If you’re looking for defensive stocks with some growth potential, consider financial technology (fintechs). These companies provide back-office software and systems to banks and other financial services players under long-term contracts. That means that fintechs can predict about 85% of their revenue accurately at the outset of any given year.

The fintech industry also has promising growth prospects, with revenue likely to grow by around 8% a year, says Stephanie Price, a research analyst at CIBC World Markets Inc. in Toronto who specializes in software and services equities. This growth will be driven by the need to replace aging back-office systems. But there also are continuous sales of add-ons and enhancements resulting from consumer demand for multiple investment channels and business demand for faster transactions.

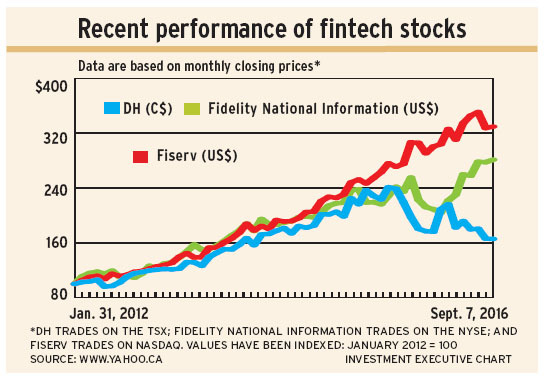

Below, the prospects for three fintech firms are examined: Toronto-based DH Corp., Fidelity National Information Services Inc. (FNIS) of Jacksonville, Fla., and Fiserv Inc. of Brookfield, Wis.

DH is the most attractive, following a drop in its share price to around $30 a share from $40 in April following disappointing earnings in the first and second fiscal quarters. Price thinks the drop is not justified by the firm’s prospects, and she expects the share price to return to $40 in the next year.

Fiserv is considered to be fairly priced. But there may be significant near-term upside for FNIS.

Here’s a look at the three companies in more detail:

– dh corp. This firm is the smallest of the three fintech companies, with revenue for the first six months of 2016 of $836 million vs Fiserv’s US$2.7 billion and FNIS’ US$4.5 billion. However, DH is a significant player, thanks to two major acquisitions, each costing more than US$1 billion.

In 2013, DH bought Lake Mary Fla.-based Harland Financial Solutions, which provides strategic technology, including systems that deal with lending and compliance, core banking and channel management, to U.S.-based mid-sized banks. In 2015, DH bought Chicago-based Fundtech Corp., which offers global payment solutions to banks worldwide.

DH still is integrating Fundtech and also realigning its businesses by product line rather than geography to improve efficiency, with expected annual net savings of $25 million.

Price and a research report from Credit Suisse in New York give the stock an “outperform” rating, with a one-year price target of $40.

A report from Royal Bank of Canada’s (RBC) capital markets division in Toronto offers a $48 share price target, based on several factors: DH’s significant U.S. exposure; leading market share in many of its businesses; DH’s share price’s significant discount to those of the firm’s U.S. peers; and the benefits DH will get from a recovery in banks’ capital spending. DH’s 106.8 million shares closed at $29.60 on Sept. 6.

Trevor Johnson, managing director, equities research, real estate and special situations, at National Bank Financial Ltd. in Toronto, is cautious. He believes the price for Fundtech was quite expensive and investors want to see both evidence that the acquisition was in the best interests of shareholders and cost savings from the realignment. His target is $39 a share.

– Fidelity National Information Services Inc. This company serves the larger end of the U.S. mid-sized banking market and also has international customers. FNIS’ 2015 acquisition of Sungard Systems International Inc. of Wayne, Penn., expanded FNIS’ potential customer base to include asset managers, brokerage firms and insurance companies.

That US$9.1-billion deal is still being integrated. However, John Scandalios, vice president, research analyst and portfolio manager at Franklin Templeton Investments Corp. in San Mateo Calif., says there’s “good tangible evidence that the expected synergies are ahead of plans,” which he doesn’t believe is priced into the stock price.

A report from RBC states FNIS “is performing at or above plan” and offers an “outperform” on the stock, with a price target of US$89 a share. The 329 million shares closed at US$80.41 on Sept. 6.

A recent report from Credit Suisse has a lower price target of US$85 a share for FNIS. However, that report states: “We are positively biased toward the stock” and that investors should consider buying it if the price weakens.

– Fiserv Inc. This company is focused on the U.S. mid-size banking market, where Fiserv is well entrenched. This firm also has grown by acquisition, but the last one – Glastonbury Conn.-based Open Solutions Inc. – was in January 2013. That deal no longer is a major driver of Fiserv’s share price, but a report from RBC states that Fiserv continues to benefit from synergies generated by that deal.

However, Fiserv’s 2016 revenue growth is at the low end of management’s expectations. That follows disappointing revenue in 2015.

A recent Credit Suisse report states this doesn’t indicate “decaying” fundamentals, but advises caution about the stock, rating it “neutral” because the market may price in a risk of similar disappointments in 2017. The report’s one-year price target is US$101, below the US$103.70 at which the 225.6 million shares closed on Sept. 6.

The RBC report states Fiserv “has an above-average track record of meeting/exceeding adjusted [earnings per share] estimates.” The target is US$110 a share.

© 2016 Investment Executive. All rights reserved.