The stock market has been unkind to dividend-paying stocks thus far in 2014. They have lagged as the bull market has moved into a higher gear.

This underperformance is occurring despite stronger growth in dividend payments. So, why is this happening?

It’s probably a late bull market phenomenon. Traders and investors tend to prefer buying growth potential in place of highly priced stocks with steady earning power.

Thus, the result is that the market’s barometer – the S&P/TSX composite index – has traded recently as high as 42 times earnings, vs 20 times only a year ago.

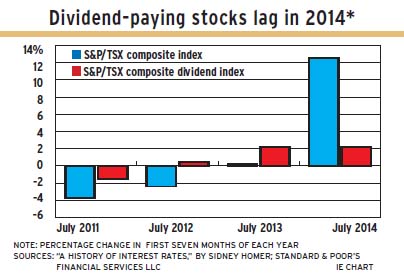

In the seven months ended July 31, 2014, the S&P/TSX composite index rose by 12.5%, while the S&P/TSX composite dividend index, a subset of the S&P/TSX composite index, rose by only 2.2%.

This is the reverse of the pattern seen in the first seven months of the preceding three years. In those years, the dividend subset of the composite index outperformed the overall composite index. (See chart above.)

– In the comparable period in 2013, the S&P/TSX composite dividend index also rose by 2.2%, but the overall S&P/TSX composite index rose by a scant 0.4%.

– In the first seven months of 2012, the S&P/TSX composite dividend index edged up by only 0.5% while the S&P/TSX composite index dropped by 2.4%.

– In the weak 2011 market, the S&P/TSX composite dividend index dropped by 1.5% and the broader index dropped by 3.7%.

This year’s underperformance by dividend-paying stocks reveals itself in a separate analysis of dividend-paying stocks listed on the Toronto Stock Exchange (TSX). In the seven months ended July 31, the increase in indicated dividends beat the average price rise for these stocks.

At yearend 2013, there were 191 stock issues – including dual-class listings by several companies – that the TSX labelled as “regular” dividend-payers; this excludes preferred shares and exchange-traded funds. For this analysis, the number was whittled down by companies taken over in 2014 and by eliminating duplicates among dual-class listings. For example, Bombardier Inc.’s Class B subordinate voting shares are included, but the Class A shares are not. The resulting total is 145 stocks.

These stocks rose by an average of 8.3% in the seven months ended July 31, 2014. Dividend increases in this group averaged 12%. This was a better showing for dividend increases than in the comparable period a year prior, when increases averaged 11.2%.

Although the average increase in dividend payments was larger this year, fewer companies raised their dividend payments. The totals – again, excluding the duplication of dual-listed stocks – were 145 this year and 160 in the first seven months of 2013.

Elevator and stair-lift manufacturer Savaria Corp. of Laval, Que., has doubled its indicated dividend rate to 16¢. Furthermore, 19 companies increased their dividends twice this year. Among this group are Canadian Tire Corp., whose dividend rate has risen by 43%, and Suncor Energy Inc., whose indicated dividend is up by 40%.

Stella-Jones Inc. raised its dividend payment by 40% in one step. And another 15 dividend-payers have increased their dividends by 25% or more.

The number of companies paying monthly dividends has increased, with Surge Energy Inc. and Chorus Aviation Inc. adopting this policy.

Indicated dividends on the S&P/TSX composite dividend index increased by 4.7% in the seven months ended July 31. This was a smaller increase than in comparable periods in 2013 (7.8%) and 2012 (6.3%), but was a larger rise than in the recession-recovery year of 2011, when the indicated dividend rate increased by 1.7% in that seven-month period.

The yield on the S&P/TSX composite dividend index has risen slightly since yearend 2010. At that point, the yield was 2.5%. At yearends 2012 and 2013, the yield stood at 3%. As of July 31, 2014, the yield was 2.8%.

© 2014 Investment Executive. All rights reserved.