The fast-food industry is a difficult one in which to do business and compete for a variety of reasons. Most prominently, shifts in consumer demand have to be met even if they add to costs; volatile agricultural prices also can increase costs, as is currently the case; and there always are new competitors entering the market because barriers to entry are low.

One strategy for surviving in this industry is to get bigger, as Miami-based Burger King Worldwide Inc. is trying to do with its proposed acquisition of Oakville, Ont.-based Tim Hortons Inc. Nevertheless, other companies are doing well with organic growth.

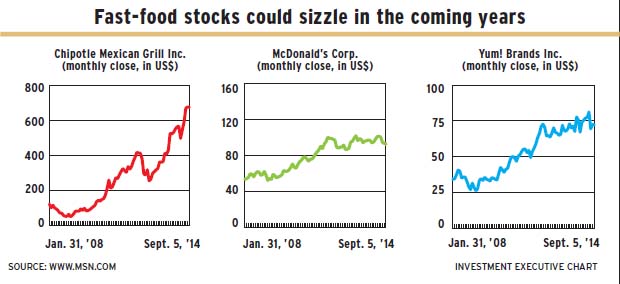

Three such firms are Chipotle Mexican Grill Inc. of Denver; McDonald’s Corp. of Oak Brook, Ill.; and Yum! Brands Inc. of Louisville, Ky.

Chipotle is a leader in a new type of restaurant chain known as “fast casual.” These restaurants fit in between “quick fast food,” such as McDonald’s or Kentucky Fried Chicken (KFC), and casual dining, such as Applebee’s or Chili’s.

McDonald’s has franchises that pay royalties, thereby ensuring a steady stream of revenue to the corporate entity and, thus, cash flow to pay a good and increasing dividend. McDonald’s is dominant in both the U.S. and Europe, each region of which accounts for 40% of revenue. The company has adapted its menu to include healthier options.

Yum! is focused on growing in Asia with its three brands, KFC, Pizza Hut and Taco Bell. Emerging economies’ consumers aren’t focused on healthy food and have huge enthusiasm for anything American.

Here’s a look at the three companies in more detail:

– CHIPOTLE MEXICAN GRILL INC. is taking advantage of new demand dynamics coming from the “millennial” generation, generally defined as those born after 1980.

Says Robert Mark, associate director of research with MacDougall MacDougall & MacTier Inc. in Toronto: “As consumers, [millennials] are a lot more discerning than boomers. They want value, but also a pleasant atmosphere and healthier options.”

Although Sarah Henry, analyst with Manulife Asset Management in Philadelphia, doesn’t follow Chipotle’s stock, she adds that the chain appeals to millennials’ desire to shop and eat in places that reflect who they are.

Launched in 1993, Chipotle has 1,600 locations in the U.S., the U.K., Canada, Germany and France. Recently, Chipotle expanded into providing Asian fast food under the name ShopHouse Southeast Asian Kitchen and partnered to open pizza outlets under the name Pizzeria Locale.

Chipotle’s menu is limited to five meals, but with lots of choice of ingredients. The food is considered relatively healthy and is prepared mostly on site.

Matthew Quinlan, portfolio manager with Franklin Equity Group, part of Franklin Resources Inc. in San Mateo, Calif., says Chipotle’s management is good, noting its use of videos to improve productivity.

An analyst report from J.P. Morgan Securities LLC (JPM) in New York calls Chipotle a “once in a decade” brand, but offers a $670 price target, which is lower than the $677.95 that the 31 million outstanding shares closed at on Sept. 5. (All figures are in U.S. dollars.)

A report from St. Petersburg, Fla.-based Raymond James & Associates Inc. lists a higher target: $725 a share.

Chipotle’s net income was $193.3 million on revenue of $2 billion in the six months ended June 30, up from net income of $164.4 million on revenue of $1.5 billion in the corresponding period a year earlier.

– MCDONALD’S CORP. ran into problems in the U.S. a few years ago as it responded to the demand for healthier and fresher options. The problem was an overexpansion of the menu, which slowed service, says Eugene Profis, portfolio manager with Mackenzie Financial Corp. in Toronto.

But those problems didn’t last. The company simplified its menu and focused on core strengths, such as drive-through breakfasts in the U.S. McDonald’s is the best of the food chains at adapting, Profis says, and has excellent real estate locations and strong bargaining power with its suppliers.

A JPM report has an “overweight” rating on the stock and recommends it as a “long-term core” holding due to a “low risk/solid absolute return.” The price target is $98 a share vs the $93.70 that the 993 million outstanding shares closed at on Sept. 5.

A Raymond James report is less enthusiastic, rating the stock as “market perform.”

Net income was $2.6 billion on revenue of $13.9 billion in the six months ended June 30 vs net income of $2.7 billion on revenue of $13.7 billion in the corresponding period a year earlier.

– YUM! BRANDS INC. generates 70% of its profits outside the U.S. – and much of that in emerging markets. China alone accounted for 52% of revenue in the six months ended June 14 and almost 46% of the operating profit.

Henry prefers Yum! stock to McDonald’s because of the growth opportunity in emerging markets; Profis also likes Yum’s prospects.

However, reports from both JPM and Raymond James rate the stock as “neutral” and “market perform,” respectively. JPM’s target price is $80 a share; the 455 million outstanding shares closed at $72.36 on Sept. 5.

Net income was $737 million on revenue of $5.9 billion in the six months ended June 14, up from net income of $612 million on revenue of $5.4 billion in the corresponding period in 2013.

© 2014 Investment Executive. All rights reserved.