A 60-year-old, single client wants to retire at age 67. Their financial advisor has determined they need $3 million in their RRSP and TFSA, combined, to retire comfortably. The client earns $100,000 per year and has annual expenses of about $70,000, which will remain the same upon retirement. The client is $500,000 away from their retirement savings goal and has moderate risk tolerance.

We asked two experts how they would construct a portfolio with ETFs for this fictitious client.

“Bookending” the portfolio

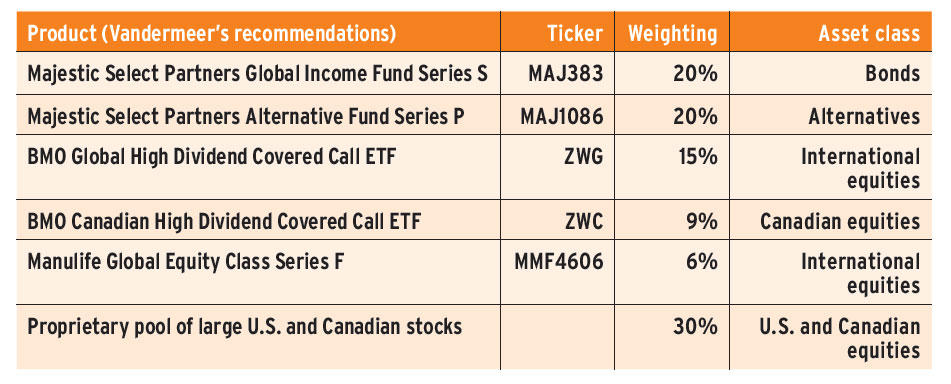

For pre-retirees, Brent Vandermeer, senior portfolio manager and managing partner with CrossPoint Financial, iA Private Wealth Inc., in Ottawa, recommends a portfolio with three basic components: covered-call ETFs for higher income yield, a modest cash component to cushion market collapses, and alternative investments for diversity.

“We basically bookend the portfolio [with] bonds on one side and alternatives on the other,” Vandermeer said. “Those proportions are the ‘walls,’ or the steady part of the portfolio.”

Equities usually take up 10%–90% of a portfolio, depending on the client’s risk tolerance, Vandermeer said. In this case, the allocation is 60%. The equities component is balanced among one low-cost ETF, individual stocks based on CrossPoint’s in-house research, and covered-call ETFs.

Vandermeer said he recommends covered-call ETFs for a steady income. And he would be clear with the client that choosing an income yield may mean sacrificing some upside performance.

Owning individual stocks and seeing the names of quality businesses on a statement can help clients stay invested, Vandermeer said. If the markets are in turmoil and the client is confident a company in their portfolio is still going to be around in five years, the client can “ride it out a lot better.”

Two years ahead of retirement, the portfolio’s equities allocation should be reduced by about 5%–10%. Risk can be dialled back up two years after retirement to maintain growth, Vandermeer said. This client is likely to reach their savings goal with a 4%–5% return, he said.

Reassessing the client’s risk tolerance regularly is important, as it can change over time and is based on personality, Vandermeer said. But some clients overestimate their risk tolerance, so it’s important to quantify it in dollar terms.

“People always think, ‘Oh, I can handle a 10% decline in the market.’ But when it happens on $2.5 million, they go, ‘Whoa, that’s $250,000,’” he said.

Keeping it simple

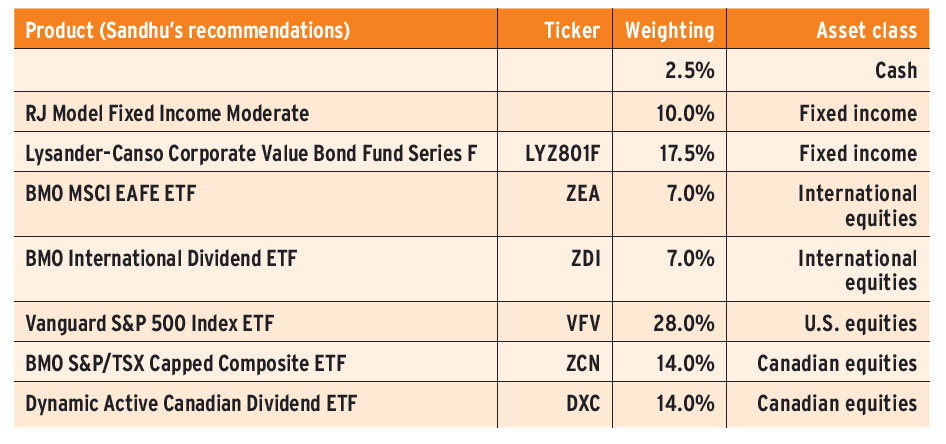

Harp Sandhu, senior wealth advisor with Sandhu Wealth, Raymond James, in Victoria, B.C., recommends keeping the portfolio simple. He suggests 27.5% fixed income, 2.5% cash and 70% ETFs, to earn steady retirement income without too much volatility.

“This [portfolio] was designed to provide some capital growth and provide some yield,” Sandhu said. “This client is going to have enough money in seven years when they retire…. Let’s keep it simple.”

The Vanguard S&P 500 Index ETF and BMO S&P/TSX Capped Composite ETF provide the simplicity, while an actively managed Canadian dividend ETF helps provide some downside protection, Sandhu said.

As the client can readily meet their yield goals to cover annual expenses, they won’t have to sell investments.

Since the client doesn’t need lots of capital growth, relatively low exposure to international equities helps reduce volatility in the portfolio, Sandhu said. The portfolio is 14% invested in international equities.

Sandhu suggested a $400,000 emergency fund spread across five buckets: a high-interest savings account; and one-year, two-year, three-year and four-year GICs. If the client saves $3.5 million by age 67, the $3.1 million in the entire portfolio will yield $86,800 in dividends per year at 2.8%. “I’m really setting up a situation for the next three to four years [during which the client is] not needing to sell units to generate income,” he said.

The client will have lower taxable income during the time between their retirement date and the point at which they must convert their RRSP to a RRIF. So, the client should transfer funds from the RRSP into the TFSA during those years to maximize tax efficiency, Sandhu said.

While the client may spend significantly less than their mandatory minimum RRIF withdrawals, the excess can be used for travel or to bolster the emergency fund. “I’m a big fan of you using your money and enjoying your retirement the way you want to,” Sandhu said.

Click image for full-size chart

Product (Vandermeer’s recommendations)

Product (Sandhu’s recommendations)

This article appears in the October issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.