Tough times are being endured by Canada’s resources industries. And the financial services sector may or may not be helped in the year ahead by actions of the U.S. Federal Reserve Board.

Together, these two sectors dominate Canada’s industries and stock markets. The largest companies in other sectors, however, seem to be better prepared for difficult times – if such times indeed occur in 2016.

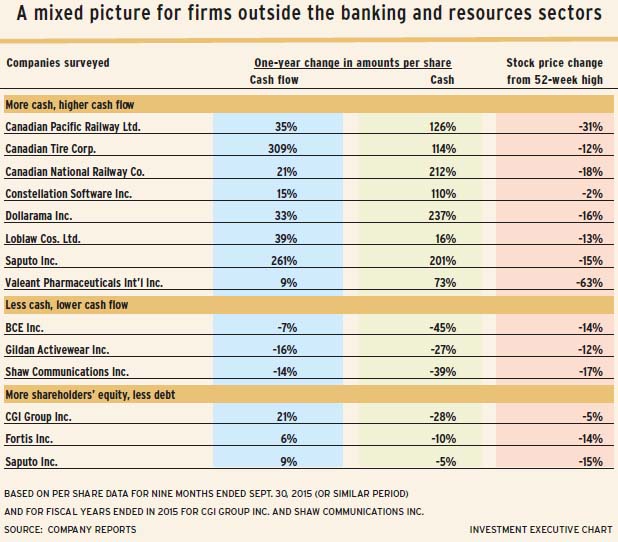

In a review on behalf of Investment Executive, I looked at the 20 largest non-financial, non-resource companies in the S&P/TSX composite index to see how they are faring as we head into the new year. My measures: cash and cash flow per share, whose strength helps businesses through rough patches.

Of the 20 firms, eight generated more cash flow and wound up with more cash in the first nine months of 2015. These businesses represent transportation, food processing, retailing, high technology and pharmaceutical industries.

The comparisons are based on figures per share. This method adjusts for changes in the number of shares outstanding, and links more closely with what a shareholder actually owns.

I cheated a bit, because a few companies don’t follow the conventional pattern of March/June/September/December quarterly reporting, with a December fiscal yearend. So, we used recent full years for CGI Group Inc. (ended September), Shaw Communications Inc. (August) and Métro Inc. (September).

I calculated the latest nine-month figures for companies with fiscal yearends earlier in 2015 (Alimentation Couche-Tard Inc. in April; Saputo Inc. in March).

Unless the final quarter of 2015 has proved to be a trend-changer, the eight companies with more cash and greater cash flow face the new year with positive momentum in their fundamentals.

Eight other companies generated more cash flow per share without boosting cash holdings. That list: CGI Group, Couche-Tard, Fortis Inc., Métro, Restaurant Brands International Inc., Rogers Communications Inc., Telus Inc. and Thomson Reuters Corp.

This rise in cash and/or cash flow contrasts with stock market performance. Each of the 20 stocks has dropped in price from its 52-week high.

This may be a signal of a company’s health. But it’s definitely bearish, and would contradict the other, favourable trends noted in a firm’s fundamentals.

In some cases, a downward trend in share prices is not a major negative. For CGI Group, Couche-Tard, Constellation Software Inc., Métro and Thomson Reuters, these share price drops have been mere glancing blows – all these firms have experienced drops of only 6% or less.

The big loser is Valeant Pharmaceuticals International Inc.’s share price, down by 63%. Next in line, Canadian Pacific Railway Ltd.’s has dropped by 31% and Magna International Inc.’s has dropped by 23%.

There also are three companies that are clear losers in the cash and cash-flow trends: BCE Inc., Gildan Activewear Inc. and Shaw.

Another sign of financial strength is growth in shareholders’ equity (book value) and a cut in debt. Three companies in the survey managed this in the periods measured. CGI Group managed to cut its long-term debt by 28%. Saputo’s book value increased by 9%.

Other companies managed to cut debt without making progress in other financial values. This group includes BCE (a 23% drop in debt), Telus (a 7% cut), and Thomson Reuters (a 12% cut).

Valeant’s shareholders’ equity per share jumped by 22%, while Couche-Tard and Constellation Software had 13% gains in that metric.

A few companies managed to cut the number of shares outstanding, thereby enhancing the value of the remaining shares: CP Rail’s shares outstanding dropped by 7%; Magna and Métro both reduced their share counts by 5%; Dollarama Inc. and Canadian Tire Corp., by 4%; Thomson Reuters, by 3%; Canadian National Railway Co. and Telus, by 2%; and Gildan, by 1%.

© 2016 Investment Executive. All rights reserved.