Southern Ontario’s auto-parts makers may hold opportunities for investors this year.

Sales of automobiles in the U.S. have been on a strong upward path since mid-2009, and while this trend may be approaching its peak, American consumers are likely to continue to be in a car-buying mood this year. European auto sales also should continue to improve for several years, thanks to continuing monetary stimulus in some European Union countries.

Chief among Canadian autoparts makers are Linamar Corp. in Guelph, Ont., Magna International Inc. in Aurora, Ont., and Vaughan, Ont.-based Martinrea International Inc. Although North America is these companies’ biggest market, all three have significant operations in Europe.

David Tyerman, managing director, transportation and industrials, with Canaccord Genuity Group Inc. in Toronto, has “buy” ratings on the shares of all three companies.

Recent reports from Toronto-based Royal Bank of Canada’s capital markets division (RBC) have “outperform” ratings on Magna and Martinrea, as well as a “sector perform” for Linamar.

A report from J.P. Morgan Securities LLC (JPM) in New York has an “overweight” recommendation on Magna, the only one of these companies JPM covers.

A recent report from the Bank of Nova Scotia in Toronto is forecasting a 1.8% increase in U.S. auto sales this year and a 3.8% rise in Europe. Sales throughout Asia also are expected to pick up. Although Asia remains a small market for these three autoparts companies, they all have a presence in the region and will benefit from growth in consumer demand.

Another plus is the auto industry’s relative immunity to new competition due to the new Trans-Pacific Partnership trade agreement, which is designed to lower tariffs and other barriers among Pacific Rim nations. Autoparts firms generally need to be close to their customers to provide just-in-time delivery; times of more than a few hours can be fatal to suppliers in this industry.

“Under just-in-time, a component may have to be delivered within four hours,” explains Tyerman. Thus, low-cost countries in Asia are unlikely to try to supply autoparts to the North American market.

Says William Aldridge, vice president, investment management, all-cap value team, with Mackenzie Financial Corp. in Toronto: “These [autoparts] companies [under discussion] don’t need to be protected.”

Magna is by far the largest of the three companies and also the most diversified, manufacturing pretty much all auto components.

Linamar and Martinrea are more focused. Specifically, Linamar focuses on engines and transmissions, while Martinrea focuses on metal components such as fenders and frames. Consolidation in the autoparts industry continues, and Linamar and Magna are in the midst of significant acquisitions.

Here’s a look at the three companies in more detail:

– Linamar corp. Aldridge says that “[Linamar CEO] Linda Hasenfratz has done a phenomenal job. [Linamar’s] a very well run company. It used to struggle with new business, but now is doing launches extremely well.” Aldridge adds that Linamar is “extremely disciplined on the balance sheet.”

The company’s highly efficient engine and transmission parts put it in the sweet spot for environmental protection by increasing fuel efficiency, says Aldridge.

The firm also provides parts used in other industries, including renewable energy and agriculture. Subsidiary Skyjack Inc. is a global supplier of aerial platforms.

Linamar’s biggest recent acquisition is the $1-billion purchase of France-based Montupet SA, a global leader in the design and manufacture of complex aluminum casting for the auto industry. The deal was announced in October 2015.

Linamar had net income of $341.4 million on sales of $3.9 billion in the nine months ended Sept. 30, 2015, up from net income of $248.8 million on sales of $3.2 billion in the corresponding period a year earlier.

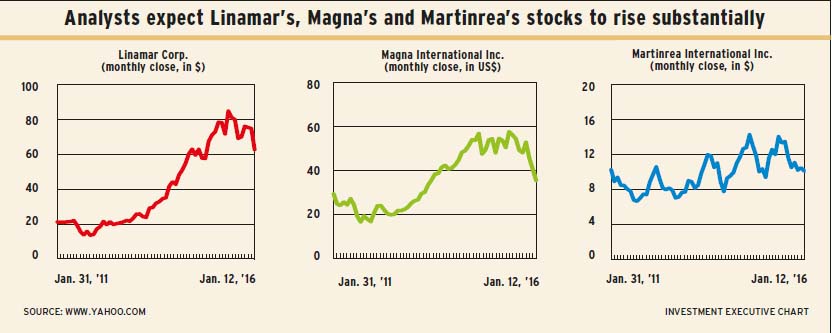

Linamar continues to gain market share, Tyerman says, thanks to its strong cost controls and new products. Tyerman has a price target of $89 a share, a little higher than RBC’s $87. That said, the RBC report states the stock price could reach $115 within four years.

The 65.7 million outstanding shares, of which the Hasenfratz family owns 23.5%, closed at $62.84 on Jan. 12.

– Magna International Inc. Aldridge describe’s this company’s management as “fantastic” and notes that the firm’s incentive is to increase return on capital. “[Magna] is very clean and well operated,” he says.

Tyerman expects Magna to resolve recent launch issues by mid-year, resulting in significantly improved financial results. He also expects annual growth in earnings per share (EPS) of around 20% over the next two years, driven by good sales growth, some margin expansion and significant share buybacks accompanied by “commensurate or better” dividend growth.

Magna also recently made a big acquisition, paying about US$1.9 billion for Germany-based GETRAG Group of Cos., a global supplier of auto transmissions, in a deal that closed Jan. 4. This deal has not yet been incorporated into earnings estimates and price targets, but the results of the deal should be positive, given GETRAG’s strong growth prospects.

Magna’s net income was unchanged in the nine months ended Sept. 30, 2015, vs the same period in 2014, at US$1.4 billion (excluding gains on divestitures and restructuring charges). Sales were down during the same period in 2015, at US$23.6 billion vs US$25.6 billion year-over-year.

RBC’s price target is US$64 a share; JPM’s is US$61; and Tyerman’s is US$56. The 413.8 million outstanding shares closed at US$35.42 on Jan. 12. The RBC report states the share price could rise to US$80 within four years.

– Martinrea International Inc. is a metals-forming business, stamping out fenders, frames and other parts. The company acquired 55% of Germany-based Honsel AG, a supplier of aluminum auto components, to feed into the trend to lighter cars, in 2011 and increased that to 100% in 2014.

Martinrea’s new president and CEO – Pat D’Eramo, who had run manufacturing for Toyota Motor Corp. in 2001-09 – was brought in about a year ago. Aldridge says revenue and margins have improved under D’Eramo’s watch.

Net income (excluding one-time items) was $89.7 million on revenue of $2.8 billion in the nine months ended Sept. 30, 2015, up from net income of $60.6 million on revenue of $2.7 billion in the corresponding period a year earlier.

Both Tyerman and RBC have a one-year price target of $19. The 86.8 million outstanding shares closed at $10.24 on Jan. 12.

© 2016 Investment Executive. All rights reserved.