Canada’s annual rate of inflation hit an 18-year high of 4.4% in September, creating a challenge for financial advisors who want to provide inflation protection for their senior clients. “Inflation has been fairly low here for decades, anchored at around 2%, and it hasn’t been a risk,” said Ryan Lewenza, senior vice-president and portfolio manager, private client group, with Toronto-based Turner Investments.

Sean Moir, portfolio manager with Mandeville Private Client Inc. in Hamilton, Ont., said he always considers inflation, regardless of the posted rate. “Inflation is a look back, so it has to be a constant in any investment plan.”

Investment Executive asked each advisor to build, for a hypothetical retired client, a portfolio that hedges against inflation, benefits from rising prices and is tax-efficient.

Moir: Be selective about fixed-income allocations

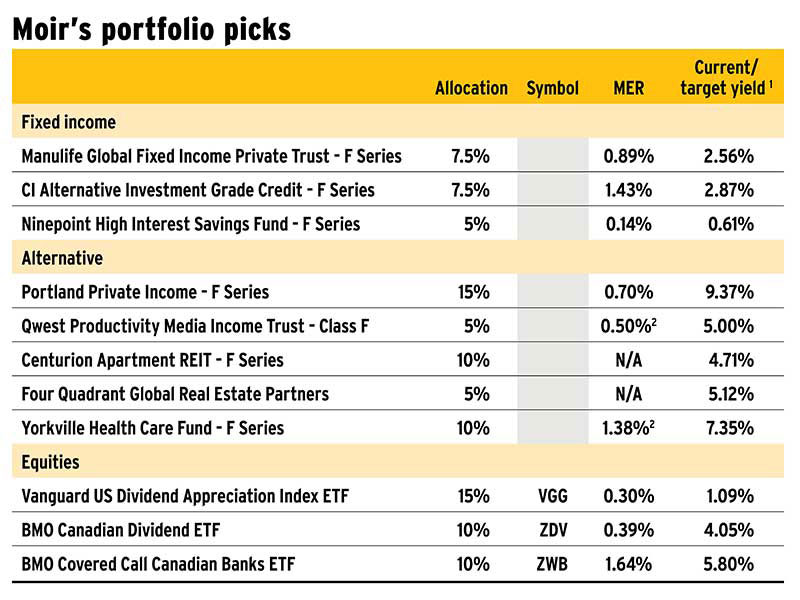

Moir’s hypothetical client is an accredited investor in their mid-60s with $1 million in their portfolio. He allocated 20% to fixed income, 35% to equities and 45% to alternative investments.

Moir noted that dividends have a preferred tax rate over regular income, making them a good choice for non-registered funds.

For the fixed income portion, Moir allotted 7.5% each to the Manulife Global Fixed Income Private Trust and the CI Alternative Investment Grade Credit Fund. He also put 5% into the Ninepoint High Interest Savings Fund as a cash wedge, “which is one or two years of income to help the client sleep at night.”

“In an inflationary environment, we need to be choosy about fixed income,” Moir said. “If inflation persists, bonds will be a scary place to invest. The two bond funds are not indexed, so managers have tools to help them fight interest-rate risk.”

For the equities portion, Moir allocated 15% to the Vanguard US Dividend Appreciation Index ETF (TSE: VGG); 10% to the BMO Canadian Dividend ETF (TSE: ZDV); and 10% to the BMO Covered Call Canadian Banks ETF (TSE: ZWB).

“VGG includes high-quality businesses with a wide moat, meaning companies have pricing power and can pass through inflationary effects to customers to yield bigger profits,” Moir said.

The two Canada-focused ETFs include energy and financials. “Higher energy prices often drive inflation, which means profits are up for oil and gas companies,” Moir said. “Banks have the option to boost mortgage rates to match inflation, which gives investors an advantage.”

The final 45% is allocated to alternative investments. “We believe private investments — including 20% in private debt and 25% in private equity that invests in real estate — consistently offer good yield and a hedge against inflation.”

Moir put 15% into the Portland Private Income Fund; 5% into the Qwest Productivity Media Income Trust; and 10% into Centurion Apartment REIT, which owns apartments and student rentals in the U.S. and Canada.

Another 5% was allocated to Four Quadrant Global Real Estate Partners, which owns office, industrial and apartment buildings in North America and is offered by Hazelview Securities Inc. The final 10% went to the Yorkville Health Care Fund, which invests in health-care properties and owns a company that delivers pharmaceuticals to seniors’ homes. Health-care costs have exceeded the rate of inflation, Moir noted.

Click image for full-size chart

Lewenza: Expect high inflation

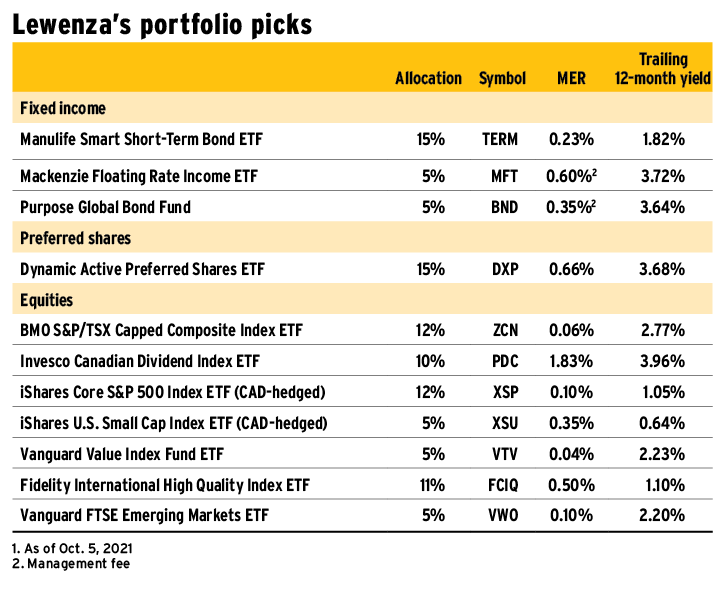

Lewenza’s portfolio is meant to be held in a registered account. For the fixed income allocation, he selected the Manulife Smart Short-Term Bond ETF (TSE: TERM), the Mackenzie Floating Rate Income ETF (TSE: MFT) and the Purpose Global Bond Fund (TSE: BND), which focuses on corporate bonds.

“Shorter-term bonds are preferable in an inflationary period,” Lewenza said. “Corporate bonds tend to outperform government bonds. Finally, if interest rates are going up, floating-rate bonds are the perfect hedge against inflation.”

Preferred shares, “which tend to perform well when interest rates are up,” can be another inflation hedge. For that allocation, Lewenza chose the Dynamic Active Preferred Shares ETF (TSE: DXP).

For equities, Lewenza looked for funds that both hedge against inflation and take advantage of rising interest rates.

Lewenza likes the BMO S&P/TSX Capped Composite Index ETF (TSE: ZCN). The fund tracks Canada’s main stock index, which comprises about 30% resources, Lewenza said. “Commodities tend to do well in an inflationary environment because you have a lot of demand,” he said.

Lewenza also selected the Invesco Canadian Dividend Index ETF (TSX: PDC) because “retirees need income, and the fund is paying a yield of 4% in dividends, which will increase over time in keeping with inflation as utility prices go up,” he said,

As well, the iShares Core S&P 500 Index ETF (CAD-hedged; TSE: XSP) is included on the assumption that with inflation, firms such as Apple Inc. can charge more for products to increase their revenue.

Lewenza also allocated some of the portfolio to the iShares US Small Cap Index ETF (CAD-hedged; TSE: XSU). “Historically, there’s a correlation between small-cap stock performance [and rising interest rates],” he said.

To capture value stocks, Lewenza included the Vanguard Value Index Fund ETF (NYSEARCA: VTV). He chose this U.S.-listed ETF in part because the Canadian dollar is at a four-year high, “making U.S.-dollar investments a good idea from a return perspective.”

And, as VTV invests in U.S. equities, no foreign withholding taxes would apply because the U.S. recognizes RRSPs as being tax-exempt. This status makes holding a U.S.-listed ETF in an RRSP more tax-efficient than holding a Canada-listed ETF that invests in U.S. equities.

Lewenza also turned to global markets. “When the economy is strong, it often means China, India and others are growing at a stronger clip,” he said. “With the Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO) you get the double whammy. You’ve got a growing economy and oil at $85 per barrel, which is in demand in emerging markets.”

Lewenza’s final choice, the Fidelity International High Quality Index ETF (TSE: FCIQ), includes companies in Japan and Europe. “Especially for retired clients, you want high-quality companies,” he said. “These are best in breed, tend to have lower volatility and give better long-term performance.”

Click image for full-size chart