Mutual fund industry giant Investors Group Inc. (IG) is planning to hand out about $80 million to its high net-worth (HNW) clients and roll out enhanced performance reporting to all IG customers a couple of years ahead of schedule.

In IG’s latest quarterly earnings release, the Winnipeg-based fund firm says that it will pay out $81 million later this year to its HNW clients who are eligible for lower-cost series of its funds, but who haven’t yet made the switch.

The company is positioning the move as aggressive price competition, but the rebate also may play to regulators, which are becoming increasingly sensitive to the impact of investment costs on client portfolios.

“While we do see competitors becoming more aggressive with price discounting for the most affluent clients, there may be other factors at play,” Paul Holden, analyst with CIBC World Markets Inc. in Toronto, writes in a research report. “Regardless of the motivation, we think it’s the right move, in terms of retention of [assets under management (AUM)] and regulatory preparedness.”

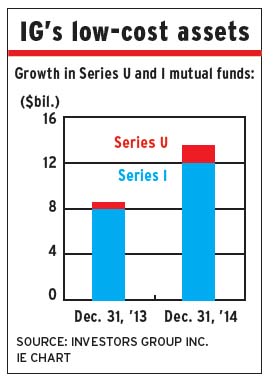

In 2012, IG introduced a series of funds that charged lower fees for clients in households holding at least $500,000 in AUM with the firm; and, IG followed that up with a second series of cheaper funds in 2013. So far, more than half of the firm’s eligible households have made the switch to the less expensive funds, representing about $13.5 billion in AUM.

But, now, the firm is planning to move the rest of those households to the less pricey version of IG funds and to rebate the excess fees those clients have paid since the two new series launched – essentially, putting clients in the position they would have been in had they switched to the cheaper funds as soon as those became available.

IG declined to comment to Investment Executive on the initiative. But, in a conference call with analysts, Murray Taylor – both IG’s president and CEO and CEO and co-president of IG’s parent firm, IGM Financial Group Inc. – explained that IG is making this move after deciding “that all clients should be benefiting from the lower-price series.”

During the call, Taylor was pressed for an explanation for a reason for IGM making the transfer to lower-fee products retroactive instead of simply applying the lower fees to future holdings.

“It’s a bold move, and it’s intended to be,” Taylor said in response. “It positions us with all of our clients very, very positively for the future. And we feel it’s a very strong position to take on the topic of pricing in that space.”

Along with the retroactive rebate for existing HNW clients, Taylor also indicated that IG has enhanced its supervisory processes to ensure that in the future, when households reach the threshold to qualify for lower-fee products, those clients will be moved into the cheaper funds when they become eligible.

IG’s earnings announcement indicates that the after-tax impact of the rebate to the firm will be about $59.3 million. The accompanying financial filings report that the pre-tax cost is expected to be $81 million.

The interim report also reveals that the move will have the effect of reducing IG’s average management fee rate by about four basis points (bps), starting in the first quarter of 2015. The distributions are slated to take place in the second half of this year.

Despite the impact of the move on the firm’s bottom line, the move is a positive one in general, analysts say.

The planned rebate comes amid ongoing regulatory deliberations about the mutual fund industry’s fee structure, and whether regulators should take action to address investor protection concerns (particularly the use of embedded trailer commissions).

At the same time, the industry also is facing the introduction of reforms over the next 18 months or so to enhance transparency to clients about both the costs of their investments and the performance of those investments in the second phase of the client relationship model reforms known as CRM2.

One of the underlying motives for increasing transparency, particularly in terms of costs and performance, is to ensure that clients understand what they’re paying, which ultimately may put more pressure on firms to compete on price as clients demand greater value from the fund companies.

Given the prevailing regulatory environment, Holden suggests, these considerations also could be a factor in the rebate decision.

“It’s not the explanation provided by management, but it is possible for a couple of reasons,” he says.

For one, he points out, the trailer fees on the cheaper series of funds is lower, which will look better to clients when IG has to begin providing new annual cost-disclosure reports under CRM2.

Moreover, he suggests, the rebate is the kind of action that makes the industry look good to regulators.

“If you want to avoid a ban on trailers, you better be on your best behaviour,” Holden notes. “The rebate is good corporate behaviour. And not only will it play well to customers, it will play well to regulators.”

Whether these considerations also played a part in IG’s decision or not, Holden says, the rebate “could be viewed as a smart strategic move from a regulatory perspective.”

Stephen Boland, analyst with GMP Securities LP in Toronto, views the rebate as a straightforward strategic decision designed to help IG retain assets and keep clients happy.

“It’s a good move by [IG] to head off any pushback on why certain clients didn’t receive a discount,” he says.

Boland suggests that similar manoeuvres may come from rival fund companies as they jockey for position with one another in the market: “I think fund companies are moving clients to more fee-based business, so these types of movements will be more common. While I don’t think trailer fees will disappear anytime soon, the asset managers are protecting their AUM bases with some moves.”

Yet, the price of defending AUM may be that fund firms must sacrifice some margin. Taylor says the decision to shift all of IG’s qualifying clients into the firm’s lower-fee products accelerates an existing decline in average management fees. Those fees already were decreasing at the rate of two bps a year over the past couple of years subsequent to the lower-fee products being introduced and clients began making the shift to these cheaper options.

As a result of the rebate move, the remaining decline in fees will be realized immediately, but should not continue in the future once all of the firm’s qualifying clients are in the lower-fee products.

Of course, if cheaper products’ popularity grow at a much faster rate and come to account for a bigger share of total AUM in the years ahead, the result will be continued pressure on fees, which is what is generally expected for the industry in the future anyway.

“While we do not expect fees to fall off a cliff, they should come down over time. And IG has more room to move than some of its competitors,” Holden writes in a research note. “We expect there will be further incremental moves over time.”

The big fee rebate isn’t the only client- and regulator-friendly move that IG has planned for the year ahead. The firm also reveals in its latest quarterly results that personal rate-of-return reporting to most of its clients will be implemented this summer, starting June 30 – a full two years before firms are required to provide this kind of reporting under CRM2.

From the start, IG will provide this data for the past one-, three- and five-year periods rather than for just the previous 12 months, as initially mandated under CRM2.

Taylor explains that IG was planning to introduce rate-of-return reporting for clients even before CRM2 became a reality. And now that the final requirements are in place, IG is ready to roll out this reporting to clients.

“[Reporting] is ready to go,” he says, “fully tested, fully operational and working perfectly.”

© 2015 Investment Executive. All rights reserved.