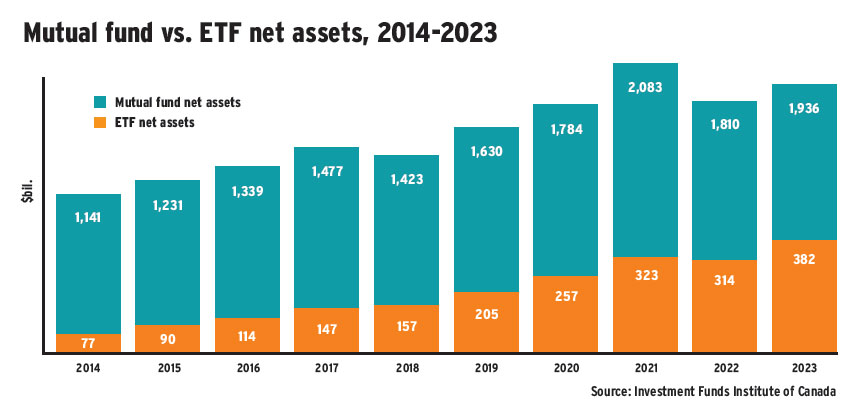

The gap between ETF and mutual fund assets is closing but is still more than $1.5 trillion wide, according to data from the Investment Funds Institute of Canada.

ETF assets increased fivefold from 2014 to 2023, rising from $77 billion as of Dec. 31, 2014, to $382 billion as of Dec. 31, 2023.

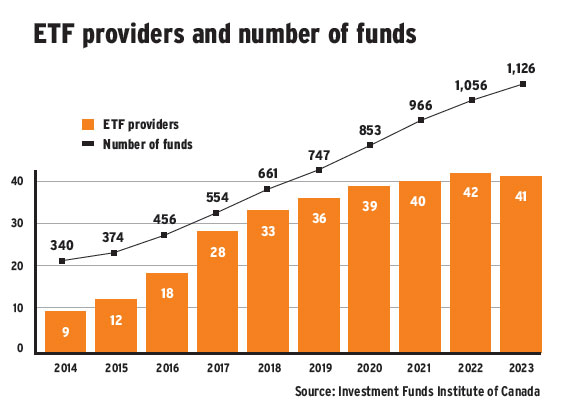

Momentum continues to be on the side of ETFs.

ETF net sales were $32.6 billion in the first half of 2024, up from $18.2 billion during the same period last year. Meanwhile, mutual funds generated $3.1 billion in net redemptions in the first half of 2024, which marks an improvement from the $12.8 billion in redemptions recorded in the same period last year.

In 2022, both ETFs and mutual funds saw assets decline amid challenging market conditions and net redemptions of $43.7 billion on the mutual fund side. However, the subsequent market recovery led to increased assets in 2023 for both camps, despite mutual fund net redemptions of $57.1 billion that year (the largest on record).

ETFs, meanwhile, have seen net sales every year for the past decade, although sales in 2022 and 2023 were down significantly from a peak of $58.3 billion in 2021.

Click image for full-size chart

This article appears in the October issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.