With crude oil prices plunging by 50% since last summer and the Bank of Canada’s unexpected decision in mid-January to cut its key lending rate by 25 basis points, equities markets are in a dither and uncertain about the strength of Canada’s economy.

Although valuations for some sectors have risen, portfolio managers of Canadian dividend and income equity funds argue that there are pockets of value and that longer-term prospects are good.

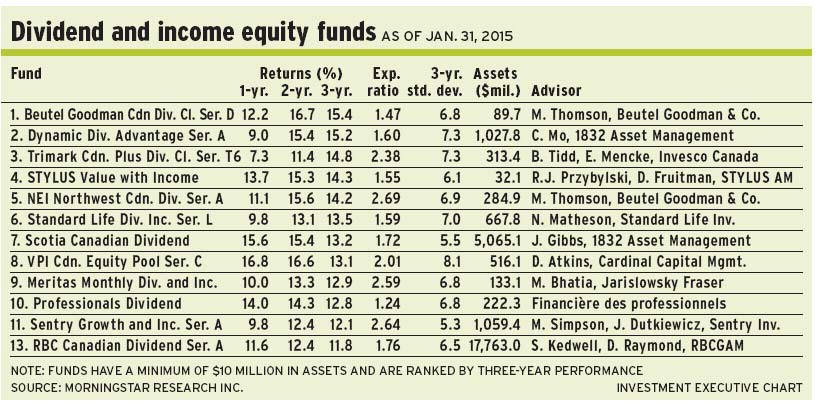

“There was a fair amount of worry about the choppiness of the Canadian economy. So, the Bank of Canada, acting in a surprising and decisive manner, assists in taking some of the worst-case scenarios off the table,” says Stuart Kedwell, senior vice president with Toronto-based RBC Global Asset Management Inc. (RBCGAM) and portfolio co-manager of RBC Canadian Dividend Fund. He shares portfolio-management duties with Doug Raymond, senior vice president with RBCGAM.

“Will that optimism prove short-lived?” asks Kedwell. “I do think this will be a choppier than normal year for equities.”

Kedwell divides Canada’s equities market into three so-called “buckets”: energy, financial services and, roughly speaking, everything else, including telecom and consumer staples.

Energy, always a volatile sector, is starting to see the ingredients for prices to bottom, says Kedwell: “Hopefully, that will lead to better performance in the back half of the year. We own the larger, more integrated companies with long-life reserves. Their stocks will turn when crude prices rise again, not if [they rise].”

Financial services also have been hit by falling energy prices, as declining expectations have raised concerns about corporate and personal lending. But, Kedwell argues, the odds of major corporate loan losses are low.

“What is harder to gauge is the length of decline in energy prices and what that will mean for the personal and commercial sides of the banks. What will happen to credit card portfolios or auto portfolios – especially in Western Canada?”asks Kedwell. “It’s early days still. But there are indicators that the consumer is acting in a more cautious manner.”

Kedwell also believes telecom and consumer stocks are trading at rich valuations.

A bottom-up stock-picker, Kedwell has a bias toward financial services, which includes banks and real estate investment trusts; the sector accounts for 47% of the RBC fund’s assets under management (AUM). “The banks,” he says, “will continue to be very capable of delivering a current yield of 3.5%-4.25% and dividend growth over time of 4%-7%.”

The RBC fund also has 23% of AUM in energy, 8.5% in industrials, 7% in consumer discretionary and smaller weightings in sectors such as utilities. The fund’s running yield is 3.25%.

One top holding is Brookfield Asset Management Inc., which holds interests in property, infrastructure and renewable energy. “Brookfield’s three underlying vehicles each distribute 4%-5% yields, plus dividend growth of 4%-7%,” says Kedwell.

Brookfield stock, trading at about $65 a share, pays a 1.1% dividend. There is no stated target.

The market is fairly valued overall, argues Michael Simpson, senior vice president with Toronto-based Sentry Investments Inc. and lead portfolio manager of Sentry Growth & Income Fund. He shares portfolio-management duties with James Dutkiewicz, chief investment strategist with Sentry.

“You have to search harder to find companies trading at a discount,” says Simpson. “There is a great debate about the energy sector. What type of earnings and cash flow will these companies generate over the next 12 months? If you’re optimistic and believe that oil will soon be back to US$65-US$70 a barrel, there could be some value. If you foresee a long recovery, on the other hand, there isn’t overwhelming evidence to go into the market now.”

He notes that telecom stocks have been bid upward in recent months, although dividends exceed the 1.4% yield on the benchmark 10-year Government of Canada bond. “By historical standards, some of these sectors look expensive. But the market is tending to prize highly those firms that are very stable in their earnings and cash flows, have good balance sheets and have the ability to pay dividends and to grow them.”

About 53% of the Sentry fund’s AUM is in Canadian stocks, but, significantly, U.S. companies account for 43% of AUM. (There also is 4% in cash.)

“We can diversify away from resources and materials and banking. There are companies that you can’t find in Canada,” says Simpson in explanation, noting that the Sentry fund’s portfolio includes health-care names such as Baxter International Inc.

About 30% of the Sentry fund’s AUM is in industrials, 19% is in consumer staples and discretionary, 15% is in energy, 7% is in technology and a comparatively low 4.2% is in financial services. “Given my view of Canadian consumers and the amount of debt they carry,” says Simpson, “I’m comfortable with our weightings.” The fund’s running yield is 2.8%.

One top holding in the 53-name Sentry portfolio is AutoCanada Inc., which owns a network of automobile dealerships. “[It] began as a largely Western Canadian dealership and [has] a CEO who’s been in the auto industry for a long time,” says Simpson.

AutoCanada stock has fallen to about $34.75 a share vs $90 last June, and pays a 2.8% dividend. But Simpson believes, AutoCanada stock will rebound to about $55 a share within 12 to 18 months.

Markets will continue to be volatile as they try to register the strength of the global economy. “Canada is not immune to the global environment,” says Brian Tidd, vice president with Toronto-based Invesco Canada Ltd. and lead portfolio manager of Trimark Can Plus Dividend Class Fund. He shares portfolio-management duties with Eric Mencke, vice president with Invesco.

“A slowing China, in addition to weakness in Europe, would obviously have an impact on our materials sector and export-focused industries,” says Tidd. Moreover, he adds, the pullback in energy and materials was the market’s way of expressing doubts about economic growth.

“But things are even more confusing because we have a currency war on our hands,” says Tidd, adding that Japan, Canada and Switzerland have entered the fray.

To complicate matters, Tidd notes, it is hard to determine how the global oil supply glut will play out: “One of the advantages of our strategy is that we’re not macro forecasters. We’re better served by a strategy of holding a concentrated portfolio of our best ideas and picking names that can thrive even in slow-growth environment, which is our best-case scenario.”

As for valuations, Tidd argues that selectivity is paramount. “But when you have a dramatic sell-off in energy, as we’ve seen, it makes for very fertile ground to work in,” says Tidd, noting that he’s added to some existing energy names on weakness and raised energy to 13% of the Trimark fund’s AUM. “As the names sold off, the risk/reward considerations made the sector as whole more attractive.”

In similar vein, Tidd still sees value in financial services, including insurance companies; the sector accounts for about 22% of the Trimark fund’s AUM: “We own Toronto-Dominion Bank and Bank of Nova Scotia. The growth outlook is decent and the risk/reward is still pretty attractive.”

Other sector weightings include 15% in consumer discretionary, 13% in industrials, 12% in basic materials and smaller weightings, such as 7% in consumer staples. About 17% of AUM is in the U.S. and 11% in international markets, largely because, Tidd argues, “high-quality businesses like Johnson & Johnson cannot be found in Canada.” The fund’s running yield is 3.5%.

One top holding in the 50-name Trimark fund is WorleyParsons Ltd., an Australia-based engineering firm that specializes in the energy sector and has seen its share price cut in half.

“[It is] a true engineering company that gets paid for [its] expertise,” says Tidd. “But there is uncertainty about capital expenditure outlook for new projects in this environment. The share price reflects no recovery – ever.”

WorleyParsons is trading at A$9.60 ($10), or 9.6 times earnings. But, given a three- to five- year outlook, Tidd believes the stock has “significant” upside and, in the meantime, is paying an 8.8% dividend.

© 2015 Investment Executive. All rights reserved.