This year, Alberta and Prince Edward Island cut corporate taxes and Manitoba cuts its sales tax. The fiscal positions of most provinces improved, except in Alberta, Ontario, and Newfoundland and Labrador; six of the other seven provinces are projecting surpluses in fiscal 2020. But as debt loads remain high everywhere east of Saskatchewan, don’t expect a wave of future tax cuts.

The only new cut on the horizon is the promise by Ontario’s Progressive Conservative (PC) government – elected in June 2018 – to reduce personal income taxes in the third year of its mandate. There’s also the possibility of a personal tax cut in Alberta – when the government can afford it – and further cuts in P.E.I.’s small-business tax rate.

Voters and businesses like tax cuts, but they aren’t necessarily the best way for governments to help grow their economies, says Sébastien Lavoie, chief economist at Laurentian Securities Inc. in Montreal.

“When a company is deciding where to locate or expand, tax rates aren’t as important as attracting good staff – and that often depends on the quality of human resources,” says Lavoie.

Lavoie applauds the affordable daycare policy in British Columbia and Quebec’s tax breaks for seniors who continue to work. In his view, these kinds of measures, coupled with low or no taxes on small businesses, work well: “Small businesses need the cash flow they generate to grow. You can tax them when they are big.”

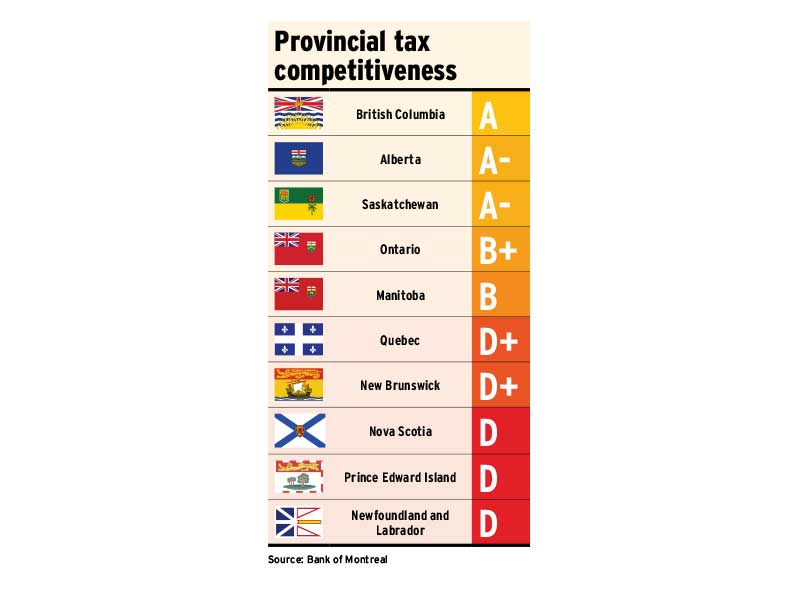

Another factor that could change the provincial tax front is the change in the political landscape, says Robert Kavcic, senior economist, capital markets division, at Toronto-based Bank of Montreal. At the beginning of 2017, seven provincial governments were Liberal. Today, four are PC and three are centre-rightist (the United Conservative Party [UCP] in Alberta, the Saskatchewan Party and the Coalition Avenir Québec [CAQ]).

Kavcic anticipates these new governments will follow Quebec’s example, beginning with restructuring of the province’s finances, followed by tax cuts. The Quebec Liberal Party, which preceded the CAQ, turned a large deficit into a balanced budget in fiscal 2014, the first year of the Liberals’ mandate, by finding $7.2 billion in expenditure savings and subsequently put substantial amounts aside for debt repayment.

Here’s a look at the major 2019 tax cuts:

Corporate income taxes

The UCP cut Alberta’s corporate income tax (CIT) rate to 11% from 12% as of July 1, following the party’s April 16 election. The UCP also passed legislation to cut the CIT by one percentage point on Jan. 1 in each of the next three years. Alberta already had one of the lowest CIT rates, slightly higher than Quebec’s 11.6% and Ontario’s 11.5%. Alberta’s will be the lowest among the provinces in 2022, at 8%.

CIT rates elsewhere are 12% in B.C., Saskatchewan and Manitoba; 14% in New Brunswick; 15% in NL and 16% in Nova Scotia and P.E.I.

Sales taxes

Manitoba’s PC government’s pre-election budget reduced the provincial sales tax (PST) to 7% from 8% as of July 1. That fulfilled a 2016 election promise and the PCs were re-elected on Sept. 10.

Other PST rates are Quebec’s and the Atlantic provinces’ 10%, Ontario’s and Manitoba’s 8%, B.C.’s 7%, Saskatchewan’s 6% and Alberta’s zero.

Small-business taxes

Following P.E.I.’s April 23 election, the PC government lowered the province’s small-business tax rate to 3% from 3.5% as of Jan. 1, 2020. During the election campaign, the PCs promised to lower the rate to 1% from 3.5% within a year, but the party didn’t get a majority.

P.E.I.’s rate will be less than Ontario’s 3.5%; at par with Nova Scotia’s and NL’s; and higher than New Brunswick’s (2.5%), and B.C.’s, Alberta’s and Saskatchewan’s (all at 2%). Manitoba’s small-business rate is zero. Quebec’s small-business rate, at 6% as of Jan. 1, will drop by a percentage point on Jan. 1, 2020, and reach 4% on Jan. 1, 2021.

In 2009, small-business rates were much higher: Quebec’s was 8%; Ontario’s, 5.5%; New Brunswick’s, Nova Scotia’s and NL’s, 5%; Saskatchewan’s, 4.5%; Alberta’s, 3%; B.C.’s, 2.5%; and Manitoba’s, 1%. Only P.E.I.’s was lower, at 2.1% as of April 1.

The federal small-business tax rate dropped to 9% as of Jan. 1, 2019, from 10% in 2018 and 10.5% in 2017.