DESPITE SLUGGISH ECONOMIC growth, Canada’s two publicly traded airlines – Montreal-based Air Canada and Calgary-based WestJet Airlines Ltd. – have done well during the past few years. Both firms should continue to do so as long as a decent level of economic growth continues.

In fact, analyst reports from Toronto-based Royal Bank of Canada‘s (RBC) capital markets division and TD Securities Inc. have “buy” or “outperform” ratings on the two stocks. These ratings are based on continued increases in demand, more cost-cutting measures and new growth initiatives at both airlines.

However, not everyone is as optimistic. Any disappointment on the demand side is likely to push the share prices down significantly, suggests Joe D’Angelo, portfolio manager with Signature Global Advisors, a division of CI Financial Corp. in Toronto, who doesn’t hold either stock in the mutual funds he manages.

Ben Cherniavsky, analyst with Toronto-based Raymond James Ltd. in Vancouver, is concerned that there could be too much domestic capacity in 2014. Air Canada and WestJet are adding a combined 3%-4% in domestic seat miles while traffic may grow only in line with the 2.5% expected increase in real gross domestic product.

Airline stocks are very volatile – not just in Canada, but globally. Travel is a discretionary expense for businesses as well as for consumers, and both segments will reduce their consumption when the economy is weak. Given the large fixed costs in the airline business, small changes in demand can have a disproportionate impact on profits.

In most ways, airline travel also is a commodity business. With little differentiation between flights on different airlines, price is usually the main determinant for customers. In the past, says Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd., this has resulted in price wars and big drops in net income or losses during periods of weak demand.

Among commercial airline companies, there are two types: flag carriers and commercial firms. The flag carriers are state-sponsored, often subsidized and given preferential treatment, such as access to the best landing sites. Air Canada began in this way. Commercial airlines, on the other hand, include both large unionized companies with big legacy costs and discount carriers, which generally are not unionized and have newer, more fuel-efficient airplanes. WestJet is in the latter camp.

In recent years, capacity has dropped as a result of legacy firm bankruptcies and an increase in code-sharing, in which several airlines use each other’s flights to book customers to their final destination, thereby reducing the need or incentive for more flights. Air Canada code shares with 31 airlines, 20 of which are members of the global Star Alliance. WestJet code shares with 10 airlines.

Nevertheless, airline stocks remain very sensitive to the demand outlook. This is particularly true for business travel, which is where most airlines make most of their profit, given the much higher price that can be charged to business travellers, who book first class or business class for long flights. As a result, most analysts and fund portfolio managers consider these “trading” stocks that clients should buy when the price is down and sell when the price goes up rather being than long-term holds.

As a legacy player with high fixed costs and large pension and benefit liabilities, Air Canada is considered a particularly risky investment because small changes in demand can have a significant impact on its bottom line.

WestJet is more stable because it’s a relatively recent entrant, has a newer fleet, is not unionized and operates in the lucrative discount market.

Both the RBC and TD reports assume that both airlines can continue to grow as long as the economy expands. But that assumes that WestJet doesn’t steal market share from Air Canada with the former’s expansion into regional markets and its flights to Europe.

Air Canada and WestJet both will start offering discount flights to Europe for the leisure consumer in 2014. Air Canada’s new Rouge service will offer more routes initially, but WestJet’s prices will be cheaper and the firm may be able to offer inexpensive connecting flights to other European destinations if it can negotiate an agreement with Ireland-based European discount airline Ryanair Ltd.

For WestJet, the risk is that it’s taking on too many changes and new initiatives and won’t have the focus to execute all of them well.

Here’s a look at the two companies in more detail:

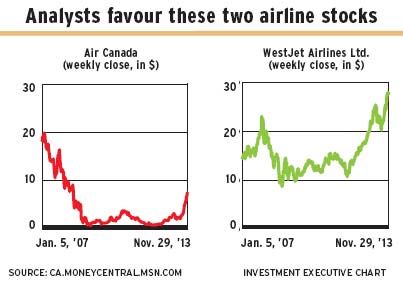

– air canada saw its share price drop dramatically in 2007 and 2008, then languish below $4 until this past summer, when the price of the 283 million outstanding shares moved up briskly. They closed at $7.56 each on Nov. 29.

The RBC report says that Air Canada is executing well and continues to be on target toward its 15% reduction in cost per available seat mile in the medium term.

The TD report also is impressed with Air Canada’s recent operating and financial performance.

Both reports rate the stock as “speculative,” with an “outperform” recommendation from RBC and a “buy” recommendation from TD; both reports have the same 12-month “base case” price target of $8, which also is Cherniavsky’s price target, even though he rates the stock as “market weight.”

Both the RBC and TD reports say the stock price could go much higher. The RBC report says the shares could reach $12 apiece within 12 months. The TD report says the share price may reach $20 in three to four years.

Air Canada “represents the most significant upside return potential in our coverage universe,” says the RBC report. Hence, its upside price target of $12, which assumes that yields, or average fares paid per mile, rise by 1.5%, traffic grows by 7% in 2014 (vs 6% in the base case) and 5% in 2015 (vs 4%) and that jet fuel prices are 10% lower than expected.

The TD report says that $20 a share is possible within three to four years, assuming the continuation of the growing positive spread between return on invested capital (ROIC) and the weighted average of the cost of capital, combined with cost reductions, prudent capacity growth, international growth opportunities and “management’s message of focusing on ROIC and earnings growth.”

But this is the upside. The downside, according to the RBC report: there’s also a risk of the stock price falling to around zero if there’s only a 2% increase in traffic in 2014, yields drop and fuel prices are 10% higher than expected.

The RBC report also notes that Air Canada’s balance sheet is heavily leveraged, which makes the stock particularly sensitive to negative industry data. Long-term debt and finance leases were $3.7 billion, and pension and other benefit liabilities were $4.4 billion as of Sept. 30.

Net income was $16 million in the nine months ended Sept. 30 on revenue of $9.5 billion. That compares with a loss of $76 million and revenue of $9.3 billion in the corresponding period in 2012.

– westjet airlines ltd. Reflecting this company’s steadier performance, its shares fell by less than Air Canada’s in 2008, then started increasing a year earlier, at the end of 2011. WestJet shares, however, did have the same run-up in price, starting in mid-summer this past year. The 134 million outstanding shares closed at $27.60 on Nov. 29.

Analyst reports on WestJet from RBC and TD have an “outperform” or “buy” ratings on the stock. The RBC report’s 12-month target price is $33, vs $31 for TD, which is the same as Cherniavsky’s price target despite his “market weight” rating.

The RBC report has both a downside and upside scenarios. In the downside one, the stock price is at $20 a year from now. In the upside scenario, it’s $35 and yields would grow by 2% in 2014 and by 2.5% in 2015 as a result of robust traffic growth that closely matches the airline’s expected increase in capacity through fleet expansion and new growth opportunities.

The big risk for WestJet is in execution. The RBC report admits that WestJet has experienced growing pains with the problematic rollout of its premium economy product, which provides extra leg room and other amenities. However, the report adds, the issues apparently have been addressed.

Other analysts aren’t so sure. Cherniavsky is concerned about possible problems, given the numerous changes and new initiatives that WestJet is implementing simultaneously. He also believes that it’s a little ominous that there has been union talk at WestJet but doesn’t think a union will be established in the near term. However, he warns, WestJet’s culture has been a major ingredient in its success, and the fact that employees are even listening to union talk suggests that they’re resisting some of the changes and that the culture could be damaged.

Net income was $201 million on revenue of 2.7 billion in the nine months ended Sept. 30, vs net income of $181 million on revenue of $2.6 billion in the corresponding period a year earlier.

© 2014 Investment Executive. All rights reserved.