Long-enduring bull markets allow your clients to forget easily that bear markets also are a fact of life. They are inevitable; sooner or later, all bull markets end and share prices drop – and keep dropping – in a bear market.

We are being reminded of this cycle now, almost seven years after the previous bear market ended.

Bear markets start when the market is overvalued. The best evidence for this comes from the dominant U.S. stock market, which sets the pace for Canada. The S&P 500 composite index, Wall Street’s benchmark, currently is trading at around 21 times earnings, well above the index’s long-term median of about 16.

The S&P 500’s dividend yield was as low as 2% early in 2015; that metric was 3% when the bull market started in 2009. The index now is trading at about 2.6 times book value vs 1.4 times in 2009.

In addition, weakening economic growth is a clue that market weakness is imminent.

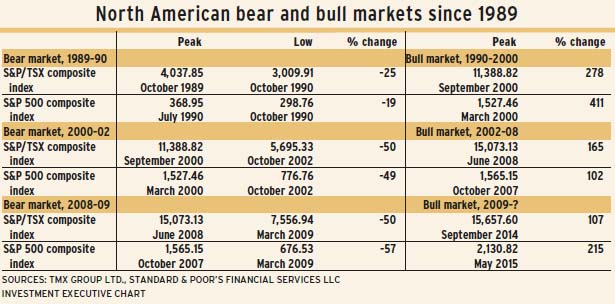

Bear markets come in assorted sizes and shapes. Some bears have been extremely short, lasting only months. Others have been prolonged agony for investors. In addition, there sometimes is much disagreement about what constitutes a bear market: what one analyst may view as one long bear market, another analyst may interpret as a series of short bull and bear swings.

Today, a drop of 20% from a bull market high generally is regarded as a bear market. Another definition would be a series of descending waves in market indices, with the indices reaching successive lows over a period of months.

At the start of a bear market, there is no clear or certain guide to determine when and where it will end. But there are clues based on market action in the past.

By the 20% measure, the Canadian market (as represented by the S&P/TSX composite index) definitely is in a bear trend. The S&P/TSX composite index has dropped by more than 20% from its September 2014 peak; by mid-January, it had fallen by 26%.

This puts the Canadian market in dangerous territory, as it dropped below the halfway level of the preceding bull market’s rise during intraday trading on Jan. 20. This “50% level” sometimes is where a market drop will reverse.

In index numbers, the S&P/TSX composite’s halfway level is 11,612. As of mid-January, the index had fallen as low as 11,600.

Because the S&P/TSX composite failed to stop at the halfway point, you might expect the market to continue lower and retrace about two-thirds of its preceding bull market run. That level would be around 10,300 for this index. But there’s no guarantee that would be a sure bottom.

On Wall Street, the bull/bear issue has yet to be determined. As of mid-January, the S&P 500 had dropped by 14% from its record high, set in May 2015 – enough to say the U.S. market is in a downtrend, and that the index must rally by 10% to reverse that trend.

The S&P 500 reached as low as 1,827 in mid-January, which is below its September 2015 low and above its August 2015 low. This situation increases the likelihood of a full-blown bear market.

A 20% drop to 1,700 on the S&P 500 would push the index lower and violate another important low, which was set in February 2014.

Previous highs often become levels at which a dropping market will stop. The critical one for the S&P 500 now is the 1,500-1,600 zone. The U.S. market peaked in that range in 2000 and again in 2007. Intermediate highs made since 2009 are below those levels.

The oldest method of market analysis, the Dow Theory, now says that Wall Street’s bull/bear status is undecided. The Dow Theory works by comparing the movements of two averages, the Dow Jones industrial average and Dow Jones transportation average: these must move in parallel paths to confirm a trend.

The transportation average has dropped since December 2014 through a series of lows. The industrial average confirmed this bear trend in the mid-January 2016 sell-off, dropping below its 2015 low.

Gauging how long a bear market will last is even more indeterminate. An estimate by Richard Russell, a renowned market analyst who wrote a market advisory newsletter, Dow Theory Letters, since 1958, is worth pondering.

“I expect this bear market will last until possibly 2020,” he wrote in 2012. Russell repeated this sentiment this past September, two months before he died at the age of 91.

© 2016 Investment Executive. All rights reserved.