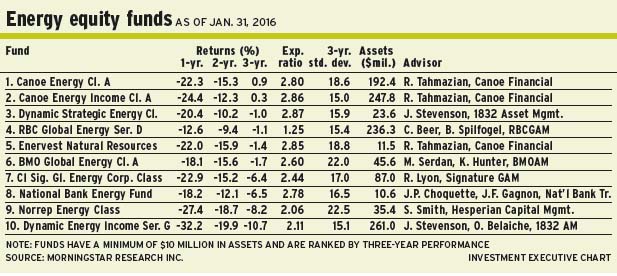

Energy equity funds have been in an agonizing slump as oil prices trended as low as US$26 a barrel, then back up to US$36. Yet, portfolio managers are optimistic that the nadir has been reached and they look to brighter days ahead as supply/demand imbalances are corrected.

“Oil will start to move up in the second half of 2016 from a fundamentals basis, because we are seeing a rebalanced situation in which demand continues to go up and supply is not rising as quickly,” says Jennifer Stevenson, vice president of 1832 Asset Management LP in Calgary and portfolio manager of Dynamic Energy Income Fund. “Whether it’s in the summer or at Christmas is tricky to call. It will happen in the back half of the year. Leading up to that, though, there is room for the price to fall further briefly.” (Stevenson shares portfolio-management duties with Oscar Belaiche, senior vice president with 1832 AM.)

The factors that might push the crude oil price lower in the short term include storage build-up due to the traditional North American refinery maintenance season, during which time less oil is refined. At the same time, the return of exports from Iran is expected, starting around April. “As the Iranian sanctions come off, that will keep trepidation in the market until we get some comfort on the pace of additional supply,” Stevenson says. “That’s why we will have some choppiness ahead of us.”

What is uncharacteristic today is that geopolitical tensions that normally affect the crude price have had little impact. To Stevenson, this signifies that “we’re now in the bottom of the bathtub. Once we get through the seasonal catalysts – [such as] refinery maintenance impacting the price – we could see a sharp snap-back in commodity prices and stocks.”

In terms of equities valuations, Canada is starting to show more pockets of value than U.S. equities are. “Our profitability is better,” says Stevenson, noting that domestic producers have benefitted from a weak Canadian dollar.

“But different companies trade within different ranges. Companies that used to trade at 10 to 11 times cash flow now trade at seven times. Those that used to trade at six times can be bought at four. Everything has moved down and looks reasonable,” says Stevenson. “But we could exit this year with oil in the high US$40s. That looks pretty good.”

About 30% of the Dynamic fund’s assets under management (AUM) is in cash. This is largely the result of concentrating on higher-quality companies and dropping those with potential balance-sheet problems. From a geographical perspective, about 36% of AUM is in Canadian stocks, 24% is in the U.S. and 10% is in Europe.

One of the top holdings in the 30-name fund is Pioneer Natural Resources Co., a U.S.-based firm that produces about 200,000 barrels of oil equivalent (BOE) daily. Pioneer stock is trading at about US$119.35 ($161.85) a share. Stevenson has a target of US$162 in 12 to 18 months.

The oil price is being driven by a complex web of geopolitical and geo-economic issues and derivatives trading, all of which makes timing the recovery of both the commodity and energy stocks impossible, says Rafi Tahmazian, director of Calgary-based Canoe Financial LP and portfolio manager of Canoe Energy Class Fund.

Nevertheless, he argues that a turnaround is inevitable, although he is reluctant to pinpoint when it will occur: “Everything in the business world has a life. You amortize computers and draw down the cost over a period. It says zero on the balance sheet, but you still have a computer. When it comes to depletion, you draw down the value of a pool of oil, and what’s left? An empty cavern.”

Oil supplies must be constantly replenished to sustain the industry. “You have to believe that demand will continue to grow. Fundamentally, it’s impossible in the medium term to reverse the growth in demand, based on all the noise about renewable energy. Any decline in demand [for oil] is probably two decades away,” says Tahmazian, who argues that the oil price will rise again, driven by a global population that will climb to 10 billion by the early 2050s.

Meanwhile, Tahmazian maintains that the current low oil price is being held back by speculators exploiting an oversupply situation.

“The natural supply/demand picture lags the direction of the oil price,” says Tahmazian, pointing to the situation in 2014, when oil plummeted from US$100 to US$45 in a few months. “Did we wake up one day and find a bunch of oil that wasn’t there before? No. Oil supply was growing, but there was lack of clarity about it and the derivatives market had kept the price unrealistically high. When the news about oversupply became overwhelming, that trade started to crack – and the speculators reversed their opinions.”

A less volatile environment will be required in order to determine where the price of the commodity should really be. Says Tahmazian: “To get a better picture of supply and demand, we need a benign environment so that it stops speculators from trading and lets the natural fundamentals take more control. Then you will start to see a better picture.”

About 25% of the Canoe fund’s AUM is in cash. There is also 35% in Canadian stocks, 30% in U.S. large-cap firms and 10% in high-yield bonds issued by Canadian energy firms.

Two top holdings in the 24-name fund are Spartan Energy Corp., which produces 9,000 BOE a day, and Raging River Exploration Inc., which produces 16,000 BOE. Both companies are active in Saskatchewan. “They have best-in-class assets, manageable balance sheets and running room to grow with the lands that they possess,” says Tahmazian.

Spartan stock is trading at about $2.50 a share, while Raging River stock is trading at roughly $8.82 a share. There are no stated targets.

What has driven the oil price to rock-bottom levels is the perception that there is a massive amount of oversupply, argues Chris Beer, vice president of Toronto-based RBC Global Asset Management Inc. (RBCGAM), and portfolio co-manager of RBC Global Energy Fund. He shares portfolio-management duties with Brahm Spilfogel, vice president of RBCGAM.

“The media likes to mention that oil inventories are at higher levels than in 1990, but they forget to include that in 1990 demand for oil was 80 million barrels a day. Today we’re almost at 96 million barrels. We need more inventory in the system,” says Beer. “But the issue is that during 2015, we built about one million to 1.5 million extra barrels of visible inventory that the market has been very focused on. Seasonally, demand is better in the second half of [each] year, so we should see a decline in inventories then.”

Currently, global oil consumption stands at 95 million barrels a day, vs the 96.5 million barrels that are produced. That has resulted in about 350 million barrels of visible inventory.

“In the broad scheme of things,” Beer explains, “we’re talking about 1% oversupply. The market is hysterical about this.”

On the positive side, Beer notes: “OPEC is producing flat out, with the exception of Iran. Demand should outweigh supply in 2016 by about one million to 1.5 million barrels a day, and we should start to see that happen in the May-June time frame. That should eat into above-ground inventory.”

Meanwhile, U.S. production, now largely in the shale-oil segment, declined in 2015 by 400,000 barrels a day to 9.3 million barrels a day.

“But with oil below US$50 a barrel we’re expecting to see significant [retrenchment] in production – in non-OPEC members and certainly in the shale-oil segment,” says Beer.

Consensus points to oil reaching about US$40 a barrel by the end of 2016. “But our view is that we end the year at probably over US$40 a barrel,” says Beer.

The RBC fund is fully invested. The portfolio managers have allocated about 57% of AUM to the U.S., 21% to Canada and 20% to international producers.

“We’re overweighted to the U.S. largely because the companies we like have a lower debt-to-cash flow multiple than the global average.”

On the Canadian side, Beer likes Suncor Energy Inc., a leading producer. Although its stock is trading at nine times earnings before interest, taxes, depreciation and amortization, Beer argues that the multiple is justifiable once a higher oil price is factored in.

“We need north of US$50 a barrel to bring on incremental supply,” Beer says. “In the meantime, you’re getting a 4% dividend yield, a strong balance sheet and management that has executed on lowering costs.”

Suncor stock is trading at about $32.60 a share. There is no stated target.

© 2016 Investment Executive. All rights reserved.