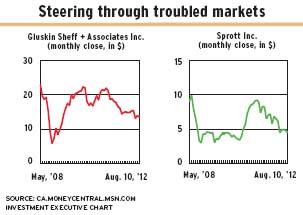

Although both firms have found the investment environment challenging since the onset of the global financial crisis, both maintain this has given them the opportunity to showcase their ability to steer through troubled financial markets and thus is resulting in increased market share.

Hedge funds are featured in both firms’ product lineups.

Both companies charge performance fees, which can greatly enhance their earnings, but they can survive without these. Certainly, neither firm suffered a loss in the past year despite little revenue from performance fees.

Both firms believe in employee ownership. At Gluskin Sheff, management, directors and employees hold 50% of the shares; at Sprott, this group holds 77%.

But one area in which the firms differ is acquisitions. Although Jeremy Freedman, Gluskin Sheff’s president and CEO, says the firm never says “never,” it has no plans for acquisitions and it isn’t looking for any. On the other hand, Sprott has made two this year, and CEO Peter Grosskopf says the firm is actively looking for more. Sprott has a strong balance sheet and unused credit facilities that can be used to finance further acquisitions.

Here’s a closer look at the firms:

– Gluskin Sheff + associates inc. was founded in 1984 by Gluskin and Gerald Sheff, who had handled the operations side of the business. Both co-founders have cut back on their workloads. Sheff retired in 2010 as CEO but remains chairman. Gluskin retired as president and chief investment officer (CIO) at the end of 2009 but still manages one of the firm’s model portfolios and continues as vice chairman.

Freedman now is president and CEO, and William Webb is CIO and executive vice president. David Rosenberg, the high-profile former chief economist at New York-based Merrill Lynch & Co. Inc., was hired as chief economist and strategist in 2009.

Gluskin Sheff’s strategy is to “look after existing clients, first, second and third,” says Freedman, who believes that’s “the only strategy that matters.” In 2002, the company set the goal of building “the best client-service team in the business.” Gluskin Sheff has been hiring “at very senior levels for the past number of years to achieve that goal,” Freedman says. That team’s size has increased to 15 professionals from nine in 2008, partly due to greater client interest in risk management.

The company is “one of the few wealth-management firms that actively manages in-house across all major asset classes,” says Webb. The approach is bottom-up in both equities and fixed-income. There are 21 investment professionals, including a credit team added in 2008.

Growth in the client roster comes mainly through referrals. Although the company has never “actively sought” institutional clients or very HNW American and Europeans clients, Freedman says. There is a growing number of both “who have been attracted to invest with the firm.”

Analysts with Royal Bank of Canada’s (RBC) capital markets division and TD Securities Inc. (TD) in Toronto favour the stock, with “outperform” and “buy” ratings, respectively.

“We believe Gluskin has higher growth potential relative to peers over the medium to long term,” says a report by RBC analysts, “in part reflecting operating in the HNW segment of the wealth market, which we believe offers higher potential growth and relatively less competition from banks and insurers than is seen in the mutual fund market.”

The TD analysts had upgraded Gluskin to a “buy” rating on May 14, noting in a report that they expect both margin and multiple expansion over the next few years: “Essentially, we do not believe that investors are paying much for Gluskin [Sheff]’s performance fee potential, which drives any special dividends it might declare.”

Net income was $37.3 million on revenue of $109.2 million for the 12 months ended March 31, vs net income of $33.6 million on revenue of $103.1 million for the corresponding period the year prior.

Gluskin Sheff’s 29 million outstanding shares, of which 14.4 million are publicly traded, had closed at $13.60 on Aug. 10. The 12-month price targets from the analysts at RBC and TD are $19 and $20, respectively. The current quarterly dividend is 16.25¢, providing a yield of 4.8%.

– Sprott Inc. Although this company now offers core equities and fixed-income products, it’s still a major precious metals investor – $3.6 billion of its AUM was in bullion funds as of June 30 – and that tends to be reflected in its stock price.

For example, the TD analysts have a “hold” recommendation on the stock because they think the near-term stock price will be dependent on a reversal of not only the recent weakness in precious metal commodities but also of the decoupling between precious metals stocks and the underlying commodity prices.

The latter situation is due to gold companies not returning profits to shareholders and instead making investments that investors don’t feel are worth it. Grosskopf admits that this is a valid complaint but feels that the companies are slowly becoming more shareholder-friendly. He also “strongly believes” the price of precious metals is “long overdue for a rebound.”

The TD analysts’ report says that in the longer term: “We believe that the company has several interesting projects on the go that could drive superior growth.” These include expansion in the U.S., new consulting relationships and expansion of Sprott’s product lineup.

RBC’s analysts agree about Sprott’s growth outlook but their concerns over the short-term outlook had caused them to downgrade the stock in late July to “sector perform” from “outperform.”

Sprott has been making significant investment to build an organization that can manage $20 billion in AUM, says Grosskopf. The firm has substantially increased its investment-management team to 35 professionals from 12 four years ago, and its client service team to 28 from less than 10.

Since early 2007, funds that Sprott has launched include two equity funds (“all-cap” and small-cap), two balanced funds, two income funds and four alternative-strategy funds. In addition, a closed-end strategic fixed-income fund was added in 2011, and tax-efficient versions of 12 funds have been introduced since October 2011. Sprott also plans to launch a global macro fund for the institutional market later this year.

“We see ourselves as alternative managers, trying to add value in ways that are difficult to replicate,” Grosskopf explains. He notes that while Sprott’s portfolio managers use leverage when shorting stocks, they don’t generally use leverage otherwise.

Net income was $33.7 million on revenue of $154.3 million for the 12 months ended June 30, down significantly from net income of $136.6 million on revenue of $350 million for the corresponding period a year earlier.

The 167.6 million outstanding shares, of which around 94 million are owned by Eric Sprott and only 20 million are publicly traded, had closed at $4.50 on Aug. 10. Analysts at RBC and TD have a 12-month price targets of $5.50 and $5, respectively.

The current quarterly dividend is 3¢, providing a yield of 2.7%. However, Sprott usually also pays a special dividend based on its results for its fiscal year, which ends Dec. 31. IE

© 2012 Investment Executive. All rights reserved.