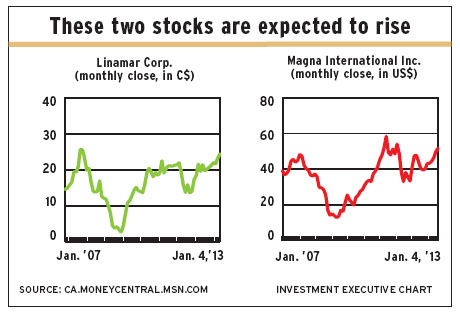

With the recent recovery in automobile sales in the U.S., share prices for Canadian autoparts manufacturers Linamar Corp. of Guelph, Ont., and Magna International Inc. of Aurora, Ont., have picked up as well – and analysts think there’s still more upside.

Autoparts manufacturing is a challenging business because suppliers have to keep finding efficiencies to accommodate the price declines that are written into their contracts, says Massimo Bonansinga, portfolio manager at Signature Global Advisors, a division of CI Financial Corp. in Toronto, and they have no margin for error because the automakers insist on “just in time” delivery.

It was the success of Japanese automakers such as Honda Motor Co. Ltd. and Toyota Motor Corp. in the 1980s that forced the Detroit Three – Ford Motor Co., Chrysler Corp. (now Chrysler Group LLC) and General Motors Co. – to find ways to cut costs.

The easiest way to do that, Bonansinga explains, was to “offload more of the costs of a car away from the unions and on to suppliers, who pay lower wages and have more flexible work rules.” That meant buying more autoparts from suppliers and usually writing automatic price drops into contracts.

The automakers usually have a couple of suppliers, so that if one company can’t deliver, the other can. This policy also limits the bargaining power of the suppliers.

The result was a good deal of consolidation in the auto industry and more integration between automakers and autoparts manufacturers. “Today, autoparts manufacturers are much more a partner than they were 20 years ago,” says Bonansinga, who notes that autoparts manufacturers are often expected to be able to follow automakers globally, which introduces further complexity into the autoparts business.

There are two categories of autoparts, Bonansinga says: “commoditized” products include most of the interiors, seating, exterior plastic parts, most of the air conditioning units, some engine parts and traditional batteries and lighting systems; “complex” products include transmissions, fuel-efficiency components/systems and electronics.

Margins are bigger and the annual price declines smaller on the complex items, which makes firms that focus on complex products the preferred investments.

Here’s a closer look at the firms:

– LINAMAR CORP. is not a pure play on autoparts because the company also produces parts for power generation and various lifts for industrial use, the latter mainly through Skyjack Inc., a wholly owned subsidiary acquired in 2001-02. But the autoparts business – mainly transmissions and engines – is the major one, accounting for $1.8 billion of the firm’s $2.5 billion in sales in the nine months ended Sept. 30, 2012.

North America is by far the biggest market for Linamar’s autoparts sales, at $1.5 billion; but the firm does have a growing presence in Asia/Pacific ($114 million) and in Europe ($166 million). The business in Europe is small enough that a report from Royal Bank of Canada’s (RBC’s) capital markets division in Toronto doesn’t consider this market problematic despite falling sales.

Other pluses behind the RBC report’s “outperform” rating are “a strong book of new [product] launch business [and] continued growth in the North American market for Skyjack products.”

A report issued by Toronto-based Canaccord Genuity Corp. points to Linamar’s strong book of business, which is expected to generate $4.1 billion in sales in 2015, up from the $3.2 billion estimated previously. Linamar is targeting $5 billion in sales in 2015 and $10 billion in 2020.

The Canaccord Genuity report also expects “further margin expansion from stronger industrial margins through the cycle” and notes that Linamar expects its net debt/market capitalization ratio to fall to around 35% in the next four to six quarters from the current low-40% range.

According to the Canaccord Genuity report, Linamar “provides an excellent growth story with good operating momentum, attractive sales growth and margin expansion attributes and an attractive valuation.”

Both the Canaccord Genuity and RBC reports have 12-month price targets of $29, up from the $24.38 that the 64.7 million shares closed at on Jan. 4.

Marc-André Robitaille, a portfolio manager with AGF Investments Inc. in Toronto who focuses on dividend-paying stocks, also sees Linamar’s upside potential, but he doesn’t hold the stock in any of the funds he manages because he finds it more expensive than Magna’s.

Linamar’s net income in the nine months ended Sept. 30, was $115.4 million on revenue of $2.5 billion, vs net income of $74.4 million on revenue of $2.1 billion in the corresponding period a year earlier.

– MAGNA INTERNATIONAL INC. is, by far, the biggest Canadian autoparts manufacturer, with almost US$23 billion in sales in the nine months ended Sept. 30. However, Bonansinga says, there are two potential drawbacks to owning shares in this company: a significant portion of its sales are commoditized products for interiors and chassis/exteriors; and Magna has significant exposure to Europe, at about 45% of its sales. However, he adds, Magna mainly supplies German automakers, so it’s in the better part of that market. Magna also is fixing some problems in its European seat-production facilities.

However, Bonansinga considers Magna a very solid company financially, one that’s getting better and better operationally.

An RBC report has an “outperform” rating on Magna’s stock, based on the expectation of “gradual progress” on European margin expansion; “aggressive expansion” in emerging markets, which are key growth areas; and a strong balance sheet.

A Canaccord Genuity report also rates the stock a “buy,” saying Magna’s valuation is “attractive relative to its historical multiples and DCF [discounted cash flow], but normal relative to the group,” suggesting “the upside potential is probably limited by group valuation moves.”

The Canaccord Genuity report also cautions that earnings per share (EPS) growth is likely to slow to high single-digit levels in 2013-14 from the “solid double-digit” gain estimated for 2012 because of slowing auto sales in North America and weakness in Europe.

A report from New York-based J.P. Morgan Securities LLC is much less enthusiastic, rating the stock as “underweight.” That’s because even though Magna is “one of the last large, truly diversified North American automotive suppliers,” J.P. Morgan analysts expect Magna’s growth to “largely mirror the industry” and sees “execution in Europe as a key issue.”

There’s a range of 12-month price targets: RBC’s is US$61, Canaccord Genuity’s is US$57 and J.P. Morgan’s is US$51. The 236.1 million outstanding shares closed at US$51.55 on Jan. 4.

Net income in the nine months ended Sept. 30 was US$1.1 billion on revenue of US$22.8 billion, vs US$704 million on revenue of US$21.5 billion in the corresponding period a year earlier.

© 2013 Investment Executive. All rights reserved.