This article appears in the November 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The expert

Michael Hakes, senior portfolio manager with the Murray Wealth Group in Toronto.

The Philosophy

Hakes takes a fundamental, long-term, bottom-up approach to stock picking. He believes a concentrated portfolio of companies with superior revenue, profitability and cash flow prospects, combined with management teams with proven track records, will lead to solid long-term returns.

The scenario

Anwar, 40, received a $10-million inheritance. His time horizon is at least five years and he has good tolerance for risk.

The allocation

Hakes recommended a portfolio comprising 80% global equities and 20% Canadian equities, with 5% allocation to each stock. He didn’t recommend positions in real estate or utilities because companies in these sectors are relatively unattractive on a fundamental basis compared with other sectors.

10% to communication services stocks:

- Alphabet Inc. (NASDAQ: GOOG)

- Meta Platforms Inc. (NASDAQ: META), which Hakes said is “too cheap to ignore.”

15% to consumer discretionary stocks:

- LVMH Moët Hennessy Louis Vuitton SE (EPA: MC)

- Starbucks Corp. (NASDAQ: SBUX). Hakes said the new CEO is “revitalizing the company’s growth.”

- Aritzia Inc. (TSX: ATZ), which Hakes said has a “long runway for growth for its stores, as well as e-commerce.”

5% to a consumer staples stock:

- Danone SA (EPA:BN), which Hakes said is aiming to “launch new products and take back lost market share.”

10% to energy stocks:

- BP PLC (NYSE: BP)

- Whitecap Resources Inc. (TSX: WCP), a Calgary-based oil and gas company.

20% to health care stocks:

- UnitedHealth Group Inc. (NYSE: UNH), a diversified healthcare company.

- Eli Lilly and Co. (NYSE: LLY), which expects to launch a new obesity drug next year.

- AstraZeneca PLC (NASDAQ: AZN), a global biopharmaceutical company with “a robust pipeline of new drugs,” Hakes said.

- Intuitive Surgica l Inc. (NASDAQ: ISRG), a global leader in robotic surgery based in California.

Hakes said he holds an overweight position in health care because he is excited about the growth potential of new drugs and procedures being developed.

15% to financials stocks:

- Morgan Stanley (NYSE: MS)

- Aon PLC (NYSE: AON)

- Bank of Nova Scotia (TSX: BNS)

15% to technology stocks:

- Mastercard Inc. (NYSE: MA)

- Microsoft Corp. (NASDAQ: MSFT)

- Broadcom Inc. (NASDAQ: AVGO), a California-based global semiconductor devices company.

10% to industrials stocks:

- Airbus SE (EPA: A IR), a Netherlands-based global aerospace company.

- Air Canada (TSX: AC)

The scenario

Anwar also received a $10,000 employment bonus.

The allocation

Given the size of the investment and for greater efficiency, Hakes recommended putting the full amount in the Murray Wealth Global Growth Fund, which he said provides exposure to a concentrated portfolio of best-in-class companies with strong growth potential.

The expert

David Strachan, portfolio manager with IPC Securities Corp. in Stouffville, Ont.

The philosophy

Strachan builds strategic portfolios with a tactical overlay by using a mix of individual securities, passive ETFs and actively managed funds.

The scenario

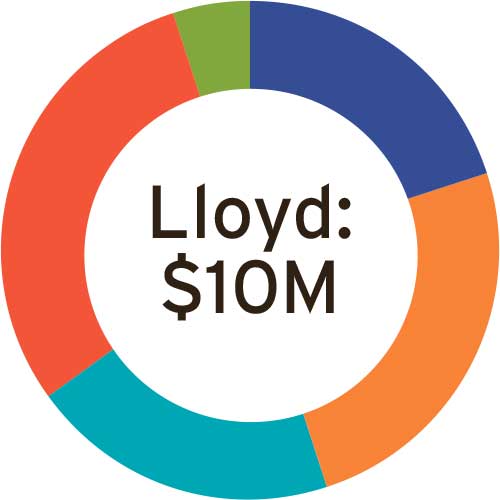

Lloyd, 50, inherited $10 million. He has moderate risk tolerance and seeks both current income and long-term growth.

The allocation

20% to Canadian equities

Strachan recommended a “fairly concentrated mix of predominantly blue-chip companies that have a long history of reliable dividend payouts.” He aims “to generate income and growth by emphasizing large, best-in-class companies, with diversification by industry.” Names he likes include BCE Inc. (TSX: BCE), Enbridge Inc. (TSX: ENB), Toronto-Dominion Bank (TSX: TD), Canadian National Railway Co. (TSX: CNR) and Thomson Reuters Corp. (TSX: TRI).

Strachan also recommended tactical names “as well as a sprinkling of growth-oriented companies.” Among these companies are Dollarama Inc. (TSX: DOL), Suncor Energy Inc. (TSX: SU) and Aritzia Inc. (TSX: ATZ).

25% to U.S. equities

In this asset class, Strachan “likes to keep things straightforward and inexpensive.” He “hedges against currency fluctuations in trying to capture the unhindered performance of the broader U.S. market.” He recommended the Vanguard S&P 500 Index ETF (CAD-hedged; TSX: VSP), which prov ides inexpensive access to the broad U.S. market, and the Mackenzie US Mid Cap Opportunities Fund, which provides diversification by market capitalization.

20% to global equities

Here, Strachan believes in outsourcing management to global teams with solid t rack records. He recommended the AGF Global Select Fund, a large-cap, growth-oriented fund, and the Fidelity Global Innovators Class fund. He pointed out that “the Fidelity Global Innovators Class falls into the high-risk, highreward category, so the allocation is much lighter than [to AGF] Global Select.”

30% to fixed income

For the fixed-income component of the portfolio, Strachan recommended three actively managed funds:

- The Fidelity Canadian Bond Fund, a core position that is fairly evenly split between corporates and government bonds, with the majority of the holdings rated A or higher.

- The Mackenzie Unconstrained Fixed Income Fund, which uses options strategies to offer downside protection and generate income.

- The PIMCO Monthly Income Fund, a multisector global bond fund that seeks to maintain a high yield and can invest up to 50% in below-investment-grade holdings.

0%–5% to cash

“It is important to maintain some cash for unexpected events and to have dry powder to take aim at favourite positions when they present value,” Strachan said.

The scenario

Lloyd also received a $10,000 bonus through work.

The allocation

Strachan recommended that the entire amount be held as part of Lloyd’s cash position to average down when opportunities arise.