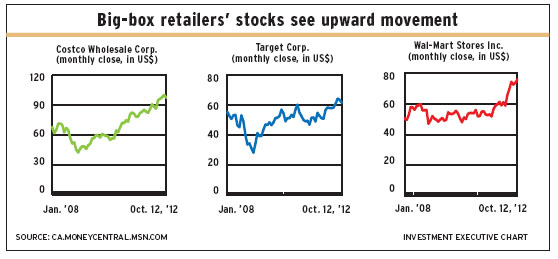

The falling unemployment rate and the firming housing market in the U.S. suggest a pickup in American consumers’ spending, which makes the stocks of big-box retailers such as Issaquah, Wash.-based Costco Wholesale Corp., Minneapolis-based Target Corp. and Wal-Mart Stores Inc. of Bentonville, Ark., good investment opportunities.

American consumers aren’t going on big spending sprees just yet, as the U.S. unemployment rate still is high, at around 8%. But that rate is down from 10% in late 2009, and shoppers are expected to increase their purchases gradually.

“These stocks are a good way to play the recovery of the American consumer,” says Charles Burbeck, head of global equities with Barclays Bank PLC‘s private wealth-management division in London. Wal-Mart is particularly well positioned because its low-income customer base is sensitive to changes in the labour market, he says: “Even very small changes in consumer sentiment translates into stronger sales and higher profits.”

The average annual income of Wal-Mart’s American customers is in the low $40,000 range, vs $64,000 for Target and $96,000 for Costco, according to analyst reports issued by New York-based J.P. Morgan Securities LLC. (All figures are in U.S. dollars.)

Target’s middle-income and Costco’s middle- to high-income customers are likely to be more secure in their jobs. But they also will increase their spending as they feel more confident in their country’s future economic growth.

Prospects for the three companies are good over the medium to longer term, but all face challenges in finding further strong growth.

Wal-Mart is so big – with more than $450 billion in annual sales and more than 10,000 retail outlets – that it’s hard to see where the company can generate further strong growth. If it opens stores too close to existing ones, that may cannibalize existing sales.

Both Costco and Wal-Mart have expanded internationally with mixed success. Results for both companies have been very strong in Mexico. Tony Genua, senior vice president and research director, North American equities, with Toronto-based AGF Investments Inc. and lead manager of AGF American Growth Class Fund, says Costco has been extremely successful in Canada.

But neither Costco nor Wal-Mart has done well in Britain, which Burbeck attributes mainly to lack of size and, thus, having less buying clout with suppliers than these firms have in the U.S. Genua, however, says it sometimes takes considerable time to figure out the right mix of products to get to sufficient size in foreign markets.

Target is just now going international, planning to open stores in Canada in 2013 and 2014.

Costco and Target, with sales of about $90 billion and $70 billion, respectively, still have room to grow. Their challenge is the risk that American middle-income earners will be squeezed in the coming years by higher taxes necessitated by the U.S.’s huge fiscal deficit and debt load.

A new approach being adopted by Target and Wal-Mart is opening smaller stores in affluent areas where their stores don’t yet exist. This makes sense, and if middle-income Americans do get squeezed, residents in these areas may be attracted.

Target and Wal-Mart offer a full range of groceries as well as a complete line of clothing, footwear and accessories, kitchenware and small appliances, bed and bathroom linens, electronics and pharmacy services, which Costco also offers. Costco is a “wholesale club” and charges membership fees and sells mainly bulk quantities of groceries and household supplies. Wal-Mart also has a wholesale club operation, its Sam’s Club outlets.

All three big-box firms could be good investments, Burbeck says, even though Costco’s shares are selling at 26 times this year’s earnings vs Wal-Mart’s and Target’s 15 times earnings. Burbeck’s preference is Wal-Mart because its low-income consumer base provides the most potential for an upside earnings surprise.

The J.P. Morgan research reports recommend “overweighting” Costco and Wal-Mart but has a “neutral” rating on Target. Analyst reports issued by New York-based UBS Securities LLC have a “buy” rating on Target but give Costco and Wal-Mart a “neutral” rating.

Here’s a look at the companies in more detail:

– costco wholesale corp.‘s revenue growth has been very strong, says Genua, at a compounded annual rate of 12% over the three years of 2009-11 (vs 5% at Wal-Mart and 3% at Target). He adds that Costco pays wages that are above average for the sector and has the “most productive warehouse stores,” with average sales of $154 million in the U.S. vs $82 million at Sam’s Club and $56 million at its other major wholesale competitor, Westborough, Mass.-based BJ’s Wholesale Club Inc.

The J.P. Morgan report says the Costco has strong international growth potential that isn’t diluted by much exposure to Europe’s sluggish growth/recession, having only 22 stores in Britain. Specifically, growth prospects in Canada and Mexico look good. The report also notes that membership fees provide stability, and the recently announced fee increases will push earnings upward.

Costco’s 10-year targets include: increasing annual sales of fresh food to $26 billion from $10 billion; increasing private-label sales to 25% of total sales from 15%; and doubling prescription revenue to $8 billion from $4 billion.

Net income for the 53 weeks ended Sept. 2 was $1.7 billion on revenue of $99.1 billion, vs $1.5 billion on revenue of $88.9 billion for the 52 weeks ended Sept. 2, 2011.

Costco’s 439 million shares closed at $97.55 on Oct. 12. The J.P. Morgan report has a 12-month target of $101 a share vs the UBS report’s 12-month target of $96.

– target corp. purchased the leaseholds of Zellers Inc. stores from Toronto-based Hudson’s Bay Co. and plans to open 100 to 150 stores, many of those in former Zellers locations, in 2013 and 2014. The strategy is to offer competitive discount prices that are not as low as those in Target’s U.S. stores. The UBS report notes that retail prices in Canada are “normally” about 15% higher than those in the U.S.

Besides the Canadian expansion, Target has three other strategies. The REDcard program provides a 5% discount on purchases made with Target debit or credit cards. This program is aimed at the 10% of core customers who account for about 50% of sales and have average household income of around $100,000.

Meanwhile, the Pfresh program involves the introduction of perishable, dairy and frozen foods in the stores, an effort to get customers into the stores more frequently.

City Target stores are smaller stores in urban centres aimed at attracting foot traffic and convenience shopping.

Net income for the 12 months ended June 30 was $2.9 billion on revenue of $71.3 billion, vs $3 billion on revenue of $68.4 billion in the corresponding period a year earlier.

Target’s 663 million shares closed at $61.52 a share on Oct. 12. The J.P. Morgan and UBS reports have 12-month targets of $71 and $66, respectively.

– wal-mart stores inc. is the largest retailer in the U.S.; it also operates in 27 other countries. The firm is particularly profitable in the U.S., says Burbeck, which accounts for about 60% of revenue but 70% of operating profits.

The company tried limited product selection in 2008 in the hope that customers would buy the higher-margin goods offered. This didn’t work, so the company has reversed that policy.

The latest strategy is twofold: put up Neighbourhood Market stores in affluent areas and have the regular stores compete directly with dollar stores by displaying products that can be purchased for $1 or less. TV ads focus on how much individual consumers save by shopping at Wal-Mart.

The company also aims to cut sales, general and advertising costs in the next five years, most of which will be passed onto customers. The J.P. Morgan report says this has the potential to increase the frequency with which shoppers go to Wal-Mart stores.

Net income for the 12 months ended June 30 was $17 billion on revenue of $460.7 billion, vs $17.3 billion on revenue of $431.9 billion for the year-earlier period.

Wal-Mart’s 3.4 billion shares closed at $75.81 a share on Oct. 12. The J.P. Morgan report has a 12-month target price of $80 a share; the UBS report’s 12-month target is $69.

© 2012 Investment Executive. All rights reserved.