More dealer advisors worked independently this year — as opposed to working as part of a team with other licensed advisors — than in 2023, according to Investment Executive’s 2024 Dealers’ Report Card.

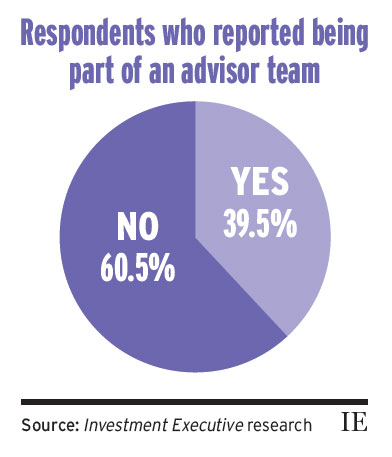

The majority of advisors (60.5%) reported that they either worked alone or with associates and assistants only, with the remaining 39.5% saying they served clients as part of a group that included other advisors. This result was a slight change from 2023, when 58.5% of respondents worked as the sole advisor and 41.5% worked as part of a team.

Working solo generally was seen as an advantage among those advisors who chose to operate that way, while advisors on teams extolled the benefits of working alongside peers.

“I’m in the ‘steady as she goes’ phase, [and am] not wanting to add any more clients,” said an advisor with Manulife Wealth Inc. in British Columbia.

“I have great staff, so I don’t need another team. And I wouldn’t be the boss if I did that,” said an advisor with Investia Financial Services Inc. in Ontario.

“In teams, there’s more of a sales focus, and [that’s] just not for me,” said an advisor in Ontario with Peak Financial Group.

Other advisors mentioned negative past experiences with team environments that led them to strike out on their own. One advisor with Carte Wealth Management Inc. said they found the team structure “ineffective.”

As one advisor with Investment Planning Counsel Inc. (IPC) in Ontario put it, “[There can be] too many cooks in the kitchen. I’ve been part of a team in the past and I work better solo.”

One alternative arrangement suggested by advisors was to create an informal alliance within a branch or shared office space — giving the advisor the best of both worlds. Another Carte Wealth advisor said having several professionals in the same space allows them to be “independent together.”

Still, there was a small group of solo advisors who considered making the transition to a team structure. All the non-team advisors for 2024 were asked whether they planned to join or form a team in the coming year, and more than a quarter (27%) of that segment said that was the goal. Frequently cited reasons included the need for succession planning and improved work/life balance.

“I need someone to take the bottom end of my book off my plate,” said an advisor with IPC in Alberta. An advisor with Carte Wealth said, “I am pretty much on my way out of the industry, so I am looking at it from a succession point of view.”

Better client service also is possible with a team. For example, an advisor with IG Wealth Management in Alberta said that as their book and their clients’ needs have expanded, “I can’t do it all on my own anymore. I’ve grown very quickly. I’d probably bring on a young CPA [chartered professional accountant].”

Generally, the goal is a “robust client offering,” said an advisor in Alberta with Peak Financial Group. On an ideal team, they added, other advisors would have complementary skill sets.

Advisors who were already working in teams in 2024 expressed similar sentiments: “There is someone there to back up the other advisor,” said an advisor with CI Assante in Atlantic Canada. “You’re not in a silo. You can review different client scenarios with the team and help share the workload.”

Among the advisors already in teams in this year’s Report Card, 40.2% said they planned to expand their practices in the coming year. Their penchant for a team environment has resulted in more active plans to bring on younger advisors and deepen client services.

With a team, “we can offer a variety of insurance and investments and marketing strategies to help the business,” said an advisor with Investia in Atlantic Canada. “We can also have advisors that specialize in areas. We try to be a boutique.”

Joining a team can be a good decision for young advisors looking to build a book of business. An Investia advisor, in Ontario, said they were new to a growing team and appreciated the learning opportunity: “There is a lot of value for younger advisors to really get a strong foundation [from] working with a more senior advisor. I don’t think there’s a necessity for massive teams, but smaller groups of advisors are very beneficial.”

Still, finding the right people to work with remains a challenge.

“I look for someone who provides good recommendations [and who has] good values — not someone who pushes products to meet sales targets,” said a CI Assante advisor in Alberta. An advisor with Manulife Wealth in B.C. cited qualities such as “loyalty, integrity [and] tenacity.”

Diversity also was noted as an important quality of an effective team. For one Investia advisor in Atlantic Canada, the ideal team would “reflect the diversity of our clients,” which include women and new immigrants. “I am working toward hopefully hav[ing] a team that is as diverse as Canadians.”

This article appears in the September issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.