Stocks issued by companies in the Asia-Pacific region have been in a funk. In Japan, for example, concerns have been raised recently about so-called “Abenomics,” Shinzo Abe government’s plan to resuscitate the world’s third-largest economy.

But with share valuations at a low point, fund portfolio managers argue that this concern represents a buying opportunity because regional economies are going through a transition and will rebound eventually.

Investors should note that China, the world’s second-largest economy, is undergoing the most significant transformation in more than 30 years, says Chuk Wong, vice president with Toronto-based 1832 Asset Management LP and lead portfolio manager of Dynamic Far East Value Fund.

“Thirty years ago, the Chinese opened their economy to Western companies,” says Wong. “[China has] gone through a major reform and, looking back, they have done an amazing job – which is an understatement, given the size of the economy. The Chinese model is migrating from [being] investment- and export-driven to a more balanced economy that is driven by domestic consumption.”

This process, he adds, will take many years to achieve: “We are at the very beginning of this transformation. We are talking about a more sustainable growth rate. And, in most cases, we are talking about lower growth. But slower growth is a good thing for China.”

Wong believes that policy-makers will take action to ensure China’s 2014 gross domestic product (GDP) growth rate remains close to the consensus expectation of 7%-7.5%

Wong also notes that the Shanghai stock market has gone through a rough patch; investors have been leaving in droves on concerns that earnings have been in free fall: “But we believe that earnings have been bottoming out, if not already at the bottom.”

He adds that Hong Kong-listed stocks, which he prefers to those listed in Shanghai, are trading at around eight to nine times earnings, or almost 50% cheaper than shares in the U.S. “It’s due to the uncertainty about the Chinese economy,” says Wong. “But that’s exactly where the opportunity is. The downside is limited, but the upside potential is a lot higher.”

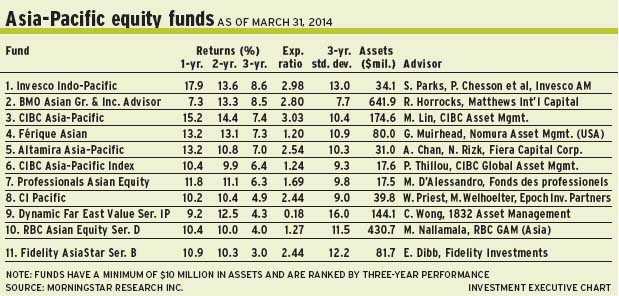

About 30% of the Dynamic fund’s assets under management (AUM) is in Greater China (that is, Hong Kong and Taiwan), 32% is in the countries belonging to the Association of South-East Asian Nations, 15% is in Japan and smaller holdings are in markets such as South Korea, Pakistan, and India.

Wong, a value investor running a portfolio of 58 names, likes firms such as United Bank Ltd., one of Pakistan’s largest banks. This bank was privatized in 2002 and “over the years, has done a fantastic job to reform and restructure and become one of the most competitive banks in the country.”

United Bank stock is trading at about PKR163.9 ($1.85) a share (7.5 times earnings) and pays a 7% dividend. There is no stated target.

Eileen Dibb, a portfolio manager with Pyramis Global Advisors, a unit of Boston-based FMR LLC (a.k.a. Fidelity Investments), oversees Fidelity AsiaStar Fund. She acknowledges the concerns about China and Japan are the main sources of uncertainty hanging over stocks in those markets.

At the same time, there’s uncertainty about the direction of government policy in Japan. “People are waiting for the so-called ‘arrows of Abenomics’ to take effect,” says Dibb, referring to looser monetary and immigration policies that the government launched in late 2012. “We are waiting for more policies to be hammered out by the Diet [Japan’s parliament] and more positive news on that front.”

Local issues also are having an impact in other markets in the region, too. For example, Thailand is in turmoil because of protests over the February elections.

But Dibb argues that there is hope in markets such as Japan, which has cooled lately: “[Japan is] attempting to go from many years of deflation to a period of inflation, and that could be a huge positive for the economy. So, when stocks are inexpensive, you could see a natural flow into certain segments as consumers go up the wealth spectrum.”

Like Wong, Dibb notes that valuations have sunk to low levels. Japan’s benchmark Topix index is trading at about 1.1 times price to book value – or about half the valuations for U.S. stocks. Meanwhile, consensus estimates for earnings per share growth for Japan-based companies is expected to be about 8%-9% over the next few years. Says Dibb: “Returns on equity have been traditionally lower in Japan [than the US], so valuations will be lower.”

From a portfolio standpoint, Dibb clearly is bullish on Japan. About 45.6% of the Fidelity fund’s AUM is in that market. There is also 23% in Greater China, 11% in Australia and smaller holdings in markets such as South Korea. Dibb, a “growth at a reasonable price” investor, runs a portfolio holding about 175 names.

One top holding is Orix Corp., a leading Japan-based financial services firm involved in real estate and equipment leasing. The firm was restructured recently and invested in Robeco Groep NV, a Netherlands-based asset-management subsidiary, which is expected to boost Orix’s return on equity to 9.6% from 7.3% this year.

The stock is trading at about ¥1,450 ($15.45) a share – at book value. There is no stated target. The positive long-term prospects for China remain, argues Mark Lin, vice president international equities, with CIBC Asset Management Inc. in Montreal and portfolio manager of CIBC Asia-Pacific Fund.

“In the past few years,” says Lin, “the Chinese economy has not only been growing but fuelled by cheap credit. After the [global] financial crisis, all countries injected liquidity into the system and Chinese banks lent without rigorous loan standards. When you have cheap money, asset classes go up. The domestic Chinese stock market is not mature, so one of the natural outlets for investing has been real estate, which has done exceedingly well.”

In Lin’s view, the credit cycle in China has yet to turn down. As well, the country is somewhat behind the U.S., which has been deleveraging for several years.

“But when an economy slows down and the consumer deleverages [as has happened in the U.S.],” says Lin, “that sets you up for healthier, lower growth in the next cycle. Europe is in the fifth or sixth inning. But China is still in the first or second.

“Credit-fuelled growth will eventually slow,” Lin continues, “and there will be an adjustment in asset prices. We’ve already seen it in the stock market – even as the economy is growing at high single-digits.”

Lin believes China’s policy-makers are caught in a dilemma between maintaining rapid growth and keeping credit in a range that is safe: “So far, [they’ve] been targeting more on the growth side. The consequence of this is more low-quality credit going into the system. In the next few years, China will have to work through its credit cycle. But long-term growth is intact.”

Lin is skeptical about “Abenomics” and its attempts to reflate Japan’s economy. “The No. 1 challenge is the shrinking population,” says Lin, acknowledging that the weaker yen (due to a major bond-buying program) has boosted exports. “The economy has improved a little bit, but probably below expectations. Problem is: rising corporate earnings does not necessarily translate into wage increases. We have not seen that [in] the economy in a big way.”

Lin is bottom-up investor who shuns benchmark weightings. About 50% of the CIBC fund’s AUM is in Greater China, along with 21% in Japan, 18% in Australia, 6.7% in Indonesia and smaller weightings in countries such as India. Lin runs a 40-name fund, favouring companies with a minimum of 4% revenue growth rate and that benefit from barriers to entry.

One top holding in the CIBC fund is Bank Negara, a leading Indonesia-based bank that is benefiting from 5%-6% GDP growth. “[Bank Negara] focuses on the consumer,” says Lin, “in areas such as real estate and car loans, [in which] demand for financial services is rising.”

Bank Negara stock trades at about IDR5,225 (50¢) a share, (about 11 times 2014 earnings) and pays a 2.2% dividend. Says Lin: “It’s very cheap, in our opinion.” There is no stated target.

© 2014 Investment Executive. All rights reserved.