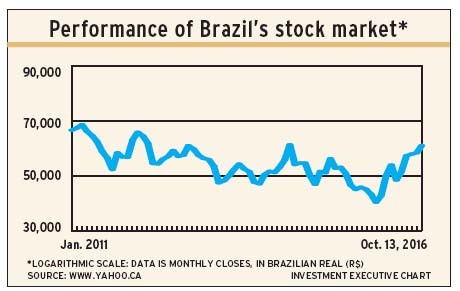

Brazil is so rife with problems – unsustainably high public debt, high inflation and interest rates, and wide-ranging corruption – that the country seems to be a place for investors to avoid. But Brazil’s stock market has rallied by a huge margin this year (a gain of about 40%), and there’s likely to be more appreciation in companies’ stock values to come.

Matthew Strauss, portfolio manager at Signature Global Asset Management, a unit of CI Investments Inc., in Toronto, expects Brazil’s gross domestic product to increase by 1.5%-2% in 2017 vs declines of approximately 3% this year and by 3.8% in 2015.

An important factor in this bullish outlook is the rise in iron ore prices to about US$55 per tonne from US$43, which has led to solid profits for the country’s low-cost producers. But the biggest positive is rising business and consumer confidence as a result of efforts to reduce corruption, including impeaching former president Dilma Rousseff on Aug. 31, and promises of fiscal reform by Michel Temer, the new president.

Fiscal reform legislation, including a proposed cap on government spending and raising the retirement age by five years to reduce public pension obligations, should help to lower the risk premium demanded by international investors. Inflation also is declining, so that premium reduction will allow Brazil’s central bank to lower interest rates, thus stimulating the economy further.

“There’s still a long way to go, but the country has a good foundation,” says Mark Mobius, executive chairman of Templeton Emerging Markets Group, a division of U.S.-based Franklin Templeton Investments, in Singapore. He notes that Brazil is a low-cost producer of many commodities, not just iron ore, and that the country also has “very capable” business leaders.

In addition, says Charles Burbeck, co-head of global equity portfolios at UBS Global Asset Management (U.K.) Ltd. in London, there’s a large middle-class with a growing appetite for discretionary consumer goods, including financial services.

There also has been a resurgence in demand for emerging-market investments. “A lot of big institutional investors were underweighted in emerging markets for a number of years, reflecting declining economic growth rates in those countries. But money is flowing back in now,” says Burbeck.

In addition to strong stock market gains this year and a 23% rise in Brazil’s currency, the real, vs the U.S. dollar, Burbeck says, there’s potential for more gains for equities because valuations of some companies still are attractive.

Mustafa Boulhabel, associate portfolio manager on the emerging market equities team at RBC Global Asset Management (U.K.) Ltd. in London, agrees. “There are very good companies with good management,” he says, adding that the shares of many of these firms have dropped by more than was justified by their prospects.

Strauss also sees room for share price appreciation, noting that the increases in share values this year bring Brazil to a neutral weighting in many investors’ portfolios.

Here’s a look at some of the companies these experts favour:

– RESOURCES PRODUCERS. Burbeck and Mobius like Vale SA, a global mining company for which iron ore is the most important product. Vale stock is trading below book value despite the company making good money with iron ore at US$55 per tonne. Burbeck thinks the stock price will rise further as China reduces its uneconomical steel and iron ore production capacity.

Strauss favours pulp and paper producer Suzano Papel e Celulose SA, another global, low-cost producer that is making money even at current low pulp prices. He thinks the stock price has probably reached bottom, putting the company in a position to increase earnings substantially with any significant increase in the price.

Although Mobius and Strauss don’t own shares of oil company Petroleo Brasiliero SA, both believe the firm could be an interesting prospect if its current reorganization is successful.

– FINANCIAL SERVICES. Cielo SA is a credit card and debit card merchant acquirer, providing payment-processing terminals for retailers. Cielo is the dominant player in Brazil in that market and, with credit card penetration low in the country, has many years of growth ahead. Burbeck says Cielo is a well-managed company.

Itaú Unibanco SA is the biggest private bank in Brazil. Burbeck says Itaú is “the J.P. Morgan of Brazil. [Itaú is] well-managed with a strong balance sheet, high return on equity and, traditionally, a very big net interest margin.”

Boulhabel prefers Banco Bradesco SA, the second-largest bank in Brazil, for its a very strong balance sheet. The bank has less exposure than Itaú to small and medium-sized companies, the loan losses for which tend to be higher than for large companies. Banco Bradesco also is involved in life and health insurance, a market in which Itaú is not a player.

– CONSUMER DISCRETIONARY. Boulhabel favours Natura Cosmeticos SA, a cosmetics company with a strong brand. He likes the firm’s “very strong management, which has a very strong focus on innovation and offers environmentally friendly products.” He says the stock isn’t cheap, but its prospects are excellent.

– INFRASTRUCTURE. Grupo CCR SA is the biggest transportation infrastructure company in Latin America. Strauss says the firm is one of the best operators of toll roads, subways and airports, and is well positioned to participate in future infrastructure projects. Although Grupo CCR’s stock is not inexpensive, earnings will be boosted as lower interest rates reduce the cost of capital.

© 2016 Investment Executive. All rights reserved.