This article appears in the December issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The scenario: Anne, 40, is an aggressive investor with a 20-year time horizon to retirement. She received a $10-million inheritance, and later a $10,000 employment bonus.

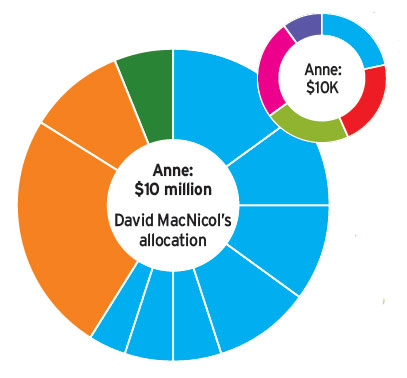

The expert: David MacNicol, founder and president of MacNicol & Associates Asset Management Inc. in Toronto.

The expert: David MacNicol, founder and president of MacNicol & Associates Asset Management Inc. in Toronto.

The philosophy: MacNicol is an active investor who believes in diversification across several asset classes, including alternatives. The firm applies both tactical and strategic approaches to buying and selling public securities, which comprise clients’ core holdings. This approach incorporates top-down macroeconomic research, fundamental data and technical analysis of momentum trends.

The allocation: $10-million inheritance

59% to public equities:

■ 15% to the iShares S&P/TSX Capped Energy Index ETF (TSX: XEG)

■ 10% to the iShares S&P/TSX Capped Materials Index ETF (TSX: XMA)

■ 10% to the Invesco Food & Beverage ETF (NYSE Arca: PBJ)

■ 10% to the iShares S&P/TSX Capped Financials Index ETF (TSX: XFN)

■ 5% to the iShares S&P/TSX Global Base Metals Index ETF (TSX: XBM)

■ 5% to the VanEck Gold Miners ETF (NYSE Arca: GDX)

■ 4% to the Sprott Physical Uranium Trust (TSX: U.UN)

35% to alternatives:

■ 25% to the MacNicol Alternative Asset Trust, which provides exposure to private North American real estate, private equity, and market-neutral and multi-strategy hedge funds.

■ 10% to the BMG BullionFund, which holds physical gold, silver and platinum bullion in a vault. “All assets are insured and we believe they provide our investors with a hedge against inflation and heightened geopolitical risk,” MacNicol said.

6% to cash via the Evolve High Interest Savings Account Fund (NEO: HISA)

The allocation: $10,000 bonus

To cut down on trading costs and increase diversification, MacNicol said he uses ETFs to replace public equities in similar-sized accounts. “We use a relative-strength program that utilizes momentum and allows us to seamlessly trade in these accounts,” he said.

He recommends:

21.7% to the BMO S&P/TSX Equal Weight Industrials ETF Index (TSX: ZIN)

21.7% to the iShares S&P/TSX Capped Information Technology Index ETF (TSX: XIT)

21.6% to the Vanguard U.S. Dividend Appreciation Index ETF (TSX: VGG)

25% to the MacNicol Alternative Asset Trust

10% to the BMG Bullion Fund

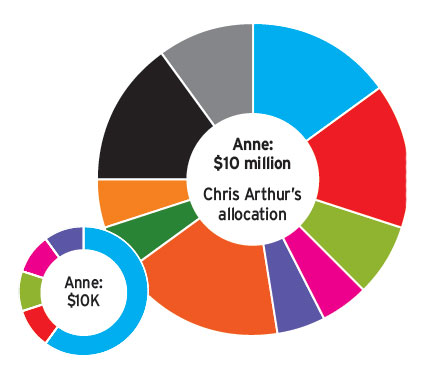

The expert: Chris Arthur, CEO and chief investment officer with Bold Wealth Partners in Toronto.

The expert: Chris Arthur, CEO and chief investment officer with Bold Wealth Partners in Toronto.

The philosophy: Arthur’s firm strives to achieve stable, long-term returns while minimizing risk through diversification. The firm focuses on private assets and real estate, and invests in publicly traded equities through ETFs to manage country, sector and thematic exposures. Laddered bond portfolios are used to manage client’s fixed income allocations and mitigate volatility. Private assets increase diversification while trying to achieve a stronger return than public equities.

The allocation: $10-million inheritance

15% to U.S. equities via the Vanguard U.S. Total Market Index ETF (TSX: VUN)

15% to international equities via the BMO MSCI EAFE Hedged to CAD Index ETF (TSX: ZDM)

7.5% to Canadian equities via the BMO S&P/TSX Capped Composite Index ETF (TSX: ZCN)

5% to technology equities via the Evolve FANGMA Index ETF (TSX: TECH)

5% to emerging-market equities via the iShares Emerging Markets Equity Factor ETF (TSX: EMGF)

17.5% to corporate bonds via individual laddered bond portfolios from investment-grade bond providers such as Bank of Nova Scotia, Toronto-Dominion Bank and Desjardins Group.

5% to real estate via direct ownership in dividend-paying real estate projects through limited-partnership agreements.

5% to gold via the iShares Gold Bullion ETF (TSX: CGL.C)

15% to alternatives via the Kensington Private Equity Fund. “This [investment] is less liquid, so the client needs to have a longer time horizon as there are not always exit opportunities,” Arthur said.

10% to cash via the Evolve High Interest Savings Account Fund and laddered GICs. These provide liquidity to meet unexpected expenses and can be deployed as opportunities arise in the capital markets.

The allocation: $10,000 bonus

With a smaller portfolio, Anne can focus on growth and technology stocks to build wealth efficiently, Arthur suggested. Divi-dend stocks and real estate investments generate steady income and reduce volatility. Keeping some cash on hand provides flexibility for other financial needs.

60% to growth equities via the BMO MSCI All Country World High Quality Index ETF (TSX: ZGQ)

10% to technology equities via the Evolve FANGMA Index ETF

10% to real estate via the BMO Equal Weight REITs Index ETF (TSX: ZRE)

10% to dividend equities via the BMO Canadian Dividend ETF (TSX: ZDV)

10% to cash via the Evolve High Interest Savings Account Fund