Global high-yield bonds began 2018 in relatively strong shape, having weathered last year’s series of small interest rate increases with the help of a tailwind from a buoyant global economy.

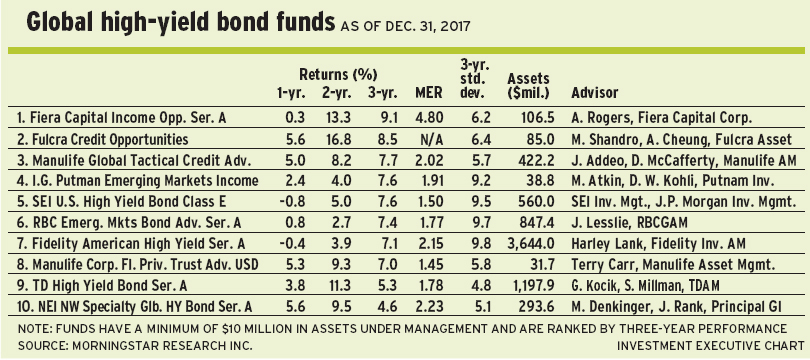

According to Toronto-based Morningstar Canada, mutual funds in the high-yield fixed-income category enjoyed a healthy 4% average gain in 2017. And Moody’s Investor Service Inc. of New York states that defaults are declining in the high-yield arena as corporate issuers enjoy rising profitability and strong balance sheets.

“Fundamentally, credit is in good shape [for issuers of debt securities],” says Joshua Rank, portfolio manager with Principal Global Investors LLC in Des Moines, Iowa. Principal GI is subadvisor to NEI Northwest Specialty Global High Yield Bond Fund, which is sponsored by NEI Investments of Toronto.

(NEI is expected to merge soon with Credential Financial Inc. and Qtrade Canada Inc. into a new company called Aviso Wealth.)

Debt issuers have been conservative from a balance-sheet standpoint, Rank says. They have not gone overboard on capital expenditures and are keeping borrowing manageable.

“From a macro viewpoint, all the major economies are moving ahead, and working in sync for the first time in a decade,” Rank says, adding that this is a good sign for the strength of bond issuers and their ability to meet interest and repayment obligations.

The global default rate on speculative-grade securities was 2.9% at the end of 2017, according to Moody’s, which forecasts that the rate will continue to slide this year to finish 2018 at 1.9% due to strong economic growth, good liquidity and low refinancing risk.

Historically, Rank says, the default rate in the high-yield category has been closer to 5%, making the current market healthy in comparison.

Corporate bonds historically have been negatively correlated, for the most part, to 10-year U.S. treasury bonds, Rank adds. This characteristic makes corporate bonds a useful diversification tool in a fixed-income portfolio.

A key strategy for protecting portfolios from any damage inflicted by rising interest rates is to stick to short-term securities. The average duration of Rank’s NEI portfolio is about 3.7 years, less than the 3.9 years for benchmark averages.

The newly passed U.S. bill on tax cuts, he adds, will further strengthen U.S. high-yield bond issuers by increasing corporate profitability. With higher cash flow, some issuers will experience upgrades in their rating status, which will give them access to a bigger pool of borrowers and to money at lower interest rates.

“The tax cuts should help extend the credit cycle,” Rank says. “The cuts give corporate issuers momentum and extend the period of bullishness. The biggest potential risks would be a surprise on the inflation side or in the pace of interest rate hikes, but those are both in check at this point.”

On a geographical basis, the NEI fund has 76% of its assets under management (AUM) invested in the U.S., 8% in Canada and about 15% in Western Europe, along with a minimal cash holding. The fund is invested entirely in corporate bonds.

Rank is leery of retailers’ debt, pointing to the bankruptcy filing last year of Toys “R” Us Inc. and the vulnerability of department stores such as Macy’s Inc.

He also is avoiding the oil services industry and “wireline” technology companies. Oilfield servicing will suffer from a decline in deep-sea exploration, he says, but he likes the bonds issued by some independent explorers and producers in the energy sector, particularly in U.S. shale.

Among the NEI fund’s top holdings are several issues of subordinated debt in the financial services sector, including issues from Ally Financial Inc., Citigroup Inc. and JPMorgan Chase & Co. Rank’s fund portfolio also holds debt issued by GardaWorld Corp., a Canadian private security firm.

Greg Kocik, managing director with Toronto-based TD Asset Management Inc. and lead manager of TD High Yield Bond Fund, says the likelihood of further interest rate increases is hanging over the bond market. But, he adds, credit risk is declining as economic strength leads to higher capacity utilization and rising employment.

Based on bond market averages, Kocik says, the spread between high-yield corporate bonds and government issues shrank to about 350 basis points (bps) after a high-yield rally in January. That change represents a tightening from about 430 bps a year earlier. Kocik doesn’t see much room left for high-yield bonds to benefit from further capital gains and reductions in the spread, Therefore, he is focusing on quality companies that manage their balance sheets conservatively.

“We don’t foresee the spread tightening significantly more, and rising government bond yields could be a headwind for the entire bond market in 2018,” Kocik says. “However, in an environment of growing economies and improving credit quality with rising cash flows, you still want to be in corporate bonds for the continuing yield advantage.”

In 2017, the U.S. Federal Reserve Board raised its benchmark lending rate by 25 bps three times to a targeted range of 1.25%-1.5%. Three more similar hikes may happen this year.

The Fed is responding to positive news, as U.S. economic growth is estimated to be around 3% for 2017 and 2018, and the unemployment rate is expected to drop below 4% in 2018. However, both Kocik and Rank say the Fed will proceed cautiously with rate hikes, as long as inflation remains benign, in order to keep the economy bubbling. Inflation in the U.S. is estimated to be around 1.7%, which is lower than the Fed’s 2% goal.

Like Rank, Kocik chooses investments with short terms to protect against rising interest rates. The average duration of the TD fund’s portfolio is less than three years.

“We’re looking at high-quality names with shorter maturities,” Kocik says. “Our duration is significantly lower than [that of] the index, and that’s a major risk-mitigation tool for us. The yield may be lower, but the quality is better. If there is a sell-off, the fund will drop less than the overall market. Despite our constructive view on the economy, we are defensive.”

The TD fund has a 92% weighting in corporate bonds, about 6% of AUM in floating-rate notes and 2% in cash.

On a geographical basis, about 80% of the TD fund is invested in the U.S., 10% in Canada, 6% in Europe and 2% in emerging markets.

Looking ahead, Kocik foresees interesting opportunities in high-yield bonds related to the retail and discretionary consumer spending industries in the U.S. Fears about the decline of traditional retailing in the face of threats from online retailers such as Amazon.com Inc., he says, “have snowballed beyond reality.” Some retailers’ debt issues are trading at attractive prices, although, he says, it’s “important to be in the right names.” One of the TD fund’s top holdings is issued by Best Buy Co. Inc., a U.S.-based electronics retailer.

In the technology sector, the TD fund holds bonds issued by Seagate Technology PLC, a California-based supplier of computer disk drives.

Other sectors that have experienced sell-offs and look ripe for opportunity include U.S. health care, metals and paper-related names in the forest products industry. In health care, one of the TD fund’s top holdings is HCA Healthcare Inc., the largest private-sector hospital operator in the world. He says the company has strong free cash flow and its bonds are moving toward an investment-grade rating.

In what Kocik calls the “unloved” forest products industry, the TD fund holds debt issued by Montreal-based Resolute Forest Products Co., which has suffered from declining paper usage by consumers with a preference for digital technology, but which, Kocik says, is well diversified in other products, such as lumber.

Kocik also is looking at energy, a sector that has been out of favour since oil prices dropped from their peaks, but is improving after several years of cost-cutting. He favours producers and “midstream operators,” such as storage companies and suppliers.

He is reducing exposure to the auto industry, for which, he says, the business cycle has “peaked.”

Both Rank and Kocik are sniffing for value opportunities in the out-of-favour metals industry.

“We always are looking forward and assessing credit risk six to 12 months out,” Kocik says. “Internally, we create our own credit ratings, and a big part of our strategy is to benefit from the lag that occurs before an improving issuer is upgraded by a rating agency.”