This article appears in the Mid-November 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The expert

Cesar Cossio, associate portfolio manager with MacNicol & Associates Asset Management Inc. in Toronto.

The philosophy

MacNicol maintains an active investment strategy and believes that a diversified portfolio should have exposure to alternative assets as well as public holdings. In the public space the firm holds strategic and tactical positions, whereas in the alternative space it invests in a portfolio of North American private real estate, hedge funds and private equity.

The scenario

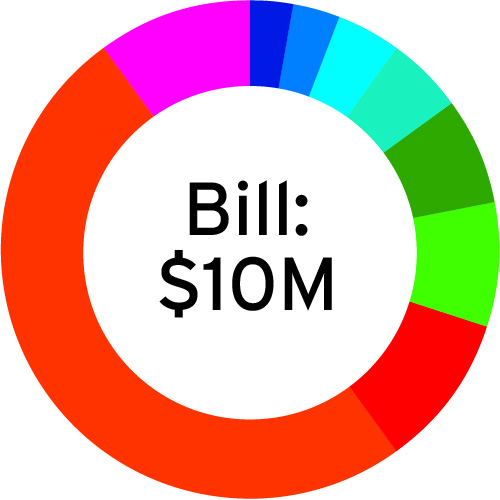

Bill, 45, receives a $10-million inheritance from his father. Bill’s goal is to create multigenerational wealth.

The allocation

30% to core equities, consisting of:

- 3% to consumer staples stocks, such as Loblaw Cos. Ltd. (TSX: L) and Post Holdings Inc. (NYSE: POST), a consumerpackaged goods holding company.

- 3% to utilities stocks, such as TransAlta Corp. (TSX: TA) and Northland Power Inc. (TSX: NPI).

- 4% to financials stocks, such as Brighthouse Financial Inc. (NASDAQ: BHF), an annuity and life insurance provider; MetLife Inc. (NYSE: MET) and Ameriprise Financial Inc. (NYSE: AMP).

- 5% to metals and mining stocks, such as First Quantum Minerals Ltd. (TSX:FM), Teck Resources Ltd. (TSX: TECK) and Yamana Gold Inc. (TSX: YRI).

- 7% to industrials stocks, such as Stantec Inc. (TSX: STN), Element Fleet Management Corp. (TSX: EFN) and Parker-Hannifin Corp. (NYSE: PH), an Ohio-based global manufacturer of motion and control technologies.

- 8% to energy stocks, such as Peyto Explorat ion & Development Corp. (TSX: PEY), Crescent Point Energy Corp. (TSX: CPG), Imperial Oil Ltd. (TSX: IMO), Chevron Corp. (NYSE: CVX) and Plains All American Pipeline LP (NYSE: PAA).

60% to alternatives, consisting of:

- 10% to the BMG BullionFund, which holds insured gold, silver and platinum bullion in a vault. These assets “will act as a hedge against heightened geopolitical risk and inflation,” Cossio said.

- 50% to the MacNicol Alternative Asset Trust, which has 40% exposure to private North American real estate (residential and industrial), 43% to private equity, 14% to market-neutral and multistrategy hedge funds, and 3% to cash.

10% to fixed income, allocated to a diversified portfolio of bonds and debt instruments, such as JP Morgan Chase bonds expiring February 2042, with a yield to maturity of 6.12%; and Morgan Stanley bonds expiring January 2024, with a yield to maturity of 6.8%.

The scenario

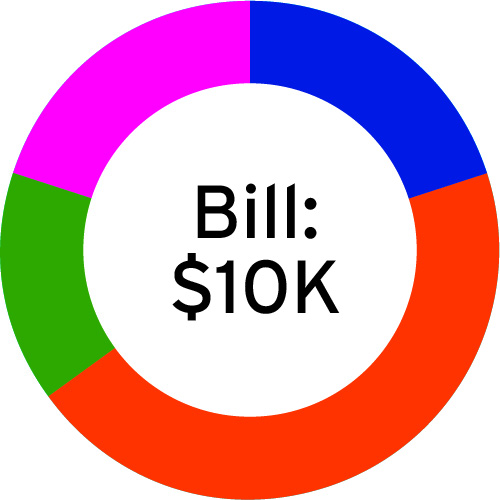

Bill also receives a $10,000 employment bonus at Christmas.

The allocation

- 20% to fixed income via the iShares Core Canadian Short Term Bond Index ETF (TSX: XSB), “which has little to no credit risk and a weighted yield to maturity of 4.75%,” Cossio said.

- 45% to equities via the BMO Premium Yield ETF (TSX: ZPAY), which has a current yield of 7%

- 15% to the BMG BullionFund

- 20% to the MacNicol Alternative Asset Trust

The expert

Carter Njovana, financial advisor with Blue Alpha Wealth in Toronto.

The philosophy

Njovana uses an active diversified approach to manage assets. He employs a mix of core stock and bond strategies, complemented by alternative strategies to offset volatility, reduce risk and bring stability to the portfolio. He primarily utilizes investment funds and ETFs managed by specialist portfolio managers to remove the decision fatigue of market-timing.

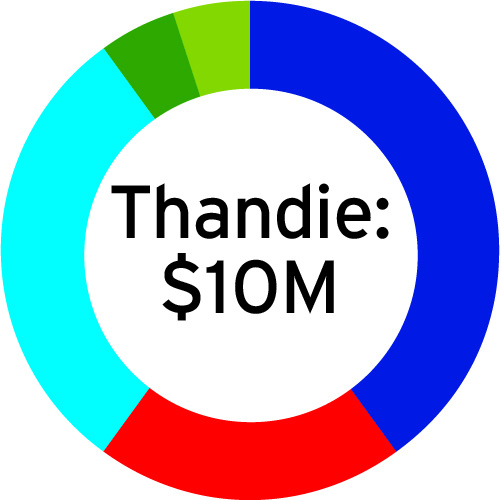

The scenario

Thandie, 53, received a $10-million inheritance. She wants a mix of capital growth and capital preservation.

The allocation

Njovana said he considered Thandie’s life stage, risk tolerance, tax situation, estimated cash needs and the economic environment when recommending a base of core equity investment funds:

40% to U.S. and global equity funds, such as the:

- Mackenzie US All Cap Growth Fund

- Dynamic U.S. Dividend Advantage Fund

- TD Active Global Equity Growth ETF (TSX: TGGR)

20% to Canadian equity funds, such as the:

- Mackenzie Ivy Canadian Balanced Fund

- Mackenzie Canadian Small Cap Fund

- Dynamic Active Canadian Dividend ETF (TSX: DXC)

30% to alternative investments, such as the:

- Ninepoint Alternative Credit Opportunities Fund, to diversify beyond volatile bond yields

- Ninepoint Energy Fund, to benefit from the mismatch between heightened demand and low supply for energy globally

- RiverRock Mortgage Investment Corp. (for accredited investors), which provides a 7% annual yield and steady income 10% to fixed income:

- 5% to a GIC ladder allocated equally to one-year, two-year, three-year, four-year and five-year GICs yielding between 4.75% and 5.05% across different institutions. “It’s better to make 5% than lose 20% in unpredictable markets,” Njovana said.

- 5% to two-year structured notes to preserve capital while maintaining conservative exposure to stock market gains. An example would be the Desjardins Two-Step Participation Global Equity Principal Protected Notes Series 137.

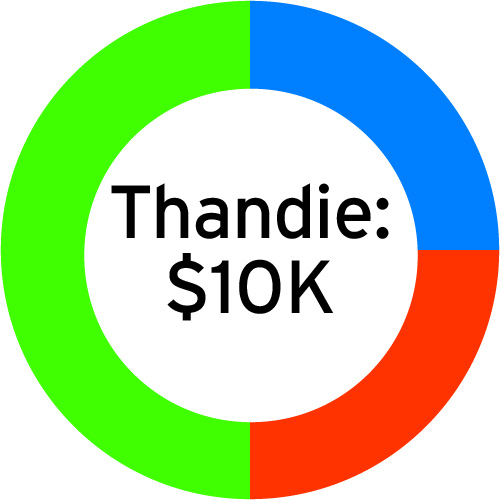

The scenario

Thandie received a $10,000 bonus and doesn’t need liquidity.

The allocation

Given the small amount and Thandie’s growth objective, Njovana recommended:

- 25% to the CI Auspice Broad Commodity ETF (TSX: CCOM)

- 25% to the CI Tech Giants Covered Call ETF (TSX: TXF)

- 50% to the Ninepoint Energy Income Fund