Clients who received Covid-19–related government benefits will want their financial advisors to help estimate and manage the tax liability for 2020, tax experts say.

Ottawa paid out billions of dollars of emergency relief with no tax withheld at source, meaning clients who fail to account for taxes owing may find themselves scrambling when they file their returns in 2021.

“It’s important for advisors to have this conversation [with clients] now — before the end of the year, as opposed to waiting until next spring when they file their return — to determine if money should be set aside,” says Jamie Golombek, managing director of tax and estate planning with CIBC Private Wealth Management in Toronto.

The Canada Revenue Agency will issue tax slips in February with information about government benefits received, but “clients will want to know well before then what their taxable income is going to be for the year, so they can plan,” says Jonathan Braun, senior manager, tax and estate planning, with IG Wealth Management in Winnipeg.

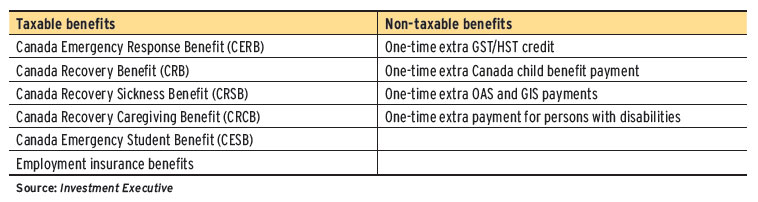

As the Covid-19 pandemic caused businesses to go into lockdown earlier this year, the federal government quickly sent out financial aid to people who found themselves out of work. While some benefits — such as a one-time top-up to old age security — were given on a tax-free basis, most were sent out on a pretax basis. The biggest of the latter programs was the Canada Emergency Response Benefit (CERB) program, under which Canadians could receive up to $14,000. That program ended Sept. 27, but others, including a simplified employment insurance regime, have been developed to replace it. (See table below.)

How much should your client set aside for next spring’s tax bill? The answer will depend on your client’s taxable income for 2020 and their combined federal/provincial marginal tax rate — the rate at which tax is calculated on the next dollar of income — in the client’s province of residence. Tax rates vary widely: a client with very low income may have no tax liability associated with their benefits, while someone with income in the top bracket may have to repay more than half of amounts received.

Golombek recommends you and your clients refer to complimentary online calculators and tax bracket tables from major accounting firms to determine the marginal tax rate most likely to apply to a client. “It’s very hard to get a handle on how much tax you’ll owe on the CERB without running the numbers on a calculator,” he says.

However, setting aside 30% of benefit amounts received is likely enough to cover the associated tax liability for a middle-income earner who lost their job for at least part of the year and received the CERB in lieu. Money set aside for this purpose should be parked in a liquid vehicle, such as a high-interest savings account, Golombek says.

Clients also could consider making RRSP contributions if they have unused contribution room and money available, experts say. Contributions to an RRSP may effectively allow clients to offset the benefit amounts they received with an income tax deduction, and “basically reduce the tax liability on that extra income,” Braun says.

However, Rebecca Hett, vice president of tax, retirement and estate planning at Toronto-based CI Investments Inc. in Calgary, cautions against clients rushing to make an RRSP contribution before ensuring that they were indeed eligible for all of the CERB or other government benefits they received: “A significant amount of money went out to Canadians who may not have qualified [for relief funds].”

Clients who received government benefits for which they were ineligible must return those amounts.

“As an advisor, I might caution clients to hold [money] aside,” Hett says. A client who wants to contribute to their RRSP to offset a tax liability associated with their benefit should wait until the first 60 days of 2021 to do so, which would still allow the client to take the deduction for 2020.

Clients who received government benefits for only part of 2020 and who worked the rest of the year from home also may be eligible to claim work-from-home expenses, tax experts suggest (see Claiming home-office expenses in a pandemic). While eligible workspace expenses can be deducted against only the income to which the expenses relate, they nevertheless would reduce a client’s total taxable income and any associated tax liability.