Globally focused U.S. equities markets have eked out modest gains since the start of the year, weighed down by many factors, including slowing global economic growth and the U.S. presidential election campaign. Yet, portfolio managers such as Larry Puglia, vice president at Baltimore-based T. Rowe Price Group Inc., remain upbeat and argue that there is room for upward momentum in certain names.

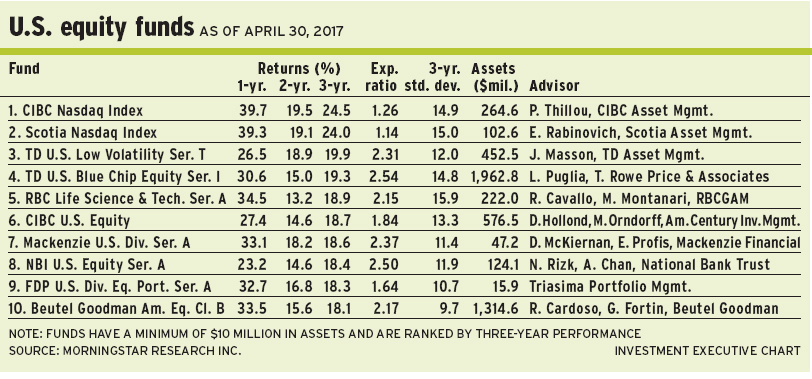

“Numerous things are influencing the market and the presidential election is No. 1,” says Puglia, portfolio manager of TD U.S. Blue Chip Equity Fund. “I don’t think we’ve had an election [campaign], in recent memory, in which there are more contrasting views as to what it will take to run the country well and have the economy grow. There is a lot riding on this election.”

Health-care stocks have been among the most affected adversely, Puglia notes, as there is uncertainty regarding how either political party will address the sector after the election. Travel-related stocks also have been hurt by the emergence of the Zika virus and there’s been some negative broader fallout from the U.S. energy patch. Meanwhile, market leadership, once led by so-called “FANG” growth stocks (Facebook Inc., Amazon.com Inc., Netflix Inc. and Google Inc.) has given way to value stocks. “There are some cross-currents there,” says Puglia, “because value has been performing much better than growth.”

At the same time, Puglia notes, there has been concern that slowing economic growth in China may cause it to devalue its currency again. That could “set off a currency war,” he says, “in which various countries devalue, too, in order to be more competitive.”

On a positive note, however, Puglia points out that a weakening U.S. dollar may help U.S. multinationals with exports, and modest U.S. job growth may hold back the Federal Reserve Board from making further interest rate hikes.

From a valuation standpoint, Puglia says that the benchmark S&P 500 composite index is trading at about 15.8 times 2017 earnings. “This suggests that the market is slightly above long-term historical averages. To us, [that] appears reasonable, certainly in the context of interest rates,” says Puglia, adding that balance sheets generally are in good shape and the American consumer has deleveraged. “But having said that, there are a lot of expensive stocks, too,” he adds, pointing to some consumer staples and industrial names that are no longer cheap.

About 30.5% of the TD fund’s assets under management (AUM) is in information technology, 25.6% is in consumer cyclical, 22.8% is in health care and 10.5% is in industrials, with small holdings in sectors such as financials.

“We’re not favouring companies that make devices; [rather], those that have a high degree of recurring revenue,” says Puglia.

Running a portfolio with 134 names, Puglia likes stocks such as Facebook Inc., which now boasts about 1.6 billion users of its social media platform. “[Facebook stock] still is reasonably valued,” says Puglia, noting that the stock is trading at about 18 times 2018 earnings. Facebook’s share price is about US$110 ($133.85). Given high double-digit growth, Puglia’s target is US$150 a share within 18 to 24 months.

The malaise underpinning U.S. stocks is attributable to concerns about the global economy, says Steve MacMillan, portfolio manager with Toronto-based Fidelity Canada Asset Management ULC, who oversees Fidelity American Equity Fund.

“Weaker energy prices have people concerned that the growth is stalling in the economic recovery that we’ve had for the past several years,” says MacMillan. Moreover, the drop in the price of crude oil since last summer has some investors concerned that “there could be a broader issue.”

This pessimism is reflected in not only the earnings of energy and industrial companies, but also for multinationals with significant foreign earnings. “Stocks have been weak – not so much the fundamentals in the consumer discretionary sector – but there is concern the weakness in the global economy will spread into the U.S.,” says MacMillan. He adds that slowing economic growth in China, coupled with the prospect of rising interest rates in the U.S., is creating a downbeat tone in the markets.

Compared with 2012-15, when U.S. markets were climbing a so-called “wall of worry,” the fundamentals now are somewhat weaker, while valuations are higher, MacMillan adds.

“But if you take a five-year view and were an asset allocator in Germany, for example, you would pay your government to take your money – and get a negative rate of return on government bonds,” says MacMillan. “Or you can invest in the U.S. at 16 to 17 times earnings and get a 2% dividend yield from companies that are growing earnings. They have the strongest economic outlook in the world.”

In talking to management with many companies, MacMillan adds, there are few signs of material weakness: “Over the next one to two years, the U.S. should outperform the global economy.”

MacMillan is a bottom-up stock-picker. About 25.6% of the Fidelity fund’s AUM is in health care, 18.9% is in consumer discretionary, 10.6% is in IT and 9.1% is in consumer staples, with smaller holdings in sectors such as financials. Although the fund tends to be fully invested, there is 14.8% in cash now due to two positions that recently were bought out.

Notably, MacMillan is avoiding energy and materials, largely because they have low returns on equity: “I try to avoid bad businesses throughout the cycle, because I can add value over time. Even when energy is beaten up, I look at them as bad businesses.”

Running a tight portfolio with 32 stocks, MacMillan likes names such as Autozone Inc., an autoparts retailer that serves the do-it-yourself market. “I like the business because of its lack of economic sensitivity and the recurring nature of its sales,” says MacMillan, adding that earnings growth is in the mid-single digits.

Autozone stock is trading at about US$781.50 ($950.00) a share, or at 20 times earnings.

There is much concern about corporate earnings in the U.S., says Jason Hornett, vice-president at Calgary-based Franklin Bissett Investment Management Ltd. and portfolio co-manager of Franklin Bissett U.S. Focus Corporate Class Fund.

“We’ve seen earnings estimates cut across many sectors – especially energy, which has seen the worst of it in terms of declining earnings,” says Hornett, who shares portfolio-management duties with Garey Aitken, chief investment officer at Bissett.

“We’ve also finally had the first small move from the Fed. Even though I don’t think we will see too many more increases this year, [increasing rates] mark a change in a trend, which has changed sentiment a little bit.”

Indeed, Hornett argues, the end of quantitative easing, which pumped massive amounts of liquidity into the U.S. economy and drove markets for several years, has forced investors to pay more attention to corporate earnings.

Hornett, like his peers, notes that China’s slowing economic growth also is contributing to the market malaise. “It was inevitable there would be a slowdown. [China] used to drive global growth rates, but now China’s economy is more influenced by what’s happening in the rest of the world,” says Hornett, adding that falling demand for China’s products reflects weaker trading partners.

Although valuations are at the higher end of the historical range, Hornett does not believe they are stretched.

“Corporate profitability is very strong for the S&P 500 index, close to historical highs, and provides a lot of support for valuations. The bigger risk is a domestic economic slowdown,” says Hornett, noting that the odds of that still are moderately low. “If that did occur, we would definitely start to see an impact on earnings.”

Overseeing a portfolio with 40 names, Hornett is a bottom-up investor. About 19.4% of the Franklin Bissett funds AUM is in IT, 15.8% is in consumer staples, 14.2% is in health care, 13.9% is in financials, with smaller holdings in sectors such as industrials and energy.

One recent acquisition is UnitedHealth Group Inc., a diversified managed health-care provider. “From a quantitative perspective, this is a company that has attractive risk metrics [with] a nice predictable earnings stream,” says Hornett, adding that the consensus estimate is for 29% earnings growth this year and 14% the next.

“When we look at the valuation, based on 2016 estimates, it’s 16.5 times earnings and 14.5 times 2017 estimated earnings.”

UnitedHealth stock is trading at about US$132 ($159.85) a share and pays a 1.5% dividend yield.

© 2016 Investment Executive. All rights reserved.