This article appears in the April 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The expert:

Charlie Spiring, senior wealth advisor with Spiring Wealth Management, part of Wellington-Altus Private Wealth Inc. in Winnipeg. He also is founder and chairman of Wellington-Altus Financial Inc.

The philosophy:

Spiring uses a “core and explore” philosophy, whereby he invests the majority of client assets in a diversified core portfolio that is aligned with their objectives and risk profile, and 20% in “special situations” for growth and diversification.

The scenario:

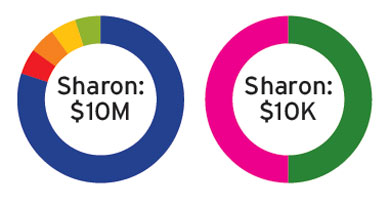

Sharon, 50, inherited $10 million. She is seeking balanced growth on her investments.

The allocation:

Core portfolio (80%)

80% to the NBI Private Wealth Management Growth Profile, a unified managed account (UMA) diversified among 14 money managers. Assets in the UMA include government, corporate and highyield bonds (target:15%); Canadian large-and small-cap equities (target:20%); U.S., international and emerging market equities (target:55%); and tactical balanced (target:10%).

Spiring said he “loves the diversification it offers.” In addition to holding stocks, bonds and alternatives, the UMA offers a fourth strategy:tactical asset allocation. This allows the fund to take advantage of investable situations that arise, such as investing in a specific sector or region.

Spiring said that since the UMA’s inception in 2015, it has experienced a “90% upside and only 60% downside capture.”

Special situations (20%)

5% to Winnipeg-based Exchange Income Corp. (TSX:EIF), which Spiring said “is the number one dividend growth stock on the S&P/TSX for the past 15 to 20 years, with a 5.5% annual rate of return that is better than the banks.” Dividends have increased annually and investors also benefit from corporate growth of the stock, Spiring said.

5% to the Hamilton Enhanced Multi-Sector Covered Call ETF (TSX:HDIV), which offers equal-weight exposure to seven sector covered-call ETFs with a sector mix broadly matching that of the S&P/TSX 60 index. The ETF uses 25% cash leverage on the underlying ETFs to enhance yield.

5% to the Purpose Structured Equity Growth Fund, an actively managed mutual fund replicating the payoff of multiple structured products in a single-ticket strategy. The security has a running yield of 8% and is extremely tax-efficient, Spiring said.

5% to Royal Bank of Canada (TSX:RY). Spiring said he sells call options against the stock, a strategy he refers to as “tripling your dividends.” “You benefit from the regular dividend, the call premium and the increase in price above market,” he said, adding that this strategy can yield more than 10% in returns.

The scenario:

Sharon later received a $10,000 employment bonus.

The allocation:

50% to Exchange Income Corp.

50% to the Hamilton Enhanced Multi-Sector Covered Call ETF.

The expert:

Godfrey Yu, wealth planner with JCIC Asset Management Inc. in Toronto.

The philosophy:

Yu is part of JCIC’s discretionary investment management team, which provides holistic financial and investment planning. Portfolios are actively managed with exposure to approximately 20 to 40 securities and are designed to be highly adaptive to changing market dynamics.

The scenario:

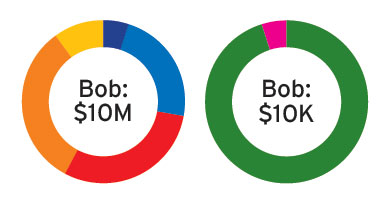

Bob, 50, inherited $10 million. He has a long time horizon, is comfortable with medium volatility, and would like modest growth over the long term.

The allocation:

For the overall portfolio, Yu recommends “a balanced asset mix, using a barbell approach across various industries and an underweighted position in fixed-income securities.” Specifically:

5% to cash for liquidity.

23% to fixed income, with a focus on short-to mediumduration corporate debt. Among his recommendations are the BMO Mid Corporate Bond Index ETF (TSX:ZCM), which provides a yield of about 3.6%; Telus Corp.senior note with coupon of 3.3%, maturing May 2029; and Loblaw Cos. Ltd.senior note with coupon of 4.48%, maturing December 2028.

Equities (72%)

“Using a barbell approach, we have exposure to secular growth companies that demonst rate earning resilience in a challenging environment in sectors like e-commerce and semiconductors at one end of the curve,” Yu said.

“On the other end, we have exposure to companies in energy and financials that will benefit from an economic recovery.”

30% to Canadian equities, such as Calgary-based Cenovus Energy Inc. (TSX:CVE), an integrated oil and gas company; Saskatoon-based Nutrien Ltd. (TSX:NTR), the world’s largest potash producer; and Texasbased Waste Connections Inc. (TSX:WCN), the third-largest solid waste management company in North America, as a defensive play.

32% to U.S.equities. “We continue to like the technology sector for its long-term secular growth potential,” Yu said. Examples are semiconductor company Advanced Micro Devices Inc. (Nasdaq:AMD) and Apple Inc. (Nasdaq:AAPL).

10% to international equities. Yu said European equities, in particular, have good growth potential. Among his picks are LVMH Moët Hennessy Louis Vuitton SE (EPA:MC), a leader in the luxury goods industry; and Schneider Electric SE (EPA:SU), a leader in energy management and automation.

The scenario:

Bob later received a $10,000 employment bonus.

The allocation:

95% to the JCIC Equity Fund, which is comprised of 40% Canadian equities, 40% U.S.equities, 15% international equities and 5% cash.

5% to cash for liquidity.