Are the stocks of Canada’s Big Six banks worth buying? Various valuations say, “Yes, they are” – a timely response, as the banks extend their superior performance.

Big banks’ shares started outperforming the market as 2011 began – and that is continuing as we begin 2013. This means that the banks, as a group, are considered “buys” – perhaps not the best buys on the market, but conservative choices nonetheless.

The change in accounting rules to international financial reporting standards from generally accepted accounting principles may blur some long-term fundamental analysis, but both cash dividends paid and stock prices are real and unaltered by accounting changes. And these two metrics typically reveal that banks are preferred long-term investments.

A closer look at some valuations:

– Book value has special relevance for bank stocks. It’s a good indicator of value. Pioneering analyst Benjamin Graham believed a stock without balance-sheet blemishes was cheaply priced if below 1.5 times book value.

You rarely find Canadian banks trading at that low a multiple, but multiples around twice book value have been considered low over the past decade. That’s where bank stocks are trading at now. Bank of Montreal (BMO) and Toronto-Dominion Bank (TD) are the cheapest, at 1.6 to 1.7 times book value. Royal Bank of Canada (RBC) and Canadian Imperial Bank of Commerce (CIBC) are the most expensive, at 2.2 times book value.

At the height of the financial services industry surge in 2006-07, the Big Six banks traded as high as 4.0 times book value.

There is great leverage for a stock’s price when book value increases while the price/book value multiple also rises.

– Banks trade well below another of Graham’s yardstick: don’t pay more than 25 times the latest seven-year average earnings for any stock. RBC and CIBC are the most expensive by this rule, at 17 times seven-year earnings. BMO and National Bank of Canada (National Bank) are the cheapest, at 14 times average earnings.

– Historically high dividend yields indicate banks are reasonably priced. High yields provide opportunities. The 2009 crash provided one such opportunity. Since then, yields have dropped, but not as low as they were in the financial-sector boom of 2002-08.

Current bank stock yields are in the high range of the post-2009 years. They range from highs of between 4.2% and 4.6%, offered by BMO, CIBC and National Bank, and down to 3.7% from TD.

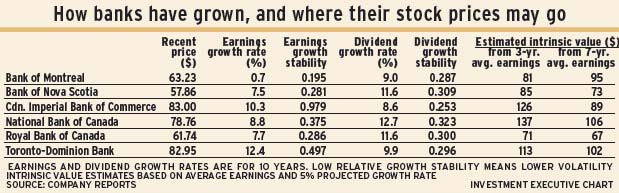

– What is a stock’s future value? Graham answered this with a rough calculation. As usual, his formula employs average earnings as the starting point. The accompanying table shows two sets of intrinsic value estimates, based on 5% growth, from the starting points of three-year and seven-year average earnings. These are conservative projections, considering that five of the six banks beat the 5% earnings growth rate handily over the past 10 years.

– Growth comes with higher volatility – at least, among bank stocks recently. The data in the table reveal this. TD and CIBC have the best 10-year earnings growth records, but also higher volatility (as measured by relative standard deviation of annual earnings).

– National Bank, Bank of Nova Scotia (Scotiabank) and RBC have the best dividend growth records – and also the highest volatility in annual payments.

– Profitability – as measured by return on equity (ROE) and return on average assets – separates the banks.

Scotiabank and National Bank stand out in both counts. National Bank’s five-year average ROE is 19%; Scotiabank’s is 18%. Both banks have the highest return on average assets, at 0.92% for Scotiabank and 0.82% for National Bank. RBC and TD come next in both measurements.

– The opportunity cost – or “alternative cost” – of an investment also puts bank shares in a favourable light, thanks to low interest rates.

A valuation formula that uses only book value and its growth rate plus the dividend yield on book value is revealing. It shows that any other investment would have to yield 11% in order to match BMO’s current stock price. For CIBC, the equivalent opportunity cost is 18%.

Recent share prices would be matched by an opportunity cost of 9% for National Bank and RBC, and 10% for Scotiabank and TD.

Are there any alternative investments offering such yields at low risk? There may be, but the banks look much safer today.

© 2013 Investment Executive. All rights reserved.