There has been a much-needed influx of newer, younger advisors to the insurance sector, according to this year’s Insurance Advisors’ Report Card. However, an analysis of the advisor population reveals a gulf between the older, more experienced advisors leading the business and these younger entrants.

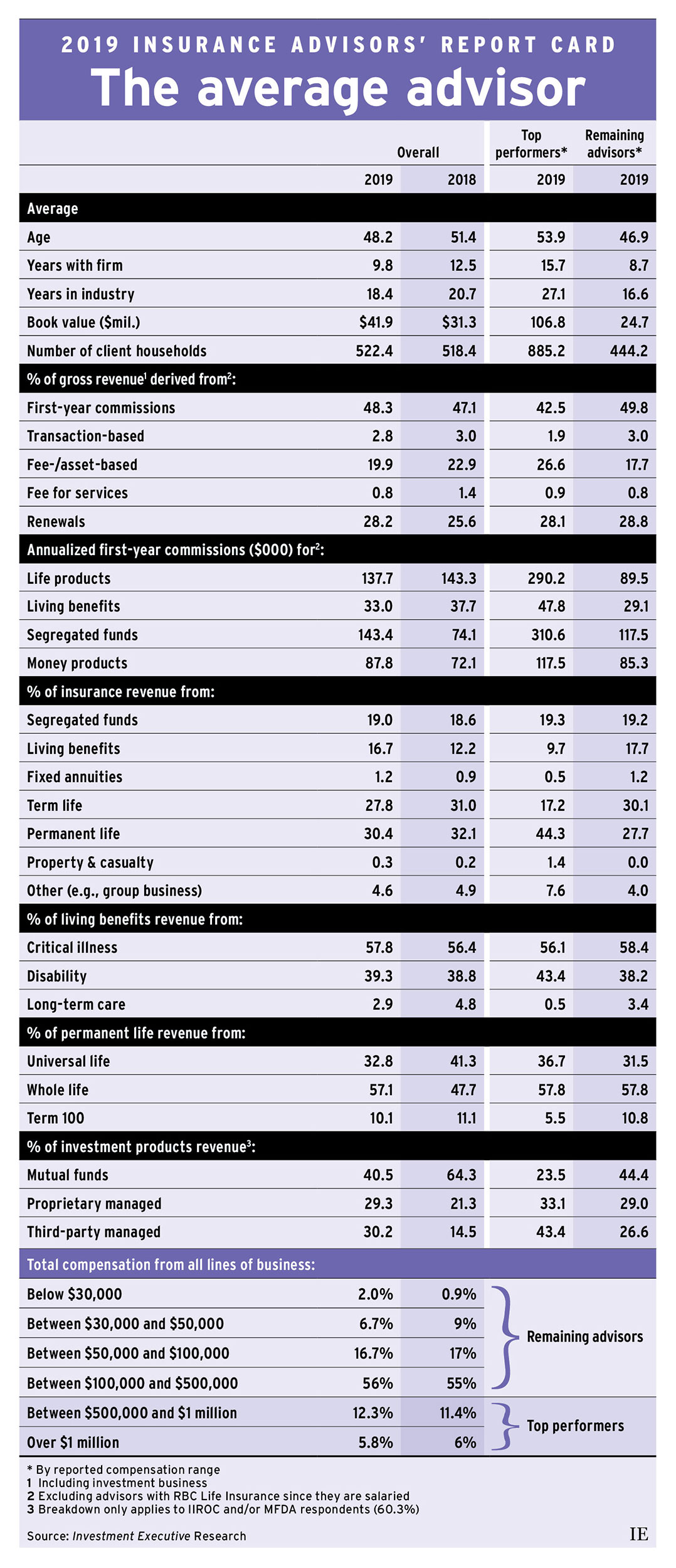

The average age of the insurance advisors surveyed this year dropped from 51.4 to 48.2. Further, the average insurance rep has been in the industry for 18.4 years, down from 20.7 in 2018. At the same time, the average respondent said they’ve been with their current firm for fewer than 10 years, down from 12.5 a year ago.

Despite indications that this industry segment’s frontline sales force was younger and less experienced, the survey results didn’t show that the average rep’s business had diminished. In fact, the number of client households being served by the average insurance rep was essentially unchanged from last year (ticking up to 522.4 from 518.4).

Click the image below to download a full-size version of the chart.

Advisors’ investment assets under management (AUM) were also up significantly this year. For respondents licensed to sell mutual funds and/or securities, average book value rose to $41.9 million this year from $31.3 million last year. This sharp increase echoed the experience of other industry segments in the Report Card series, which also reported higher average assets. This shift came amid rising markets and other factors, such as intergenerational wealth transfers, a shift from real assets to financial assets and the consolidation of clients’ assets.

However, investment assets are typically secondary to the core business of selling insurance in this segment of the industry. While the brokerage, fund dealer and bank Report Cards are overwhelmingly investment-focused, the insurance Report Card isn’t — making metrics such as AUM and AUM per client household less meaningful indicators of productivity.

To see the differences between the top-performing insurance industry reps and the rest of the sector, it is illustrative to examine respondents’ reported compensation.

The Report Cards ask advisors to identify a range for their annual compensation, so it wasn’t possible to divide this industry into the top 20% of reps and the other 80%. However, this year’s insurance survey found that 18.1% of reps fell into the top two ranges for reported annual compensation: $500,000 to $1 million per year, and more than $1 million. As a result, we are defining these reps as the industry’s top performers. The remaining respondents chose one of four ranges, starting at below $30,000 and going up to between $100,000 and $500,000.

Dividing the surveyed advisors along these lines revealed that veteran reps were the industry’s top producers, even as frontline insurance advisors skewed younger than last year.

The average age for top performers was almost 54, compared with just under 47 for the rest of the industry. The gap widened when it came to experience: the average top performer said they’ve been working in the industry for about 27 years, compared with 16.6 years for the rest of the industry.

This experience gap was also reflected in advisors’ reported tenure with their current firms. The average top performer had been with their current firm for nearly 16 years, whereas the rest of the industry had spent fewer than nine years with their current firms.

These large differences were also evident in book size data. The average top performer had roughly double the number of client households (885.2), as did the rest of the insurance industry (444.2). For top performers with securities licences, their average book value was more than quadruple that of their peers ($106.8 million vs $24.7 million for the rest of the industry).

There was also a notable difference in the composition of each group’s average commissions and revenue sources. (Advisors with Mississauga, Ont.-based RBC Life Insurance Co. were excluded from a portion of this analysis since they are salaried.)

When asked to consider all lines of business, for example, the industry’s top performers generated 26.6% of their revenues from fee- and/or asset-based sources, compared with 17.7% for the rest of the industry.

Top performers were also less reliant on first-year commissions (FYCs) compared with the industry’s younger advisors. While FYCs were still the largest revenue generator for both segments, the Report Card found that top performers generated 42.5% from FYCs, compared with 49.8% for the rest of the industry. Renewals were the second-biggest revenue source for the industry as a whole, at around 28%.

The data also showed that, while the proportion of FYCs within the overall revenue picture was lower for top performers, the quantum of such commissions was much higher than for the rest of the industry.

The FYC data must be taken with a grain of salt, as the sample size is relatively low. Still, responses to FYC questions indicated that the top performers far outpaced the rest of the industry in the two most important FYC-generating categories: segregated funds (at more than $300,000 earned vs nearly $118,000) and life products (at more than $290,000 earned vs nearly $90,000).

For the two least significant product categories in the FYC breakdown — money products and living benefits — the difference between the amount of commissions produced by both sets of advisors was much smaller.

The FYC data for all respondents indicated that seg fund commissions surged this year, overtaking life products commissions as the top source for all advisors.

The insurance product distribution breakdown told a slightly different story. When advisors were asked about total insurance revenues, inclusive of but not limited to FYCs, their reported allocation to seg funds remained little changed from 2018 at about 19.0% (a reading based on a higher response rate to this question).

The insurance product mix data pointed to surveyed advisors making greater use of living benefits products this year compared to last year, and relying less on term and permanent life products compared to 2018.

Regarding the last two product types, the top performers made greater use of permanent life products (44.3%) than term (17.2%), whereas the rest of the industry favoured term life (30.1%) slightly over permanent (27.7%).

These trends may evolve in the years ahead, partially depending on whether the frontline sales force continues getting younger and on the rate at which new blood enters the industry.