MAJOR GLOBAL AIRLINE stocks used to be shunned, except by clients looking to make some fast money on a trade. But with more airlines now focusing on profitability, paying dividends and buying back shares, these stocks now are good candidates for “buy and hold” investments.

Among the many airlines around the world, low-cost carriers remain favourites – particularly Dublin-based Ryanair Holdings PLC and Spirit Airlines Inc., which is based in Miramar, Fla. But equities analysts now are interested in legacy U.S. carriers that have learned to compete against the discounters, such as Atlanta-based Delta Air Lines Inc., as potential longer-term holds. Some other global legacy airlines, such as Tokyo-based Japan Airlines Co. Ltd. (JAL), also are recommended.

However, the big renaissance is happening among U.S.-based legacy players, which are, says Matthew Moulis, portfolio manager with Fidelity Asset Management Inc. in Boston: “focusing less on market share and growth for growth’s sake and more on returns.”

A report from J.P. Morgan Securities LLC in New York agrees: “Cost convergence, fare unbundling, widespread consolidation, diminished new entrant activity and return-oriented management teams have combined to form an industry that is actually managing itself for the first time we can recall.”

Even more telling, the J.P. Morgan report recommends that investors focus on airline stocks such as Delta, which have the “potential to attract significantly longer-term investor interest vs when the industry operated in a more capital-destructive manner.”

JAL also is focusing on shareholder return, but most European legacy carriers still haven’t gotten the message.

Here’s a look at the four airlines:

– DELTA AIR LINES INC. Moulis recommends this legacy carrier, which also is rated as “overweight” in a recent J.P. Morgan report.

“The management team,” Moulis says, “talks about free cash flow and has incentives based on return on invested capital and profitability.”

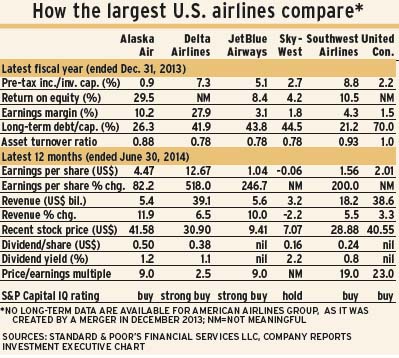

With Delta and three other airlines – American Airlines Inc. of Fort Worth, Tex.; Dallas-based Southwest Airlines Co.; and Chicago-based United Airlines Inc. – garnering more than 80% of the U.S. airlines business, their management teams now seem to appreciate history. They’ve seen the massive, cumulative losses and many bankruptcies in the industry since deregulation in 1978 and now are acting rationally, Moulis says, focusing on the bottom line and no longer chasing market share regardless of the cost.

The J.P. Morgan report states that Delta shares offer relatively low risk because the firm has “limited operational hurdles and little being asked of management besides staying the course.” The report also notes that Delta’s margins and returns have overtaken those at Southwest Airlines.

But the J.P. Morgan report also notes that Delta “remains highly leveraged to even the slightest fluctuations in demand for air travel” and, as a result, its earnings would be lower “should the U.S. economy strengthen less than currently expected.”

Moulis agrees with that assessment, adding that besides demand, fuel costs account for about one-third of most airlines’ costs – and are outside of the airlines’ control. Most airlines, including Delta, hedge the cost of fuel.

Net income was US$2.1 billion on revenue of US$28.7 billion in the nine months ended Sept. 30, 2013, vs net income of US$1 billion on revenue of US$28.1 billion in the corresponding period a year earlier.

The 850 million outstanding shares closed at US$29.29 on Jan. 6. Delta started paying a dividend of US6¢ a share in September 2013. The J.P. Morgan report has a price target for Delta stock of US$35.50 a share.

– JAPAN AIRLINES CO. LTD. Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London, favours JAL. This airline went into a two-year bankruptcy in 2010 as a result of too much capacity and high costs; but, during restructuring, Japan’s government bought the debt, wrote it off and the pension liabilities were removed.

As a result, JAL now has a “quite nice, strong balance sheet” and customer service has improved, says Burbeck. (The only other major airline in Japan is All Nippon Airways Co. Ltd. Its service used to be “much better” than that of JAL’s, Burbeck adds, but that’s no longer the case.)

Burbeck views JAL’s stock as a “leveraged play on the pickup in corporate profitability in Japan,” thanks to the depreciating yen and economic growth-enhancing policies by the new government. (See story on page B11.)

Net income was ¥113 billion (US$1.2 billion) on revenue of ¥956.1 billion (US$9.9 billion) in the nine months ended Oct. 31, 2013, vs net income of ¥140.3 billion (US$1.8 billion) on revenue of ¥634.3 billion (US$11.7 billion) in the corresponding period a year earlier. (It must be noted that the yen has fallen in value vs the U.S. dollar in the past year, so the decrease in earnings and revenue is exaggerated in U.S. dollars.)

With a recent price/earnings (P/E) ratio of 4.0 (airlines’ P/E ratios tend to be low), a price/book ratio of 1.6 and return on equity of 28%, Burbeck considers JAL stock attractively valued at the ¥5,210 (US$50) a share level that it closed at on Jan. 6.

JAL paid an annual dividend of ¥190 (US$1.94) a share on June 20, 2013, and plans to continue to do so in the future.

– RYANAIR HOLDINGS PLC is another of Burbeck’s picks. J.P. Morgan analysts also like this stock, giving it an “overweight” recommendation in a recent report.

Ryanair has done very well, even during the past five years of sluggish growth and global recession because there was still much demand from people who work in a different country than the one in which they live.

This airline is well managed, efficient, has a new, low fuel-consumption fleet and can fly to regional airports where landing fees are much lower. Although Ryanair’s fares are very attractive, the company charges for everything else. It even considered charging passengers for the use of toilets, but there was a backlash.

Ryanair also doesn’t have much competition from European legacy players, which have not restructured in the way their U.S. peers have.

Ryanair’s shares were beaten down because of two profit warnings. However, a recent J.P. Morgan report says that Ryanair’s problems have been “largely self-induced” and are, thus, easily fixable. The report anticipates that 2015 will be a “year of recovery,” with the average fare rising by 3% (vs a drop of 0.6% this year), followed by a 0.8% increase in 2016. The report also expects Ryanair’s operating margins to recover in 2014 to about the same relative superiority” to those of London-based competitor Easy Jet PLC.

Ryanair’s net income was 558 million euros (US$735 million) on revenue of 4.1 billion euros (US$5.4 billion) for the nine months ended Sept. 30, 2013, vs net income of 598 million euros (US$767 million) on revenue of 3.9 billion euros (US$5 billion) in the corresponding period in 2012.

The firm doesn’t pay a regular dividend but has bought 252 million euros worth of its shares and will buy back another 150 million euros worth by March 31. It has committed to returning a further 600 million euros to shareholders through share buybacks and a special dividend in the next year.

The 296 million outstanding shares closed at 6.43 euros (US$8.77) on Jan. 6. J.P. Morgan’s price target is 7 euros (US$9.54) a share.

– SPIRIT AIRLINES INC. Moulis favours this airline, which flies throughout the U.S., Latin America and the Caribbean. Spirit is very focused on value for the traveller, with “ultra-low” costs, although the passenger pays for everything: the ticket, checked baggage, printing the boarding pass at the airport, and food and drink.

Spirit is small, with just 50 planes vs other discount carriers (Easy Jet’s 225, Ryanair’s 300 and Southwest’s 800); Spirit has a market share of less than 2%. But Moulis says, “When you’re that small, you can grow rapidly and peers don’t notice.” He notes that its earnings per share grew by 50% during the nine months ended Sept. 30, 2013.

Net income was US$133.7 million on revenue of US$1.2 billion in the nine months ended Sept. 30, 2013, vs net income of US$88.9 million on revenue of US$1 billion in the corresponding period in 2012. The company doesn’t expect to pay dividends in the foreseeable future.

Spirit went public in May 2011. Its 72.6 million outstanding shares closed at US$46 on Jan. 6.

© 2014 Investment Executive. All rights reserved.