The Canadian Securities Administrators (CSA) are promising a lot in their proposals for self-regulatory reform. Hopefully, their reach doesn’t exceed their grasp.

The CSA’s position paper on the future of the self-regulatory organization structure in Canada has something for everyone. For industry firms, the plan to replace the Investment Industry Regulatory Organization of Canada and the Mutual Fund Dealers Association of Canada with a new single SRO promises to lower costs, generate efficiencies and enhance access to advice. Investors will have a greater voice. Critics of the current structure will see enhanced governance and accountability measures.

Portfolio managers and other non-SRO dealers won’t immediately be pulled into the new organization against their will. They may eventually get their turn in Phase 2 of the project, when the CSA is also promising a renewed effort to harmonize certain requirements with insurance regulators.

The CSA also pledges to solve the long-standing question of whether investment dealer reps should be allowed to incorporate; to ease the operation of dual-platform dealers; and to facilitate fund dealers’ access to ETFs.

The CSA’s proposals have met with near-universal acclaim from various factions in the investment industry, investor advocates, the existing SROs themselves and even the Chambre de la Sécurité Financière, which won’t be displaced by the new SRO in Quebec.

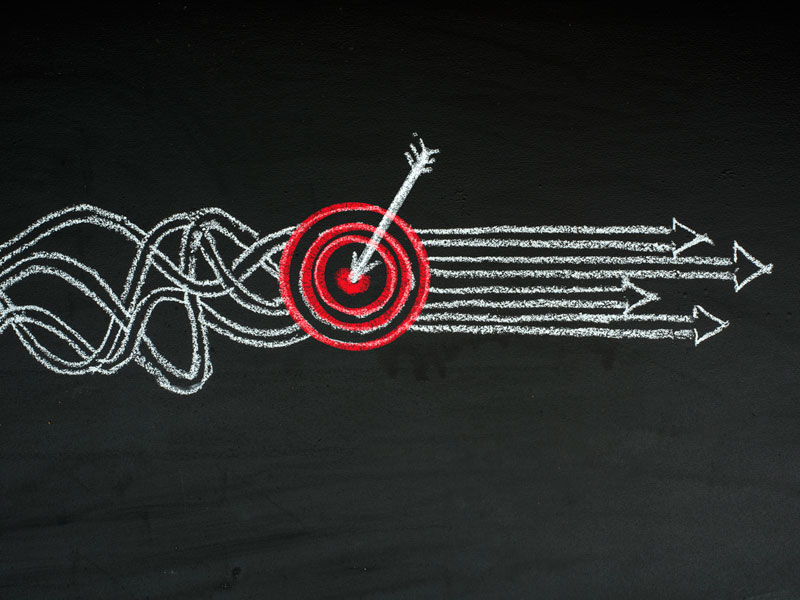

While the CSA’s proposals look good on paper, the challenge will be delivering in a timely way. There’s a lot to do, and much of it is easier said than done.

The project is an opportunity to demonstrate once and for all that the CSA can execute its plans. Yet, this reform comes when the CSA has nothing to prove. The national regulator concept is dead once again, and the CSA has the regulatory field to itself for the foreseeable future. We’ll see how well CSA members work together when the pressure’s off.

With the SRO reform proposals, the CSA has bitten off a lot. Here’s hoping it’s not more than it can chew.

Advisor chargebacks are bad for the industry

The CSA is considering a ban on the practice