Looking beyond the money

Halifax advisor Wendy Brookhouse believes the key to financial success for her clients lies in addressing the comprehensive range of issues they face - and…

- By: donalee Moulton

- December 22, 2017 November 6, 2019

- 00:50

Halifax advisor Wendy Brookhouse believes the key to financial success for her clients lies in addressing the comprehensive range of issues they face - and…

You are required to have a plan in place should your business be disrupted by a natural or unnatural disaster, such as a storm, fire…

Although legacy airlines have been known to treat their average customers atrociously, there is a lot to be learned from the service they offer their…

With the wide variety of software tools available, you can stick with the tried-and-true PowerPoint and Keynote applications, or go with one of the less…

The valuation of a financial advisor's book of business for a divorce settlement must be based on a proven methodology that brings appropriate perspective and…

Here are some steps you can take to raise the level of financial literacy among your clients

Look for investment opportunities in a broad range of sectors that focus on older consumers

Many people are more afraid of running out of money than of dying. Advisors need to ensure retired clients act prudently

Many affluent families worry that a large inheritance will rob their children of motivation. There also are concerns about how they will handle the money.…

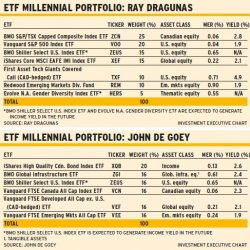

Millennial clients who begin a low-cost plan of saving for retirement now will reap the benefits over time. We asked two portfolio managers with ETF…

A desire to help children and grandchildren - combined with the availability of credit - is encouraging many elderly clients to carry debt into retirement

Spousal RRSPs can be a simple and effective tax-saving strategy for married and common-law couples. But these accounts are not for everyone - and have…

Clients seeking to access the value held in their homes during retirement often are faced with a difficult choice: should they sell and downsize, or…

With interest rates beginning to inch higher after ultra-low levels over the past several years, generating decent returns from a fixed-income portfolio remains a challenge

Women are very concerned about maintaining support for their families. They also are more likely than men to be single later in life and to…

Technology can help older clients manage both long-term assets and daily finances

Many clients rely on the Canada Pension Plan to form at least part of their guaranteed retirement income. But deciding when to take the benefit,…

There are many features to consider when selecting a monitor for your computer. Understanding characteristics such as panel type, screen size and resolution can help…

Petra Remy has been motivated by social responsibility since she was a teenager. Today, she's an investment advisor who specializes in responsible investing and financial…

Here’s one thing all financial advisors know: exercise is good for both the mind and the body. Unfortunately, many advisors don’t act on that knowledge.…

The activities that made you successful in the past will not lead to success in the future. In fact, using those old strategies now is…

Although some clients consider a joint account as a convenient way to avoid probate fees, this strategy can backfire

There are several measures you and your clients need to consider as the taxation year draws to a close, including taking advantage of certain measures…

After Canada's auditor general calls for a more efficient process for tax objections, and following the CRA's survey of accountants and businesses, the agency insists…

Taxpayers who come clean about taxes they have evaded can have penalties reduced under the voluntary disclosure program. The government wants to make the program…