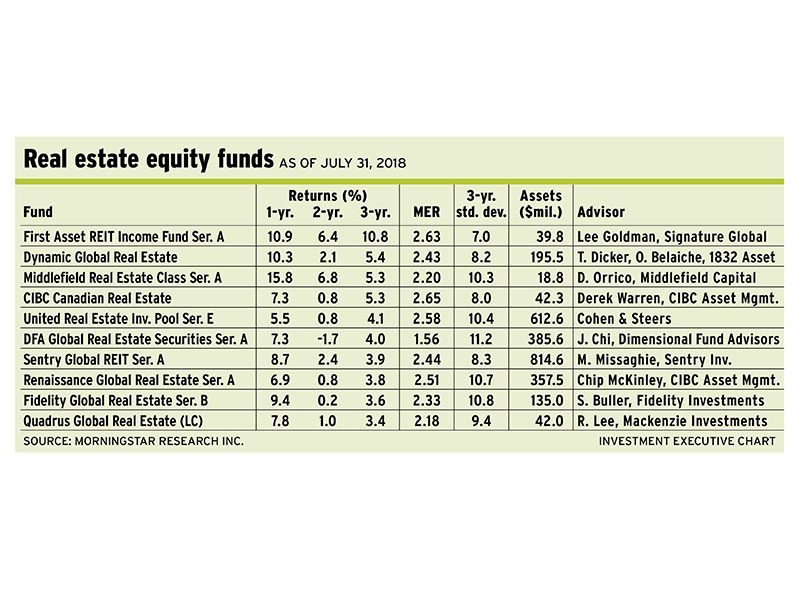

Despite a move to higher interest rates in both Canada and the U.S., the performance of mutual funds in the real estate equity category is holding up well.

In the second quarter of 2018, ended June 30, according to Morningstar Canada, real estate equity funds managed an average gain of 4.2% – better than the 0.4% decline in the international equity fund category and the flat performance of the global fixed-income fund category.

Real estate equity funds invest in real estate-based securities – primarily real estate investment trusts (REITs), which typically pay a generous, tax-advantaged distribution to shareholders and usually are regarded as income investments. But REITs’ valuations can be hurt by rising interest rates if yields become less attractive compared with other fixed-income alternatives in a rising interest-rate environment. REITs also tend to carry mortgage debt on the properties they hold, which can make them vulnerable to rising costs if interest rates rise.

Although REITs and real estate funds stumbled when the 10-year U.S. T-bond yield rose to more than 3% last May, that bellwether bond yield subsequently dropped to 2.85% by midsummer and REITs have staged a comeback as fears have eased slightly concerning the pace of rising interest rates.

Even if interest rates in both Canada and the U.S. rise a little more this year and next, they are not the only influence on real estate investments. Property values and the ability of owners to raise rents are affected strongly by economic strength. If interest rates are a reflection of a strong economy, they are not necessarily a bad indicator for real estate funds, according to real estate fund portfolio managers.

“Earlier in the year, there was more fear surrounding rising interest rates or rates rising too quickly, and the fear has dissipated somewhat,” says Lee Goldman, senior vice president and portfolio manager with Toronto-based Signature Global Asset Management and portfolio manager of First Asset REIT Income Fund. “The economy is generally doing well, and that’s good for REITs.”

Fund portfolio managers such as Goldman say the real estate outlook is particularly strong for multi-family residential properties, which are benefiting from rising demand and short supply for rental apartments. These portfolio managers also see opportunity in industrial real estate that can supply the warehousing and distribution needs of the booming online shopping business.

The First Asset fund invests across a variety of property types, including residential (30%), retail (22%), industrial (15%), office (10%) and some seniors’ housing. The fund holds several significant investments in REITs that focus on multi-family residential properties, including Canadian Apartment Properties REIT, Pure Multi-Family REIT and Killam Apartment REIT.

“Multi-family has been strong across the country, but especially in Ontario and British Columbia,” says Goldman. “Demand has increased, with lots of migration to Ontario, particularly. The shortage of supply has been going on for years.”

Toronto, for example, has a 1% vacancy rate, but receives 30%-40% of new immigrants, Goldman says. In addition, single-family homes and condominiums have been rising in price, squeezing out some buyers and encouraging more people to seek rental housing.

In industrial real estate, Goldman says, much of the available space is on the periphery of major centres, and “there’s been strong absorption with somewhat limited new supply.”

The national industrial vacancy rate of 4% is the lowest it’s been in 17 years, Goldman adds.

“Land is expensive, and zoning can be difficult to get,” Goldman says. “Rents are starting to go up, and that’s improving the performance of industrial REITs.”

In industrial real estate, the First Asset fund holds Dream Industrial REIT, Granite REIT and Summit Industrial Income REIT – all with most of their properties in Canada – as well as WPT Industrial REIT, which is listed in Canada, but has properties across the U.S.

A previous top holding, Pure Industrial REIT, was the object of a takeover bid by New York-based global giant Blackstone Property Partners LP, in January. The purchase price represented a 21% premium to the market price, Goldman says, creating a juicy payday for the fund. The deal closed in May.

On the retail side, Goldman says, there are some good names in Canada, but he is more selective now, as the trend toward online shopping is a headwind.

The First Asset fund focuses on companies with well-located urban malls hosting retail tenants that can thrive in the current environment, such as Winners, Canadian Tire and Dollarama stores, as well as banks, grocery stores and gyms. Goldman also likes real estate companies with mixed-use developments that combine retail with residential. Favorite retail names include First Capital Realty Inc. and Crombie REIT.

On the office side, the market is bifurcated, with Toronto and Vancouver en- joying low vacancies and rising rents, but Calgary and Edmonton suffering high vacancy rates and a “tenant’s rental market” as the latter pair of cities struggle to recover from tough times in the energy business. Goldman likes Allied Properties REIT, which is a niche player specializing in trendy “brick and beam” style offices converted from older buildings in several cities across Canada.

“We’re positioning in real estate companies that can grow at a pace that would offset any interest rate increases,” Goldman says.

Dean Orrico, president and chief investment officer at Toronto-based Middlefield Capital Corp. and portfolio manager of Middlefield Real Estate Class fund, suggests that real estate investments can be valuable portfolio stabilizers for investors because of stable cash flow and healthy distributions.

Unlike bonds, which pay interest at a set rate, REITs have the potential to increase their distributions. Distributions usually are more generous and are tax- efficient vs fully taxable interest payments on government bonds.

Roughly 10%-15% of real estate tenant leases, on average, are renewed every year, Orrico says. With the economy in good shape, leases can be renewed at higher levels and contribute to increasing REIT distributions.

“Tariffs and trade wars could affect economic growth and activity, but that is not a major factor to date,” Orrico says. “There is a certain security of cash flow in REITs. Recently, people have been looking to lock in some of the returns they’ve made in growth stocks and are anchoring their portfolios with more defensive, income-oriented securities such as REITs.”

In contrast to the First Asset fund, which focuses on Canada, the Middlefield fund holds 50% of its assets in Canada, 25% in the U.S. and 25% in Europe.

The Middlefield fund’s largest market weighting is in multi-unit residential real estate in Canada and Europe. Major Canadian cities such as Toronto and Vancouver are “hot,” Orrico says, but Germany also is benefiting from a favourable supply/demand picture.

“There’s a lack of supply and growing demand for apartments,” Orrico says. “A lot of millennials are happy to rent and walk to work. It’s a lifestyle decision.”

The top holding in the Middle- field fund is InterRent REIT, which has properties in Toronto and secondary centres around southern Ontario and in the Ottawa region. Other top holdings with a residential focus include Deutsche Wohnen SE of Germany and Pure Multi-Family REIT LP, which has properties in the U.S. sunbelt.

The Middlefield fund’s exposure to retail-focused REITs is a more modest 5% of assets.

“Retail has been hit particularly hard in the U.S.,” Orrico says. “A lot of malls are anchored by department stores at both ends, and online shopping has hit them hard. The Canadian market is not as ‘overstored’ as the U.S. is.”

A top holding in the retail property market is SmartCentres REIT, which has a portfolio of destination malls, value-oriented malls and mixed-use developments that are protected somewhat from the online shopping trend.

Although there may be shrinking opportunities in traditional retail, the industrial real estate market is flourishing, Orrico says: “E-commerce has been a good play for industrial space. It’s been the yin to the yang of the challenges faced by traditional retail.”

Much like the First Asset fund, the Middlefield fund owned shares in Pure Industrial REIT, but since the Blackstone takeover, the Middlefield fund gained exposure in the industrial market through investments in Granite REIT in Canada, Prologis Inc. in the U.S. and Segro PLC in the U.K. and Europe.

Another key holding in the Middlefield fund is FirstService Corp., a Toronto-based firm that doesn’t own property or act as a landlord, but instead provides property-management services to the multi-unit residential market.

“[FirstService] is an unbelievable growth story,” Orrico says. “A lot of condominium buildings are outsourcing their property management. FirstService is the largest player in the business.”