As dramatically low crude oil prices undermine Canada’s economy, fixed-income markets have responded by pushing benchmark 10-year government bond yields down to 1.4%. That’s in stark contrast to the government bond yields in the U.S., where 10-year bond yields are about 2.2%, and the Federal Reserve Board is poised to raise its overnight rate on the back of continuing economic strength.

For portfolio managers of Canadian fixed-income funds, the challenge of squeezing out razor-thin returns is met mostly by focusing on corporate bonds and keeping average duration low.

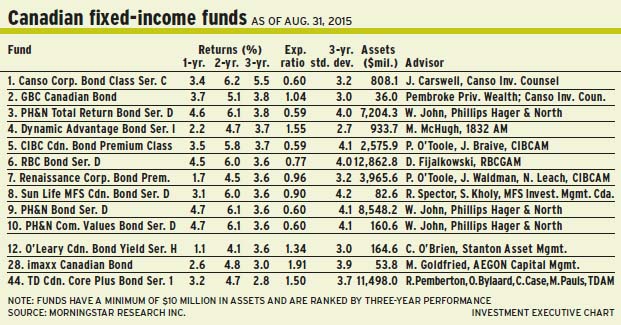

“There are two drivers of the interest rate differentials, and they’ve grown over the past 12 months,” says Robert Pemberton, managing director and head of the fixed-income team at Toronto-based TD Asset Management Inc. (TDAM), and lead portfolio manager of TD Canadian Core Plus Bond Fund. He shares portfolio-management duties with TDAM managing director Olga Bylaard, and TDAM vice presidents Chris Case and Matthew Pauls.

“Canada has been traditionally perceived as an exporter of natural resources,” says Pemberton. “Looking at what’s happened with commodity prices since the end of the summer of 2014, the Canadian economy has clearly been negatively impacted – especially by the precipitous drop in oil prices.”

Although the oilpatch is hurting, Ontario and Quebec are benefiting from a modest resurgence in manufacturing. “There’s been some offset, but it’s not enough to prevent the economy from slowing,” Pemberton says.

The second driver of interest rates, he adds, is inflationary expectations. Pemberton argues that these are driven by excesses in three areas: cheap capital, the result of quantitative easing programs in many countries; global oversupply of manufacturing capacity, which exceeds demand for goods; and labour oversupply due to job creation challenges in Europe and continued migration from Asian rural areas to its cities. “These excesses are helping to suppress interest rates and returns overall,” says Pemberton.

Will yields fall further? That’s hard to know, Pemberton says, but a mixed corporate performance and weak retail trends point to continued low yields.

“[These factors] are leading to expectations that inflation is not going to come back screaming any time soon. We ask ourselves: ‘What risks are we taking on, and are we being compensated?’ From a high-level perspective, we prefer corporate debt to sovereign debt – and especially when thinking about the latter in the long-term to maturity area. I’m interested in providing a return based on what we perceive to be the right risks vs the right rewards,” says Pemberton, who anticipates that returns for 2015 will be in the low-single digit range.

About 64% of the TD fund’s assets under management (AUM) is in corporate debt, which includes 9% in non-investment grade bonds. The remaining 36% is in Government of Canada bonds. The fund’s average duration is 6.75 years, slightly below the 7.4 years average duration in the benchmark FTSE TMX Canada universe bond index.

“We are taking a more conservative stance at present, given our concern about the absolute level of interest rates and the potential for increasing volatility in the fixed-income landscape,” says Pemberton, who is precluded from discussing specific bond holdings.

The divergence in interest rates between Canada and the U.S. reflects the gap between the relatively successful diversified U.S. economy and the more concentrated Canadian economy, says Connor O’Brien, president and chief investment officer at Montreal-based Stanton Asset Management Inc., and lead portfolio manager of O’Leary Canadian Bond Yield Fund.

“The Canadian economy, and the dollar, was supported by a decade-long spending boom in China and emerging Asia. That spending boom has subsided,” says O’Brien.

“The resource-intensive economies are slowing down substantially. At the same time, the U.S. has contributed to resource supply which has spiked up very positively because of shale-oil technology.”

In the near term, O’Brien suggests that Canada’s weak economy may play havoc with bond yields. “The odds of another Bank of Canada rate cut are real. Is 50% likely, or more? That’s to be determined. The economy is weak and it’s driven by resources. The rest of the economy is not yet kicking in enough to compensate,” says O’Brien, adding that the low dollar may take many months to stimulate manufacturing exports.

Although Statistics Canada confirmed a mild recession for the first half of 2015, and the Fed is ready to pull the trigger on a U.S. rate increase, O’Brien notes, “The market is increasingly data-driven, and Canadian bond yields could move sharply either way. The Bank of Canada’s next decision is hard to call – [the bank] may do nothing.”

O’Brien admits there is a small risk that bond yields may spike suddenly. “In the very near term, though, that risk has been postponed by our economic weakness,” says O’Brien. “[As for] corporate bonds, where we specialize, they are actually paying very well and are in very good shape. Whether it’s the Canadian banks or food retailers or pipelines, we don’t have any concerns about them being able to pay their debts. They will have little difficulty in getting through this weak patch in the economy.”

Investment-grade corporate bonds offer yields of about 2.7% – 200 basis points higher than comparable maturities for government bonds. “That’s a lean return,” adds O’Brien. “But for people seeking stability of income, they are better off getting that 2.7% than 0.7%. It’s all about what’s better. In our view, high-quality corporate bonds are the answer for people looking for a ‘better’ solution without taking equity risk,” says O’Brien, adding that he anticipates single-digit returns for 2015.

The O’Leary fund’s AUM is entirely composed of corporate bonds – no government bonds. About 85% of AUM is investment-grade bonds, with about 15% in high-yield bonds. Taking a slightly defensive stance, O’Brien has set the fund’s average duration at 5.9 years.

The O’Leary fund tends to hold bonds issued by 40 to 50 companies and spread across about 100 individual securities. On a sector basis, 24% of AUM is in financial services, 11% is in telecom, 10% is in media, 10% is in pipelines and there are small holdings in sectors such as retail and real estate.

One representative holding is subordinated debt, callable in 2017, issued by TD North Group Capital, a U.S.-based unit of Toronto-Dominion Bank, that yields 4.8%. Another holding is a 2024-dated bond issued by Enbridge Inc. that yields 4.55%.

Remarkably, there is little inflation seven years after the massive monetary easing by the Fed, says Marc Goldfried, chief investment officer at Toronto-based AEGON Capital Management Inc. and portfolio manager of imaxx Canadian Bond Fund.

“People said there would be runaway inflation. But here we are in 2015 and U.S. unemployment has dropped from 10% to 5.1%; we’ve retrenched the U.S. housing market, and deleveraged most corporate balance sheets,” says Goldfried. “We have 2%-plus gross domestic product (GDP) growth in the U.S., and growth is starting to pick up. If I was a member of the Fed, I’d be thinking, ‘Everything worked the way we hoped. The one thing we feared didn’t happen. In fact, a good part of the world is fighting deflationary pressures. But we are at a point at which a strong U.S. dollar and weak oil prices are starting to pass through the market. We will start to see pickups in inflation’.”

A U.S. rate hike is very likely this September, argues Goldfried, although he admits it might be postponed until later in the year.

“The Fed has given enough signals that [it is] likely to go in September,” he says. “If we get strong economic data, we could see two rate hikes by yearend. That second call is me throwing myself out there, but I feel reasonably confident that the Fed will go before the end of the year.”

Goldfried adds that an exogenous event, such as a Chinese stock market meltdown, could throw a damper in this scenario and keep the Fed on hold.

Turning to Canada, Goldfried concedes that it’s hard to determine the path going forward: “The Bank of Canada is being accommodative. I don’t think we’ll see another rate decrease until after the federal election. They want to see what the Fed will do and see how the July numbers unfold. But as the Fed starts to ramp up Fed funds, you will start to see the yield curve move up.”

Goldfried expects U.S. 10-year bond yields to rise by yearend from 2.4% to 2.6-2.8%. “Despite all the bad things going on in Canada, our yield curve will move up, too, although not to the same extent.”

Calling for a total return of 3%-3.5% in 2015 in the imaxx fund, Goldfried is maintaining a neutral average duration of 7.4 years and has allocated about 56% of the fund’s AUM to investment-grade corporate bonds and 27% to asset-backed securities. There also is 17% in Canadas.

The imaxx fund has a 2.66% running yield, vs 1.86% for the benchmark FTSE TMX Canada universe bond index.

© 2015 Investment Executive. All rights reserved.