As regulators deliberate the imposition of further changes to the mutual fund industry’s business practices, the decision by Investors Group Inc. of Winnipeg to discontinue the sale of mutual funds with a deferred sales charge (DSC) is an influential shift toward lower fees and away from expensive, embedded commissions.

As clients increase their knowledge and scrutiny of fees and competition heats up from low-fee products such as exchange-traded funds, a growing percentage of mutual funds are being sold on either a no-load basis or as part of a fee-based advisory platform.

The percentage of funds sold with a DSC is shrinking dramatically as a component of overall fund sales, although some industry participants believe DSC should remain on the menu for clients for whom DSC is a suitable option.

“The DSC is dying a natural death, partly as a result of a maturing industry; but [phase 2 of the client relationship model (CRM2)] also is helping to kill it,” says Dan Hallett, vice president and principal at HighView Financial Group in Oakville, Ont. “The upfront commission paid to dealers on DSC funds is big money. Forced disclosure of commissions and generally slower sales of the DSC are combining to kill the beast.”

The DSC, introduced in 1987, is designed to attract and keep unitholders by charging them no commission upon purchase of a fund’s units, but imposing an exit fee for selling the fund’s units within a specific period. This fee declines gradually every year and ultimately disappears – usually six or seven years after the purchase of the units.

However, the DSC is an expensive sales option for firms, and it ultimately translates into higher fees for unitholders. Typically, the fund-management company (not the unitholder) pays the dealer firm an upfront commission of about 5%, plus a 50 basis point (bps) annual trailer fee, which could total more than 8% before the DSC schedule ends. After that, the trailer fee usually moves up to 1%, which is typical for no-load funds.

Measures such as CRM2 that enhance disclosure to clients of fees received by dealer firms will lead more clients to compare the value they are receiving for the costs they are paying.

In addition, regulators such as the Canadian Securities Administrators are investigating the banning of all types of embedded commissions, including point-of-sale commissions paid by mutual fund sponsors to dealers as well as trailer fees.

“One of the biggest fund companies has made a decision to no longer offer the DSC option,” says Rudy Luukko, investment funds and personal finance editor at Morningstar Canada in Toronto. “Investors Group has made a preemptive move. It may be a response to competitive forces within the industry, as well as to a regulatory environment that appears to have turned fairly hostile to embedded commissions.”

Investors Group will be discontinuing the DSC effective Jan. 1, 2017, on all new lump-sum investments. The DSC will continue to be available for preauthorized contribution (PAC) plans established before Jan. 1, 2017, until June 30, 2017, or so. However, DSC fees will not apply to new PAC plans established after the 2016 yearend.

Investors Group also will reduce fees on no-load funds beginning in 2017, resulting in an annualized reduction of four to 10 bps on most funds.

“The DSC was created to provide discipline to long-term investing, but the marketplace has evolved,” Jeff Carney, Investors Group’s president and CEO, stated in a press release.

Typically, an Investors Group DSC fund charges a unitholder a redemption fee of 5.5% if the fund units are sold within two years, with the fee declining by 50 bps a year to 1.5% in the seventh year after purchase. The fee not only ties clients to a DSC schedule, but also ties them to Investors Group.

Normally, if a client wants to change advisory firms and move assets to another dealer, the client would be able to transfer the fund units “in kind” without triggering redemption fees. But Investors Group’s products cannot be transferred to other dealers, and must be redeemed if a unitholder wants to change firms.

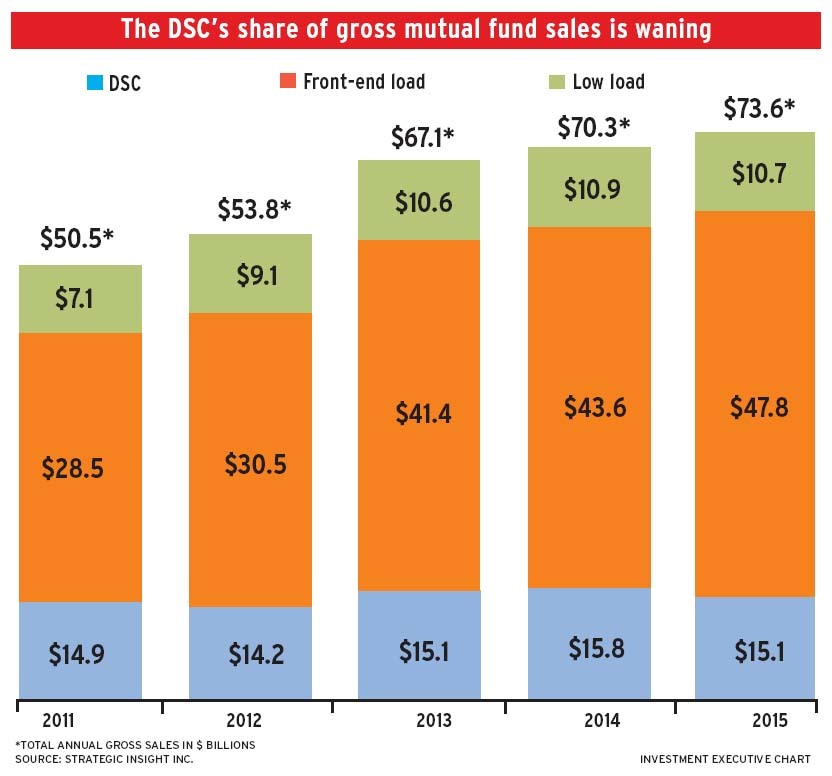

Although Investors Group may have moved preemptively before any regulations are introduced to ban embedded commissions, research from Toronto-based Strategic Insight Inc. found the DSC is waning as a percentage of new fund sales. In terms of gross sales in 2015, DSC funds represented $15.1 billion or 20.5% of $73.6 billion in sales for all “load” funds. In 2011, gross DSC sales of $14.9 billion represented 29.5% of gross load fund sales of $50.5 billion.

Sandeep Gosal, associate consultant at Strategic Insight, says “fee-based funds are steadily taking over,” and 80% of net new money coming into funds for the six months ended June 30 went into fee-based products or high net-worth pools.

“We have seen a huge increase in the use of fee-based funds among our advisors, as most moved to the fee-based model,” says Robert Frances, chairman and CEO of Peak Financial Group in Montreal, who estimates DSC commissions comprise less than 15% of the firm’s revenue.

But because DSC accounts tend to be used for clients with smaller accounts that contribute relatively less to Peak’s revenue, the percentage of clients affected would be a higher number – about 25%, he says.

“If the DSC is outlawed, it won’t be a major issue for us as a firm,” Frances says. “But our position is that doing what’s best for the client is important. We believe that means having as many sales options as possible, and choosing that one that is most suitable in each case.”

Peter Intraligi, president and chief operating officer of Toronto-based Invesco Canada Ltd., says Invesco will continue to offer all sales options, allowing clients and advisors flexibility of choice.

“If you ban commissions outright,” Intraligi says, “the small investor could be at a disadvantage and get pushed away from the advice channel to do-it-yourself or robo-advisor platforms.”

John Adams, chairman of the Toronto-based Investment Funds Institute of Canada (IFIC), said in a recent speech to the IFIC Annual Leaders Conference that competitive pressures, advancing technology and more detailed disclosure to investors will address some of the concerns regulators have about embedded fees.

Since January 2015, almost one-third of retail funds experienced a reduction in fees across the board or through preferred pricing programs, Adams said.

There has been a marked increase in the number of low-fee D-series and F-series funds, providing investors with an expanded range of choices. The result is a reduction in asset-weighted management expense ratios for long-term funds to 1.95% in 2015 from 2.04% in 2010.

However, in a recent speech, Ontario Securities Commission chairwoman Maureen Jensen said, “Disclosure is not enough.” She also praised Investors Group’s decision to abolish the DSC.

“This is the kind of leadership we are talking about,” she said. “This change will deliver positive outcomes for clients and [has] mapped a path that also benefits their advisors. [The investment] industry is a fundamental part of getting this right, and if we continue to work together, we can ultimately arrive at solutions that benefit investors and the Canadian marketplace.”

© 2016 Investment Executive. All rights reserved.