This article appears in the February 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

Gold’s reputation as an inflation hedge was tarnished in 2021.

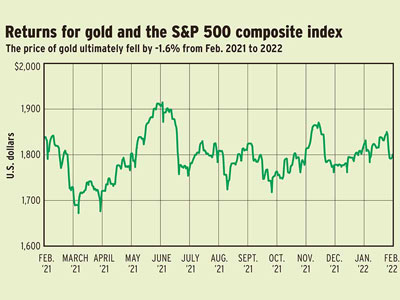

While consumers dug deeper at gas pumps and grocery stores, gold was outshone by surging stock markets and flashy novelties such as cryptocurrencies and thematics. The bullion price, as quoted in U.S. dollars, fell by more than 4% as Canada’s consumer price index (CPI) rose by 4.8% over 12 months in December.

This meant losses for pure bullion-based ETFs and mutual funds. The largest Canadian-listed ETF, the $747-million iShares Gold Bullion ETF, lost 4.7% last year. Some mutual funds fared worse, with one-year losses ranging from 6% to 8% for various versions of the BMG Gold BullionFund.

Gold’s 2021 slump exemplifies its unpredictability over shorter periods. Market timing doesn’t work, said Robert Cohen, vice-president and portfolio manager with Dynamic Funds Inc. He’s the veteran manager of the Dynamic Strategic Gold Class fund, which holds gold and gold stocks, and the Dynamic Precious Metals Fund, a five-star equity fund (as rated by Morningstar Canada).

“I find a lot of investors and investment advisors out there feel this inherent need to try to time the market. I keep saying, ‘Don’t do that,’” said Cohen, because gold stocks can surge by 5%–10% in a day. “Just own [gold] at all times. And then you can more comfortably rebalance from time to time.”

Historically, gold mining equities have outperformed gold bullion. Cohen holds only 30% of Dynamic Strategic Gold’s assets under management in bullion, which is at the low end of his range of 30%–70%. “In this environment,” he said, “we’re more bullish on equities, because equities have leverage to the underlying gold price.”

Cohen said gold is the “most uncorrelated asset class.” He noted that broad markets and gold can at times both perform well, both perform poorly or move in opposite directions.

Data compiled by Toronto-based Purpose Investments Inc., which manages the Purpose Gold Bullion Fund, illustrate gold’s lack of correlation. Over the 15 years ended in 2021, gold’s correlation was just 0.22 with Canadian equities, 0.04 with U.S. equities, 0.16 with international equities and 0.14 with Canadian fixed income. (Perfect correlation has a coefficient of 1.)

Gold is a “great portfolio diversifier,” Cohen said. With the world’s gold supply increasing by less than 1.5% per year on average, it’s a stable source of value compared with currencies. “When you’re looking at monetary policy [of] most Western countries, what they all have in common is that, especially since the pandemic hit, they have done effectively a lot of currency printing,” he said. This expansion of money supply is creating “monetary reflation.”

Since gold earns no income, rising interest rates expected this year would seem to be a negative for bullion. But Cohen said investors need to consider real, after-inflation rates, which remain negative. “We’ll see what happens with the [monetary] tightening cycle,” he said. “If inflation really picks up, then we’re going to spiral into very negative real-rates territory.”

Longer term, gold remains a proven inflation hedge. Over 10 years ended in 2021, bullion rose to US$1,806 from US$1,531 an ounce. That’s an average annual increase of 1.6%, or about the same rate as Canada’s CPI rose during that period.

But depending on fees and currency management, fund returns varied widely. Among gold-only mutual funds in retail share classes, Ninepoint Gold Bullion Fund Series F led with an inflation-beating 2.9% over 10 years. Meanwhile, with the Canadian dollar declining, the currency-hedged iShares ETF returned only 0.57% annually despite its relatively low management expense ratio (MER) of 0.55%.

Cost always matters in fund returns — more so when there’s no active management. Case in point: BMG Gold BullionFund Class F, which has an MER of 1.89%, reported a 10-year return of 1.5%. That lagged Ninepoint Gold (0.76% MER) by an amount mostly attributable to the difference in fees and expenses.The current low-cost bullion fund is the CI Gold Bullion Fund, an ETF launched in January 2021. Available in both unhedged and currency-hedged versions, its MER is 0.18%.

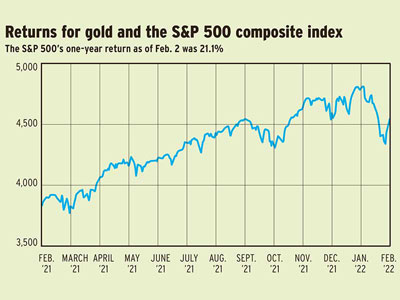

Returns for gold and the S&P 500 composite index

Click image for full-size chart

Click image for full-size chart