Canada’s economy may hit a sweet spot in 2015, says Sébastien Lavoie, senior economist with Laurentian Bank of Canada in Montreal, mostly as a result of the recent drop in the price of oil.

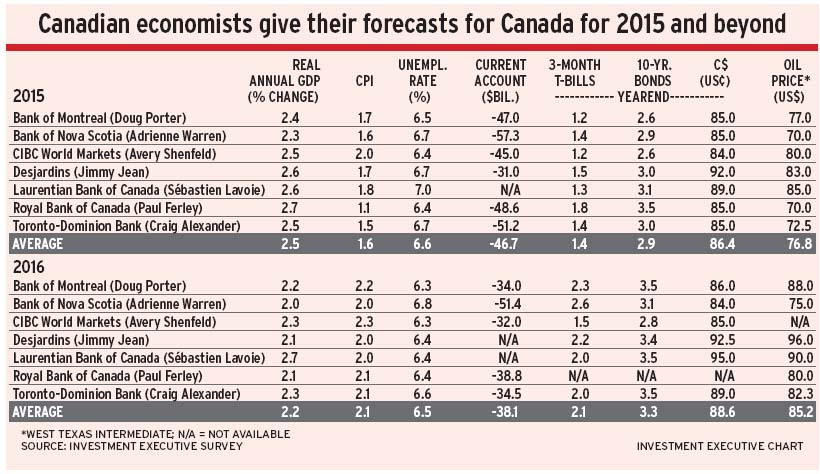

According to seven private sector economists whom Investment Executive (IE) surveyed, the increase in Canada’s gross domestic product (GDP) should be in the 2.3%-2.7% range in 2015, and 2%-2.7% in 2016. GDP increases in the U.S., meanwhile, are expected to reach 2.8%-3.3% for 2015 and 2.4%-3.1% in 2016.

Although the recent tumble in oil prices to about US$67 a barrel in early December (a decline of more than 30% from the beginning of 2014), has not be great for the Canadian economy, the drop has been offset so far by several factors.

First, oil prices are still high enough to enable energy firms in the oil-producing provinces to make money.

Second, the drop in the price of oil has both reduced energy input costs for Canadian manufacturers and brought down the value of the Canadian dollar (C$) vs the U.S. dollar. This makes Central Canada’s manufacturers more competitive, both in the U.S. market and against imports at home.

Third, U.S. economic growth is receiving a pleasant boost from the lower energy prices, which will increase demand, says Paul Ferley, assistant chief economist with Royal Bank of Canada in Toronto.

Falling U.S. unemployment has set the stage for stronger consumer spending in the U.S. – and now Americans will have even more money to spend, given the lower cost for filling their gas tanks.

However, all this optimism assumes that oil prices don’t fall much further and, indeed, start climbing again. If prices drop to the low US$60s-a-barrel range and remain there, that would create a different ball game – and definitely a negative one for Canada.

The good news, however, is that the economists whom IE polled expect oil prices to average US$70-US$85 a barrel this year and US$75-US$96 in 2016.

These economists also expect the C$ to trend upward, although only one economist foresees the loonie exceeding US90¢ by the end of 2016. This ceiling suggests that some of new manufacturing competitiveness resulting from the C$’s decline will remain in place.

The economists’ forecast for stronger U.S. GDP growth is based mainly on the anticipated pickup in consumer spending and further recovery in the housing market. The main driver will be sharp drops in the U.S. unemployment rate. The average forecast for that jobless rate is 5.5% for this year and 5.2% in 2016, well down from an estimated 6.2% this year and 7.4% in 2013.

The accelerating U.S. GDP growth is likely to be tempered by increases in interest rates, expected to start by mid-year. The U.S. Federal Reserve Board already has stopped its quantitative easing program – the buying of private-sector bonds – and has signalled its intention to start raising interest rates.

The question is how fast – and by how much – the Fed will increase rates. There’s no consensus among the economists surveyed. Forecasts for the U.S. three-month treasury bill rate are 0.6%-1.6% for the end of this year and 1.4%-2.6% for Dec. 31, 2016.

The timing and amount of the increase in rates will be determined by the impact of the increase on U.S. economic growth.

The expectation is that rates could rise until they start to slow economic growth significantly. And the potential growth in the economy depends upon how American consumers react to those increases, a psychological factor that’s hard to forecast.

Some of the economists surveyed – such as Adrienne Warren, senior economist with Bank of Nova Scotia in Toronto; and Jimmy Jean, senior economist with Desjardins Group in Montreal – suggest that American shoppers can withstand an increase in the three-month T-bill rate to around 1.5% at the end of this year and a further increase to 2.5% during 2016. (Warren’s and Jean’s predictions are at the high end of the economists’ U.S. economic growth forecasts for 2016.)

Other economists foresee consumers becoming alarmed if the three-month T-bill rate approaches 1% by Dec. 31, 2015.

Avery Shenfeld, chief economist with CIBC World Markets Inc. in Toronto, and Craig Alexander, chief economist with Toronto-based Toronto-Dominion Bank, are in this camp. They expect the rate to be less than 1% at the end of this year and only around 1.5% as 2016 draws to a close. (Not surprising, then, Shenfeld and Alexander are at the low end of the economists’ U.S. economic growth forecasts for 2016.)

The Bank of Canada isn’t expected to move as quickly as the Fed, given more moderate growth in Canada.

There’s consensus regarding how fast and by how much short rates will rise in Canada, with most economists anticipating that Government of Canada three-month bonds will be at 2%-2.6% by the end of 2016. (Shenfeld is the exception, predicting the rate will only be 1.5%.)

The two wild cards in the outlook for Canada’s economy are the direction of oil prices and the domestic housing market:

– Oil prices. The drop in oil prices to US$70 a barrel is considered reasonable, although there’s no consensus on what started the ball rolling.

Some economists, such as Alexander, think the impetus was demand-driven, reflecting slower than expected GDP growth in most regions except the U.S. Others, including Ferley, believe the drop in the price of oil was supply-driven, a result of higher than expected production in the U.S. and the Middle East.

There is, however, consensus that the drop in the price of oil to below US$70 a barrel is a supply-side story.

This belief reflects Ferley’s thesis that the Organization of Petroleum Producing Countries – particularly Saudi Arabia – is pursuing a strategy of increasing production in order to push prices down to levels that force higher-cost sources to cut back or stop production. That price threshold could be US$60.

– Housing. There have long been expectations of a slowdown in the Canadian housing market.

However, although there has been some cooling in smaller centres, large centres such as Vancouver and Toronto have remained hot – particularly in the condominium end of the market.

The economists whom IE surveyed continue to anticipate a modest correction in Canada’s housing market, particularly when interest rates start to rise.

© 2015 Investment Executive. All rights reserved.